Answered step by step

Verified Expert Solution

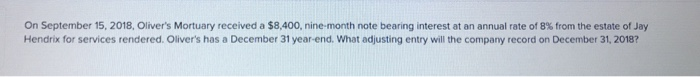

Question

1 Approved Answer

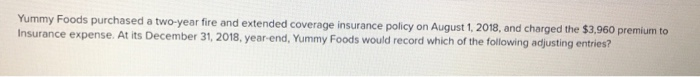

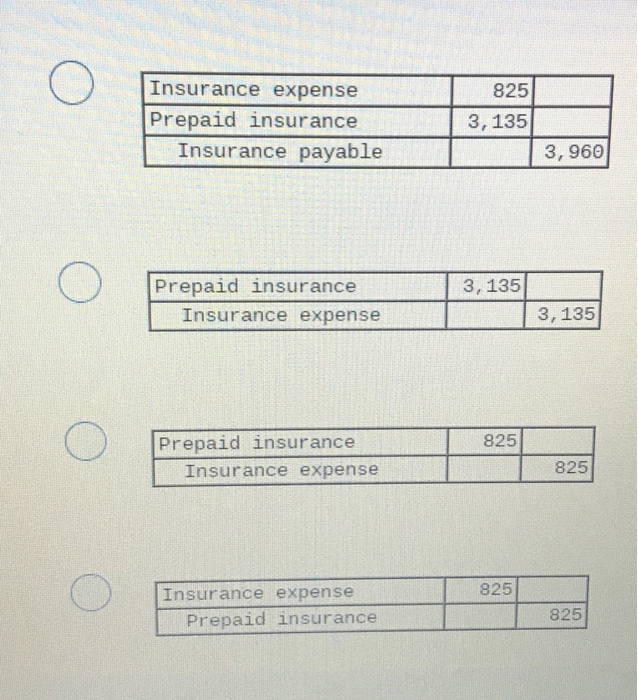

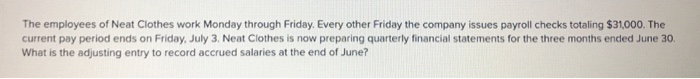

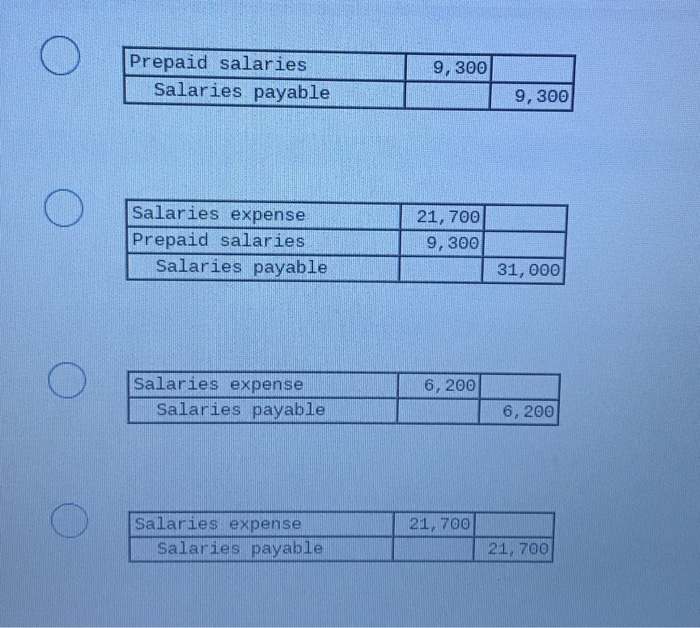

1 2 3 4 Yummy Foods purchased a two-year fire and extended coverage insurance policy on August 1, 2018, and charged the $3,960 premium to

1

2

3

4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started