Answered step by step

Verified Expert Solution

Question

1 Approved Answer

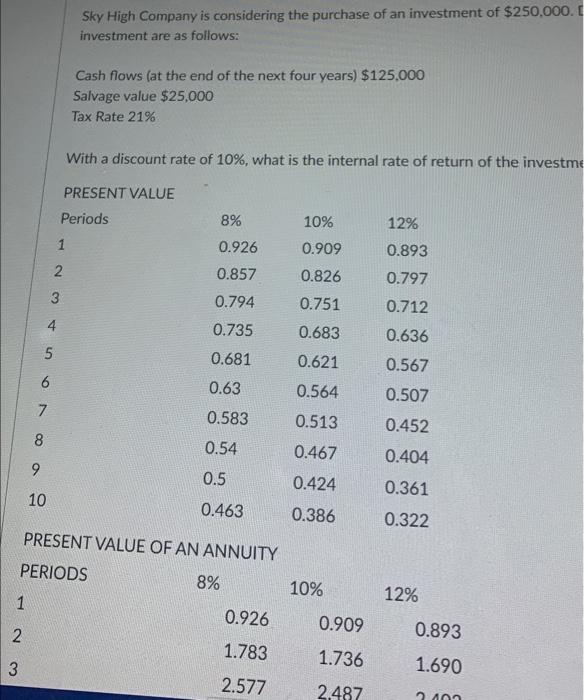

1 2 3 5 6 7 8 9 10 4 3 1 22 Sky High Company is considering the purchase of an investment of $250,000.

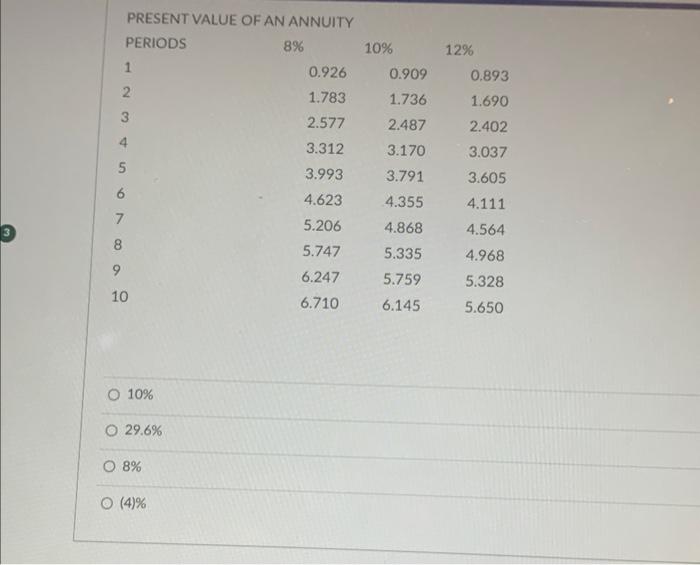

1 2 3 5 6 7 8 9 10 4 3 1 22 Sky High Company is considering the purchase of an investment of $250,000. D investment are as follows: Cash flows (at the end of the next four years) $125,000 Salvage value $25,000 Tax Rate 21% PRESENT VALUE Periods With a discount rate of 10%, what is the internal rate of return of the investme 8% 0.926 0.857 0.794 0.735 0.681 0.63 0.583 0.54 0.5 0.463 PRESENT VALUE OF AN ANNUITY PERIODS 8% 0.926 1.783 2.577 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 10% 0.909 1.736 2.487 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 12% 0.893 1.690 2.100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started