1.

2.

3.

4.

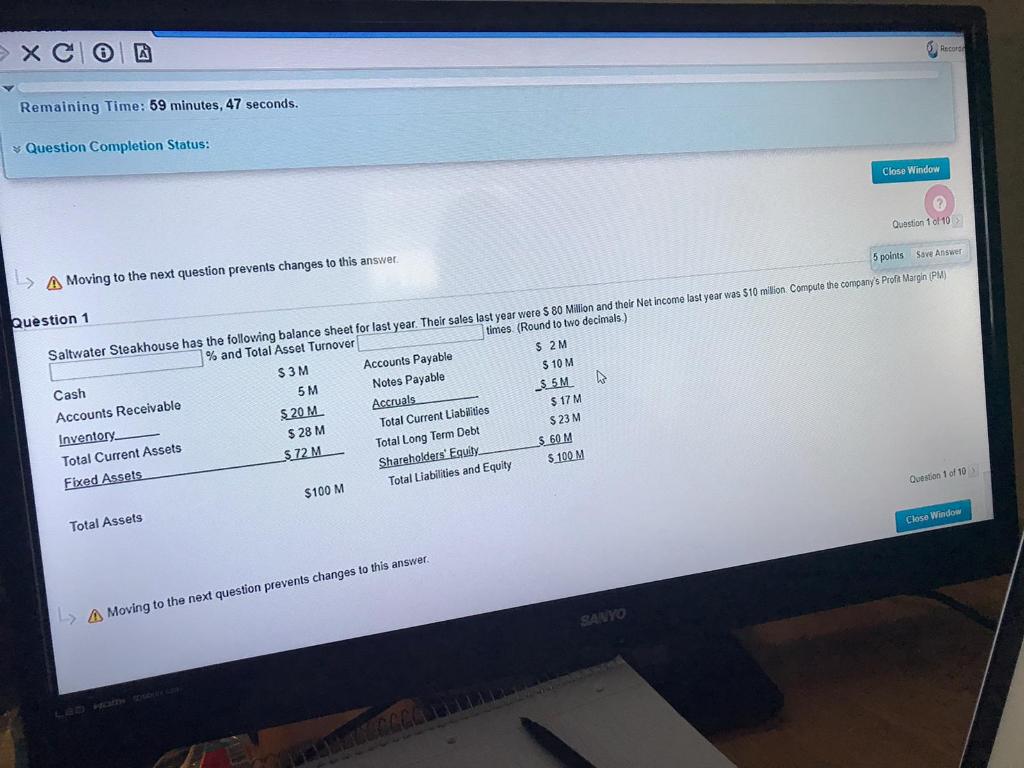

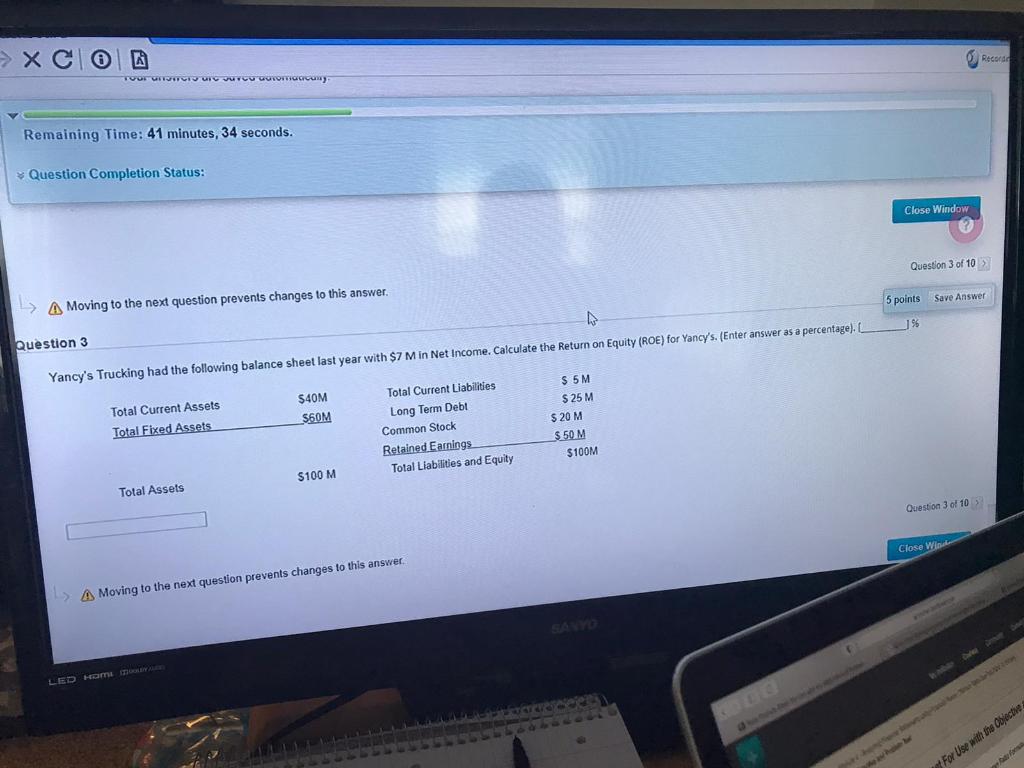

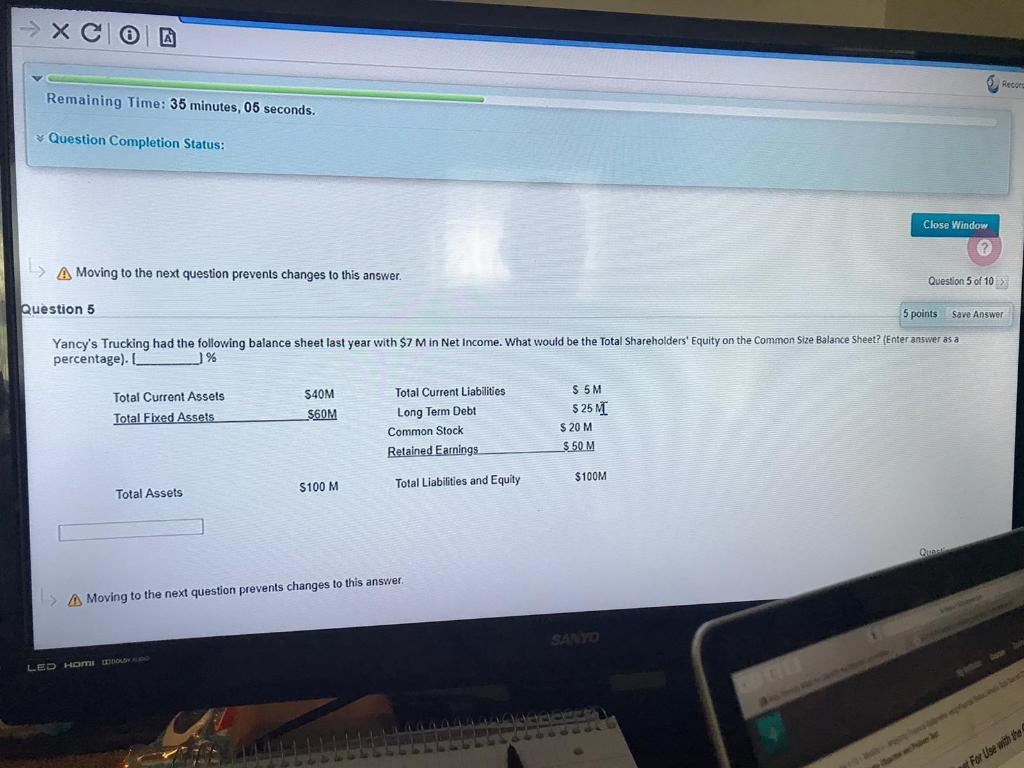

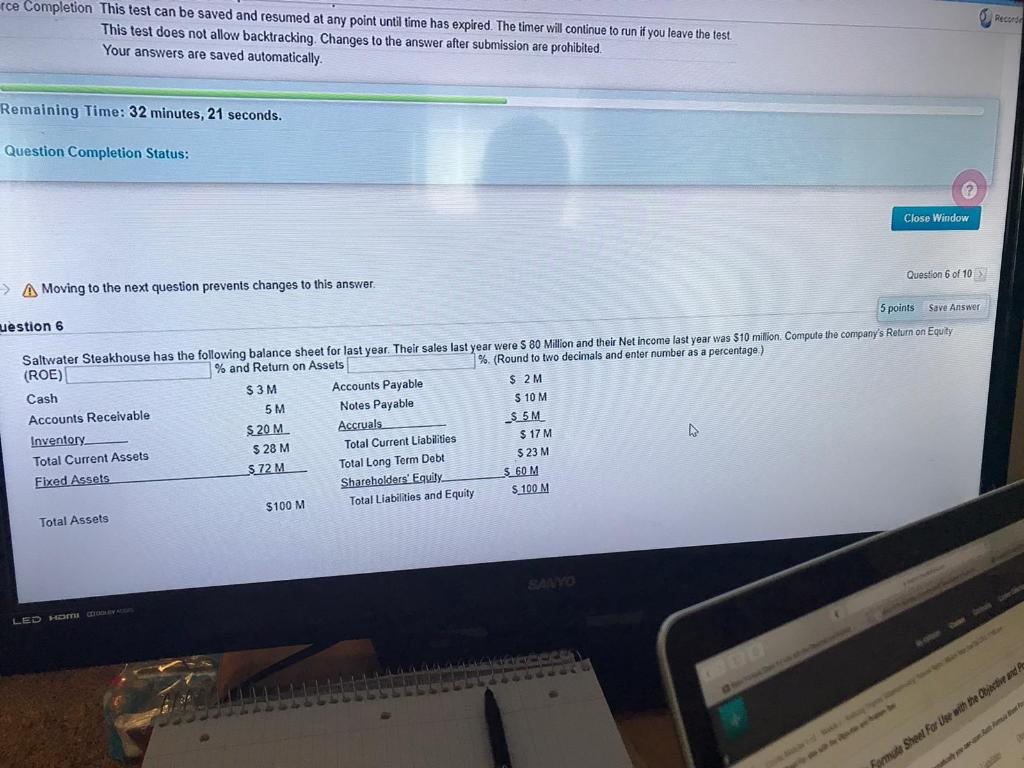

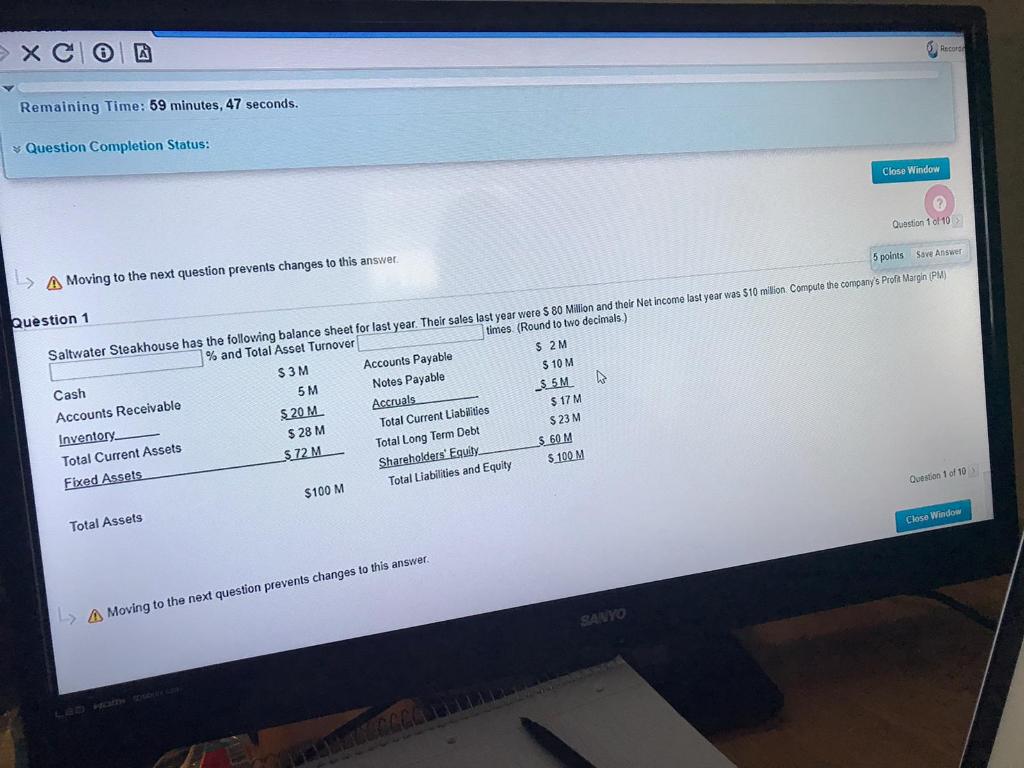

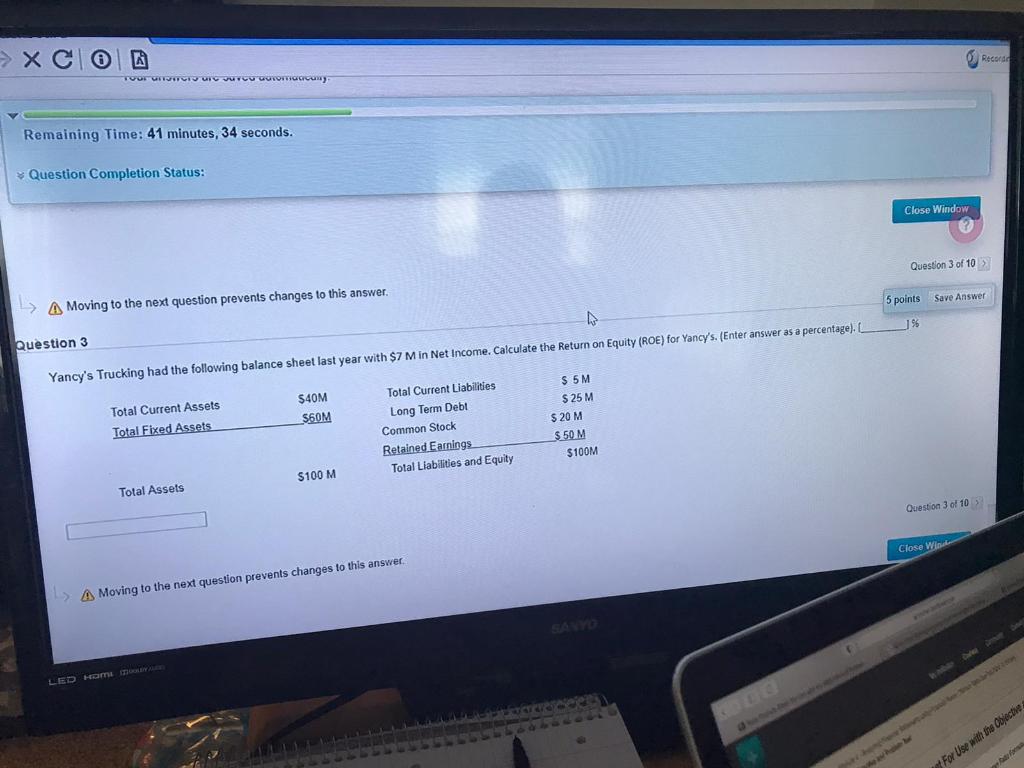

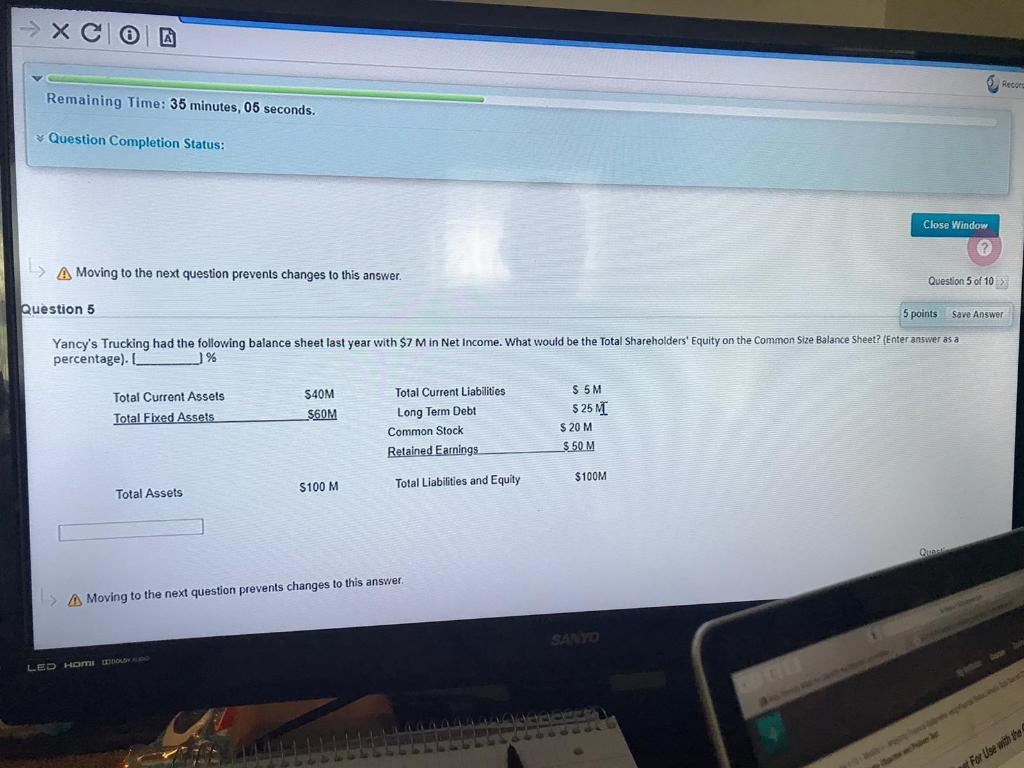

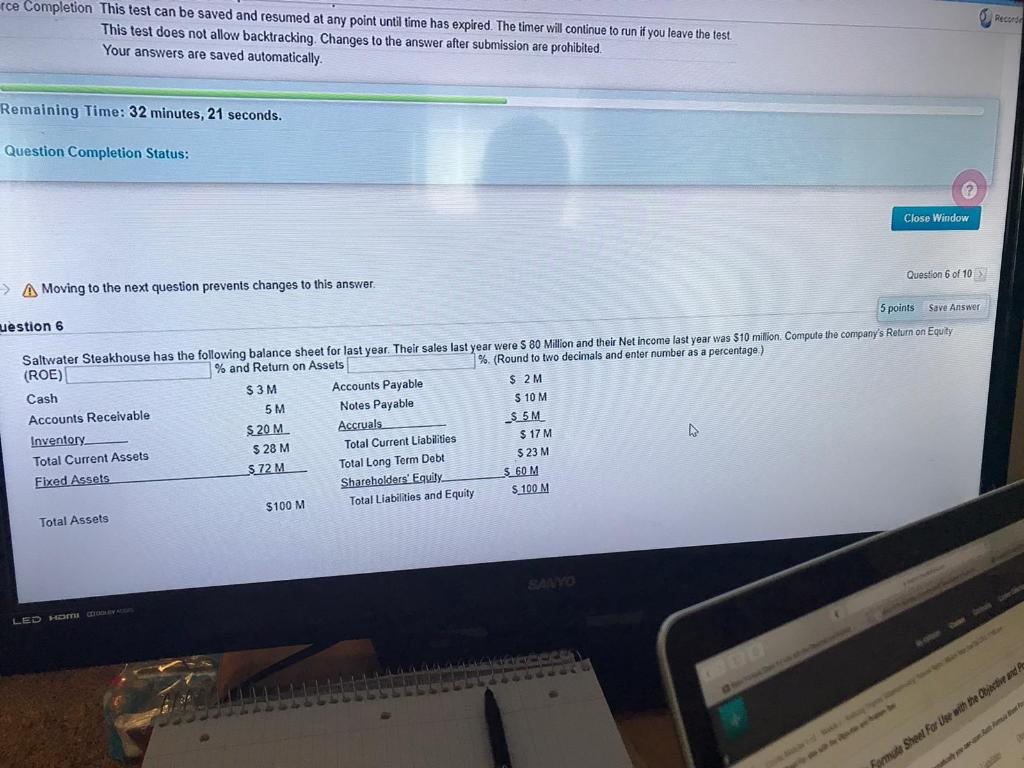

> XC Record Remaining Time: 59 minutes, 47 seconds. * Question Completion Status: Close Window Question 1 of 10 > A Moving to the next question prevents changes to this answer Question 1 $ 17M Saltwater Steakhouse has the following balance sheet for last year. Their sales last year were 5 80 Million and their Net Income last year was $10 million Compute the company's Proft Margin (PM) 5 points Save Answer % and Total Asset Turnover times (Round to two decimals Cash S 3M Accounts Payable $ 2M Accounts Receivable 5M Notes Payable $ 10 M Inventory $ 20 M Accruals $ 5M N Total Current Assets $ 28 M Total Current Liabilities $72M Fixed Assets $ 23 M Total Long Term Debt Shareholders' Equity S 60M $100 M Total Liabilities and Equity S 100 M Total Assets Question of 10 Close Window > A Moving to the next question prevents changes to this answer. SAVYO > XCO Record voor U vuru Wronsacy Remaining Time: 41 minutes, 34 seconds. > Question Completion Status: Close Window Question 3 of 10 > A Moving to the next question prevents changes to this answer. 5 points Save Answer J Question 3 Yancy's Trucking had the following balance sheet last year with $7 M in Net Income. Calculate the Return on Equity (ROE) for Yancy's. (Enter answer as a percentage). Total Current Assets Total Fixed Assets $40M $60M Total Current Liabilities Long Term Debt Common Stock Retained Earnings Total Liabilities and Equity $ 5M $ 25 M $ 20 M $ 50 M $100M $100 M Total Assets Question 3 of 10 Close Wind > A Moving to the next question prevents changes to this answer For Use with the Objectie Recor Remaining Time: 35 minutes, 05 seconds. Question Completion Status: Close Window > A Moving to the next question prevents changes to this answer. Question 5 of 10 > Question 5 5 points Save Answer Yancy's Trucking had the following balance sheet last year with $7 M in Net Income. What would be the Total Shareholders' Equity on the Common Size Balance Sheet? (Enter answer as a percentage). % Total Current Assets Total Fixed Assets $40M $60M Total Current Liabilities Long Term Debt Common Stock Retained Earnings S 5M $ 25 MI $ 20 M $ 50 M $100M Total Liabilities and Equity S100 M Total Assets Quad > A Moving to the next question prevents changes to this answer SAID LED HOM DOO For Use with the Recorde ce Completion This test can be saved and resumed at any point until time has expired. The timer will continue to run if you leave the test. This test does not allow backtracking. Changes to the answer after submission are prohibited Your answers are saved automatically. Remaining Time: 32 minutes, 21 seconds. Question Completion Status: Close Window > A Moving to the next question prevents changes to this answer. Question 6 of 10 uestion 6 5 points Save Answer Saltwater Steakhouse has the following balance sheet for last year. Their sales last year were $ 80 Million and their Net income last year was $10 million. Compute the company's Return on Equity (ROE) % and Return on Assets %. (Round to two decimals and enter number as a percentage) Cash $ 3M Accounts Payable $ 2M Accounts Receivable 5M Notes Payable S 10 M Inventory S 20 M Accruals $ 5 M Total Current Assets $ 28 M Total Current Liabilities $ 17 M $72 M Fixed Assets $ 23 M Total Long Term Debt Shareholders' Equity $ 60M $ 100 M Total Liabilities and Equity $100 M Total Assets LED IT CASE Sarmale Sheet For Use with the cada