Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. 4. Warner Corporation purchased a machine 7 years ago for $337,000 when it launched product P50. Unfortunately, this machine has broken down

1.

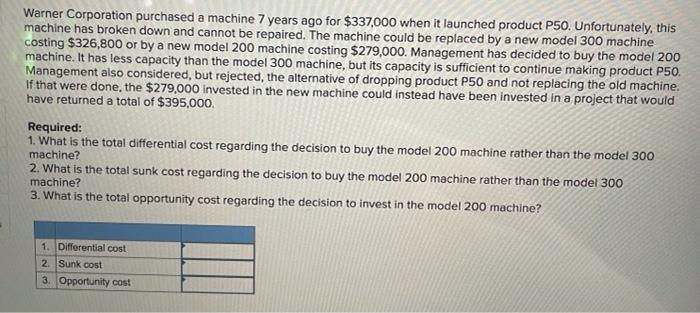

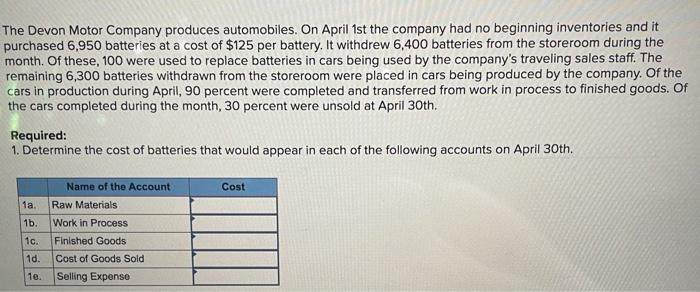

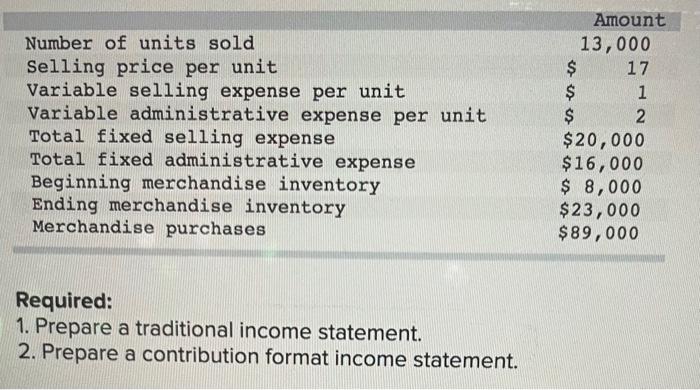

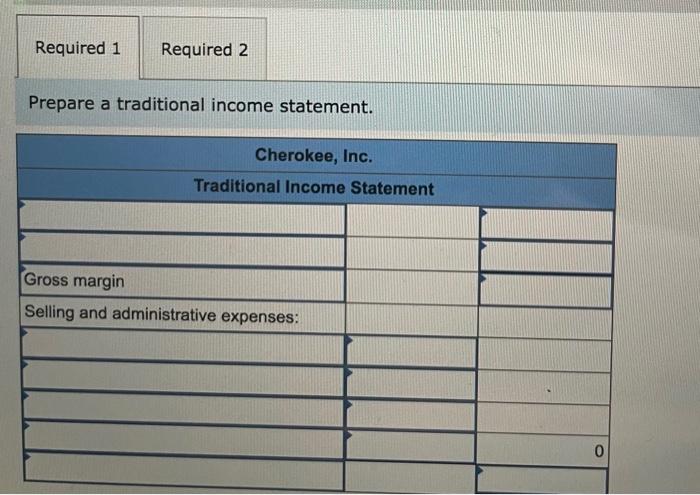

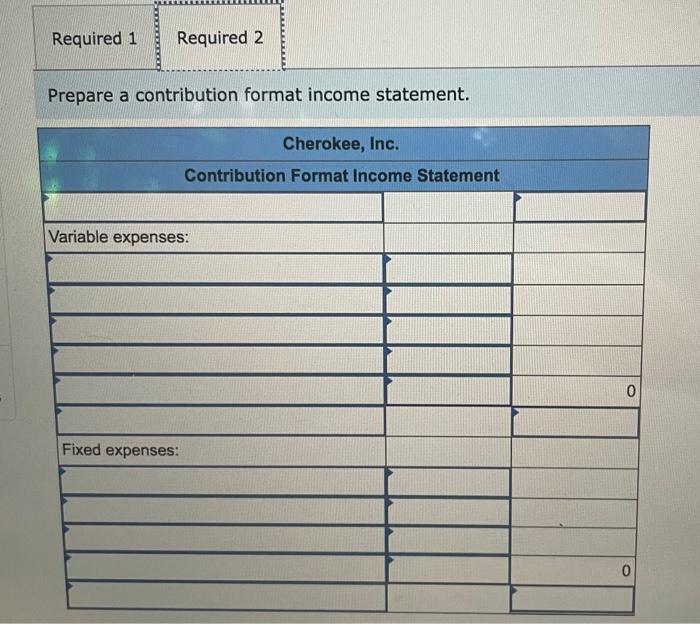

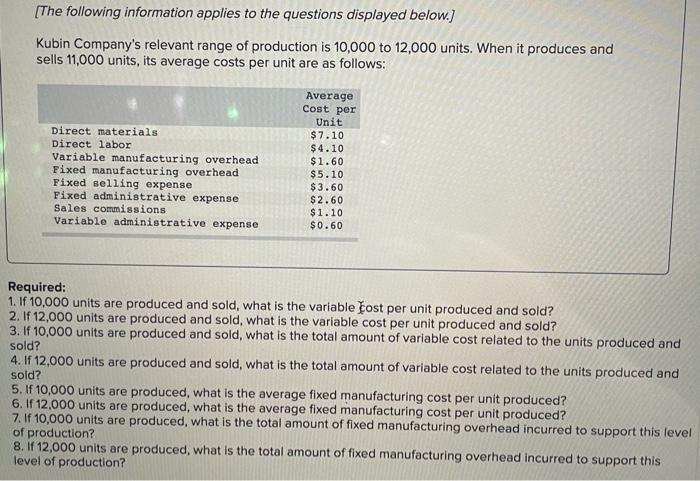

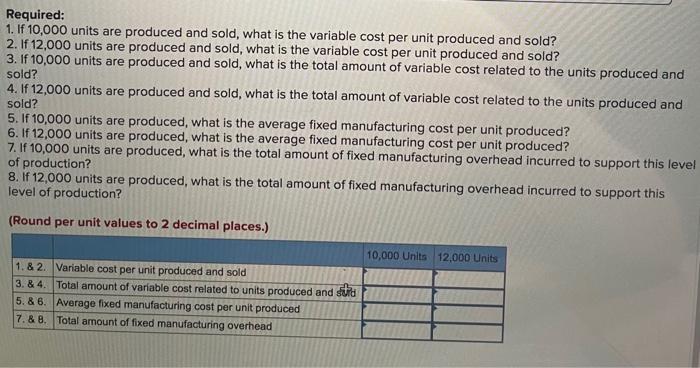

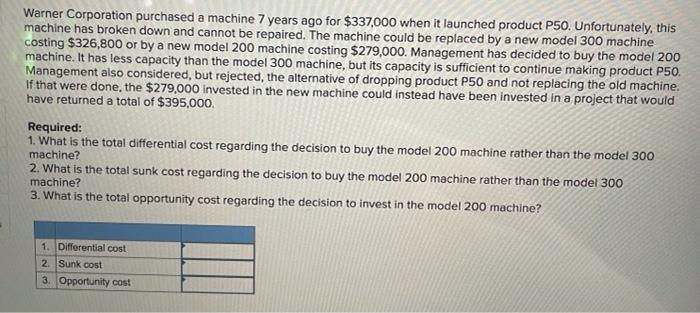

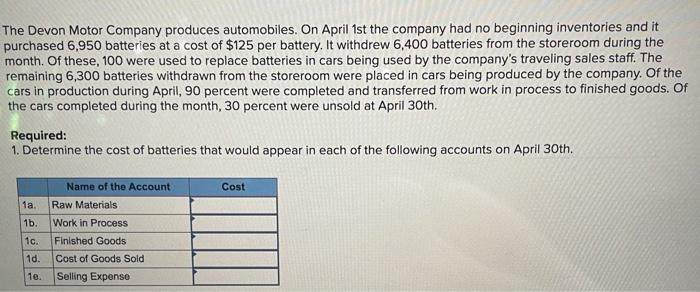

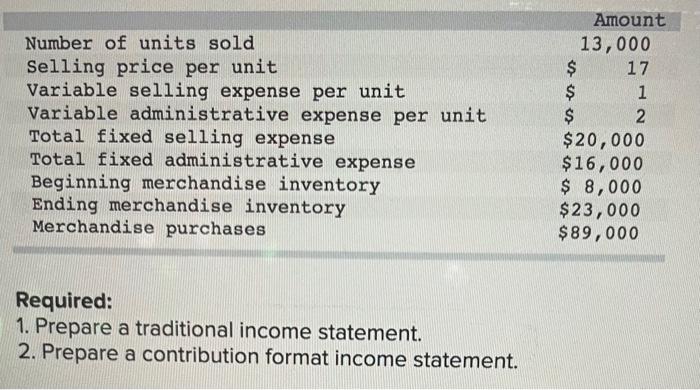

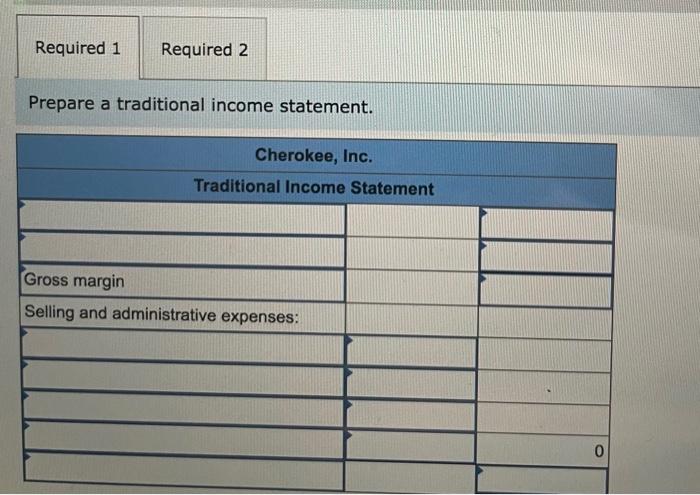

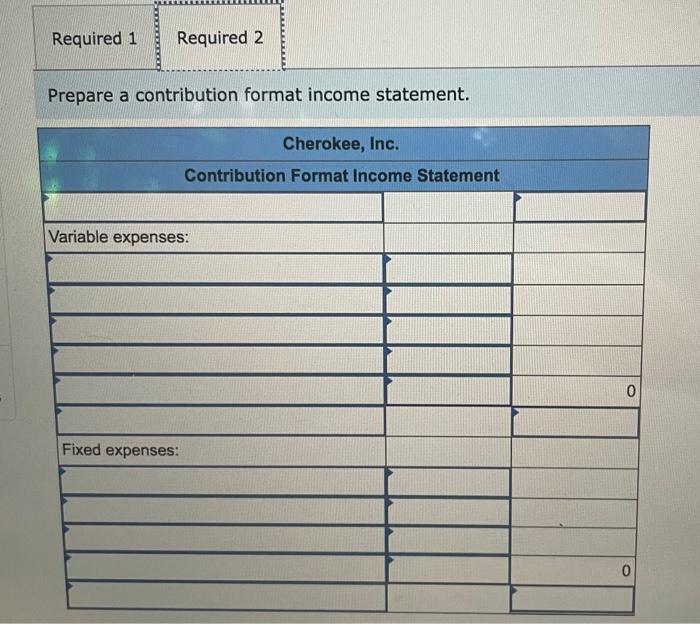

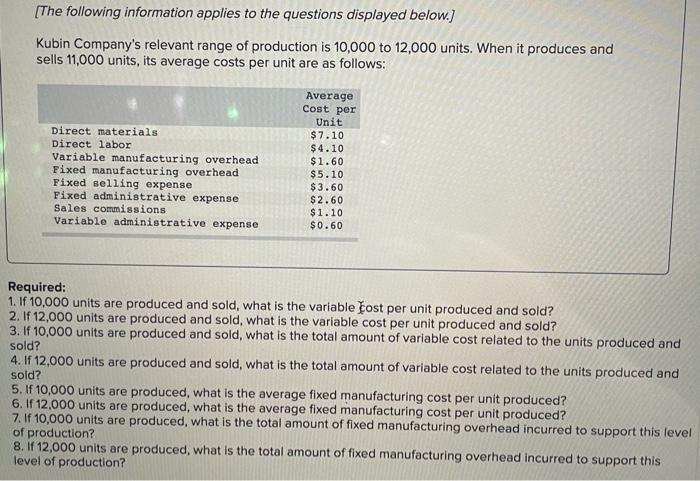

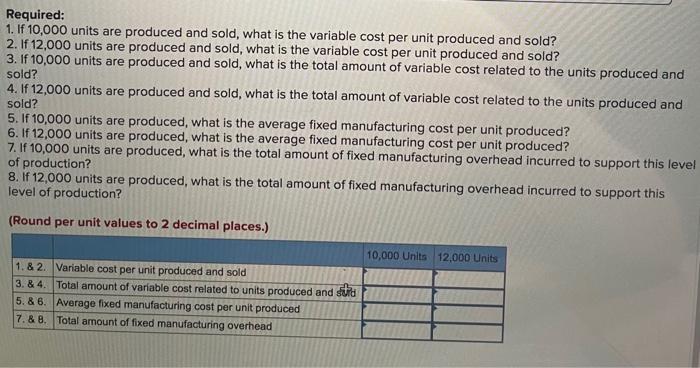

Warner Corporation purchased a machine 7 years ago for $337,000 when it launched product P50. Unfortunately, this machine has broken down and cannot be repaired. The machine could be replaced by a new model 300 machine costing $326,800 or by a new model 200 machine costing $279,000. Management has decided to buy the model 200 machine. It has less capacity than the model 300 machine, but its capacity is sufficient to continue making product P50. Management also considered, but rejected, the alternative of dropping product P50 and not replacing the old machine. If that were done, the $279,000 invested in the new machine could instead have been invested in a project that would have returned a total of $395,000. Required: 1. What is the total differential cost regarding the decision to buy the model 200 machine rather than the model 300 machine? 2. What is the total sunk cost regarding the decision to buy the model 200 machine rather than the model 300 machine? 3. What is the total opportunity cost regarding the decision to invest in the model 200 machine? 1. Differential cost 2. Sunk cost 3. Opportunity cost The Devon Motor Company produces automobiles. On April 1st the company had no beginning inventories and it purchased 6,950 batteries at a cost of $125 per battery. It withdrew 6,400 batteries from the storeroom during the month. Of these, 100 were used to replace batteries in cars being used by the company's traveling sales staff. The remaining 6,300 batteries withdrawn from the storeroom were placed in cars being produced by the company. Of the cars in production during April, 90 percent were completed and transferred from work in process to finished goods. Of the cars completed during the month, 30 percent were unsold at April 30th. Required: 1. Determine the cost of batteries that would appear in each of the following accounts on April 30th. Cost Name of the Account Raw Materials 1a 1b. Work in Process 10. 10. Finished Goods Cost of Goods Sold Selling Expense 1e. 17 Number of units sold Selling price per unit Variable selling expense per unit Variable administrative expense per unit Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Amount 13,000 $ $ 1 $ 2 $20,000 $ 16,000 $ 8,000 $23,000 $89,000 Required: 1. Prepare a traditional income statement. 2. Prepare a contribution format income statement. Required 1 Required 2 Prepare a traditional income statement. Cherokee, Inc. Traditional Income Statement Gross margin Selling and administrative expenses: 0 Required 1 Required 2 Prepare a contribution format income statement. Cherokee, Inc. Contribution Format Income Statement Variable expenses: 0 Fixed expenses: 0 [The following information applies to the questions displayed below.] Kubin Company's relevant range of production is 10,000 to 12,000 units. When it produces and sells 11,000 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Fixed selling expense Fixed administrative expense Sales commissions Variable administrative expense Average Cost per Unit $7.10 $4.10 $1.60 $5.10 $3.60 $2.60 $1.10 $0.60 Required: 1. If 10,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 12,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 10,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 12,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 10,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 12,000 units are produced, what is the average fixed manufacturing cost per unit produced? 7. If 10,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? 8. If 12,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? Required: 1. If 10,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 12,000 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 10,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 12,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 10,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 12,000 units are produced, what is the average fixed manufacturing cost per unit produced? 7. If 10,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? 8. if 12,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? (Round per unit values to 2 decimal places.) 10,000 Units 12.000 units 1. & 2. Variable cost per unit produced and sold 3.& 4. Total amount of variable cost related to units produced and strie 5. & 6. Average fixed manufacturing cost per unit produced 7.& 8. Total amount of fixed manufacturing overhead

2.

3.

4.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started