1-

2-

3-

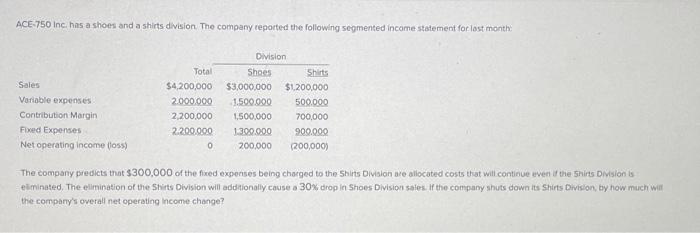

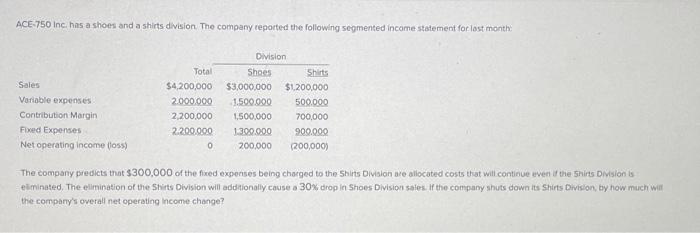

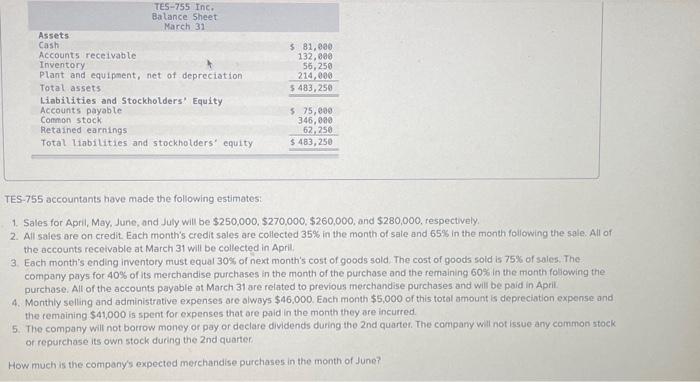

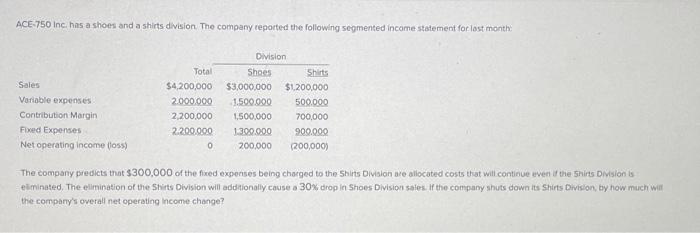

ACE-750 inc: has a shoes and a shirts division. The company reported the following segmented income statement for last month: The company predicts that $300,000 of the fixed exponses being charged to the 5 hirts Division are aliocated costs that will contiave even it the 5 inint DMision is elminated. The elimination of the Stirts Division will additionally cause a 30% drop in Shoes Division sales. If the compamy shuts down its Shirts Divislon, by how much wit the compary's overall net operating income change? TES-755 accountants have made the following estimates: 1. Sales for April, May, June, and July will be $250,000,$270,000,$260,000, and $280,000, respectively. 2. All sales are on credit. Each month's credit sales are collected 35% in the month of sale and 65% in the month following the sale. All of the eccounts recelvable at March 31 will be collected in April 3. Each month's ending imventory must equal 30 s of next month's cost of goods sold. The cost of goods sold is 75\%6 of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month foliowing the purchase. All of the accounts payable ot March 31 are refated to previous merchandise purchases and will be paid in April 4. Monthly selling and administrative expenses are alway5 $46,000. Each month $5,000 of this total amount is depreciation expense and the remoining $41,000 is spent for expenses that are paid in the month they are incurred. 5. The company will not borrow money or pay or declare dividends during the 2nd quarter. The compary will not issue any common stock or repurchase its own stock during the 2 nd quarter. How much is the company's expected merchandise purchases in the month of June? CUik-197 company manufactures three products from a common inpot in a jointprocessing operation. Joint processing costs up to the splitoff point total 575.000 per quarter The company allocates these costs to the oint products on the basis or their relative sales value at the split-olf point. Unit selling prices and total outpot at the sp it-off point are as follows: Eoch pcoduct can be processed further after the splt-off point. Additional processing requires no special facilities. The additionol processing costs (per quarter) and unit selling prices after further processing are given below: Which products should be processed further