1

2

3

4

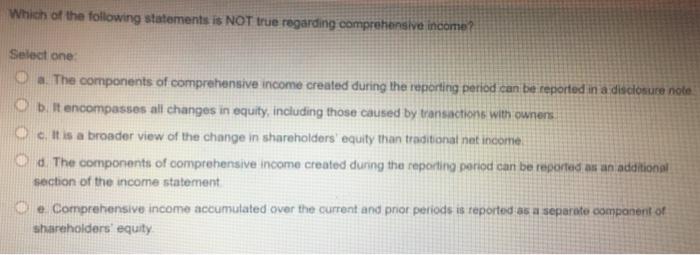

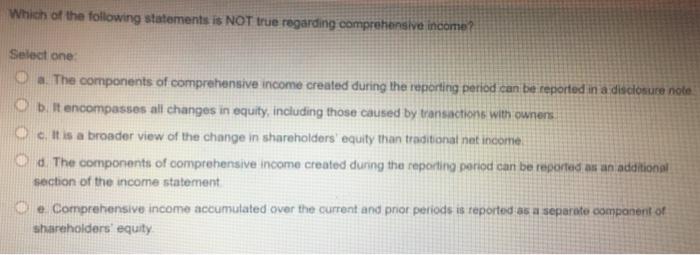

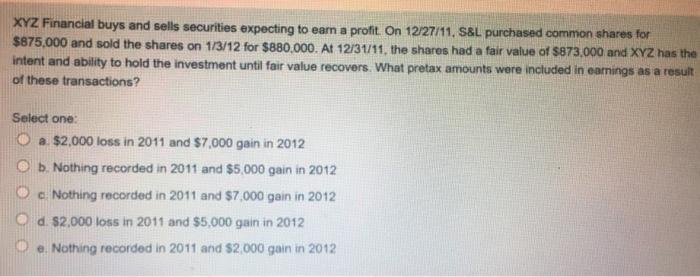

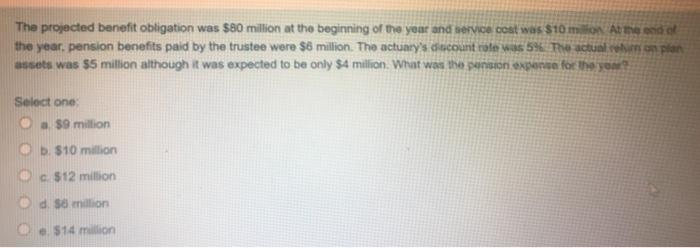

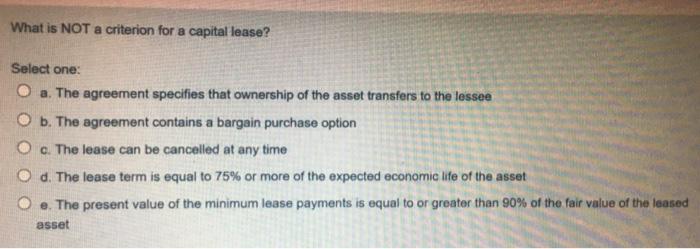

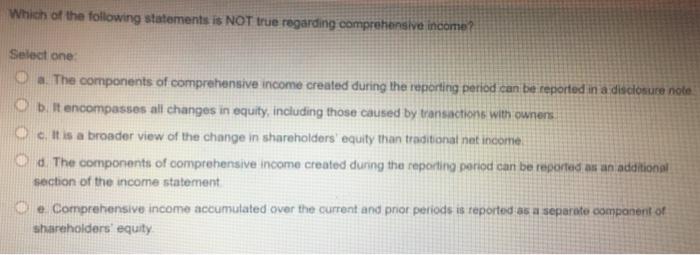

Which of the following statements is NOT true regarding comprehensive income? Select one The components of comprehensive income created during the reporting period can be reported in a disclosure note b. It encompasses all changes in equity, including those caused by transactions with owners @ It is a broader view of the change in shareholders equity than traditional net income d. The components of comprehensive income created during the reporting period can be reported as an additional section of the income statement e. Comprehensive income accumulated over the current and prior periods is reported as a separate component of shareholders equity XYZ Financial buys and sells securities expecting to earn a profit. On 12/27/11, S&L purchased common shares for $875,000 and sold the shares on 1/3/12 for $880,000. At 12/31/11, the shares had a fair value of $873.000 and XYZ has the intent and ability to hold the investment until fair value recovers. What pretax amounts were included in earnings as a result of these transactions? Select one: a $2.000 loss in 2011 and $7,000 gain in 2012 b. Nothing recorded in 2011 and $5,000 gain in 2012 O c. Nothing recorded in 2011 and $7.000 gain in 2012 d. $2,000 loss in 2011 and $5,000 gain in 2012 e. Nothing recorded in 2011 and $2.000 gain in 2012 The projected benefit obligation was $80 million at the beginning of the year and service cost was $10 million At me end of the year, pension benefits paid by the trustee were $6 million. The actuary's ecount role was 5%. The actually plan assets was $5 million although it was expected to be only $4 million. What was the pension expense for the you Select one 9 million @b, $10 million @c. $12 million d. S million $14 million What is NOT a criterion for a capital lease? Select one: O a. The agreement specifies that ownership of the asset transfers to the lessee O b. The agreement contains a bargain purchase option O c. The lease can be cancelled at any time O d. The lease term is equal to 75% or more of the expected economic life of the asset O e. The present value of the minimum lease payments is equal to or greater than 90% of the fair value of the leased asset