Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. But if you want it to reflect monthly compounding you multiply it by 12, because there are 12 months in 1 year.

1.

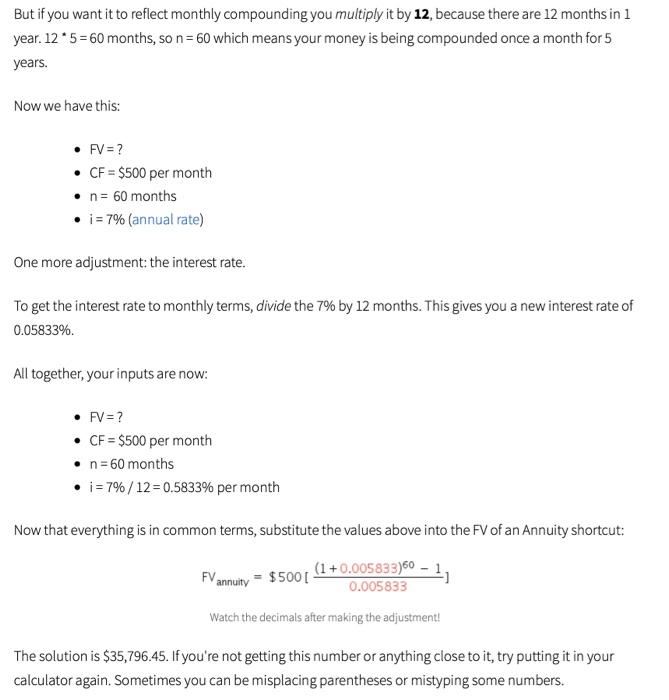

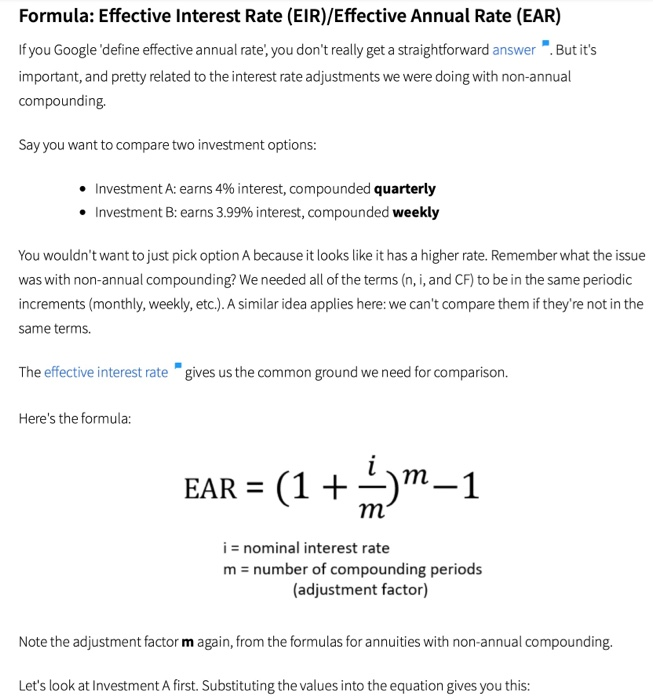

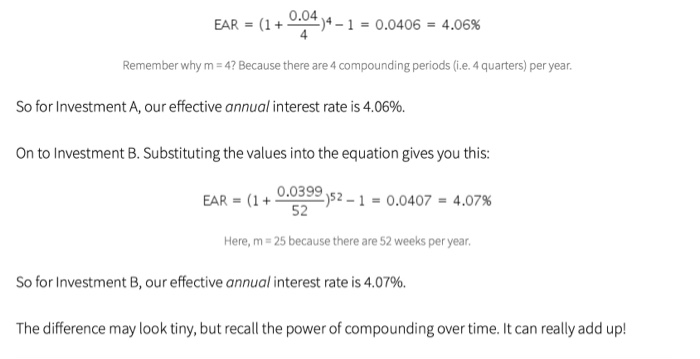

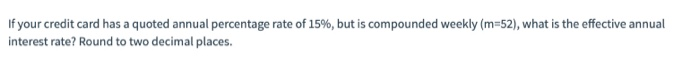

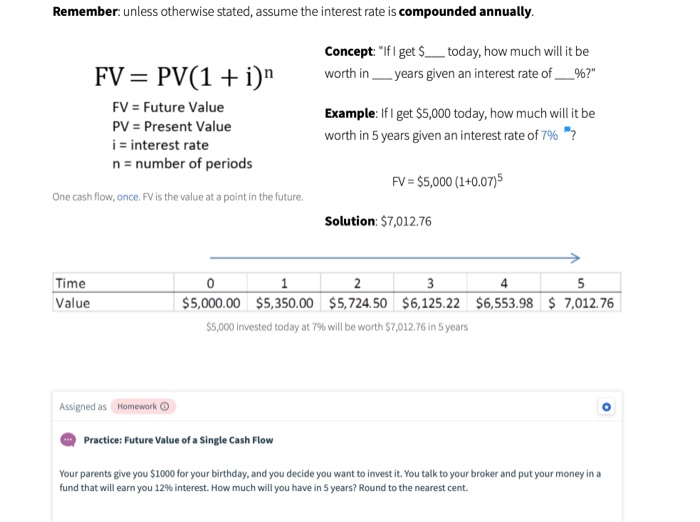

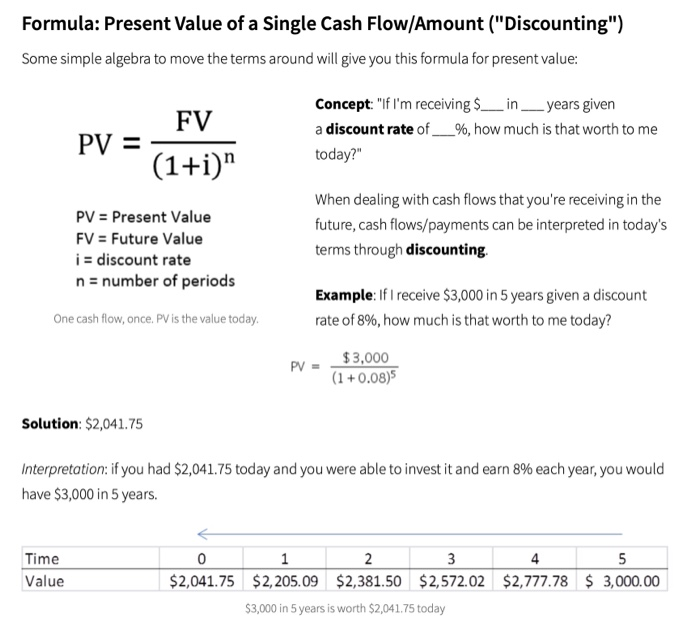

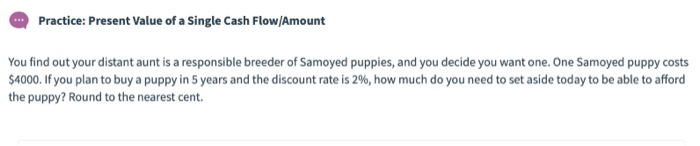

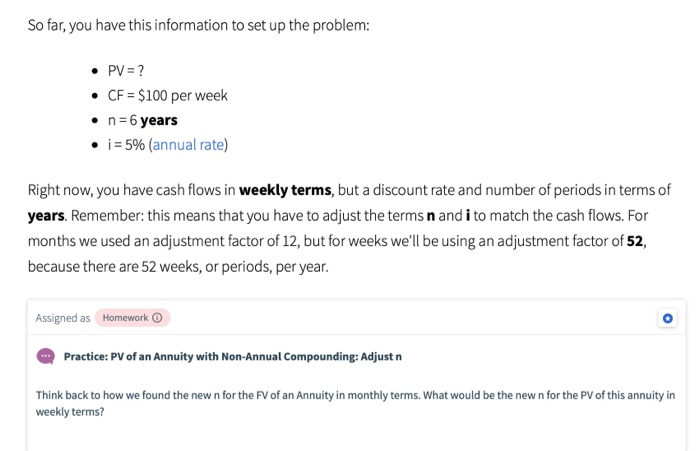

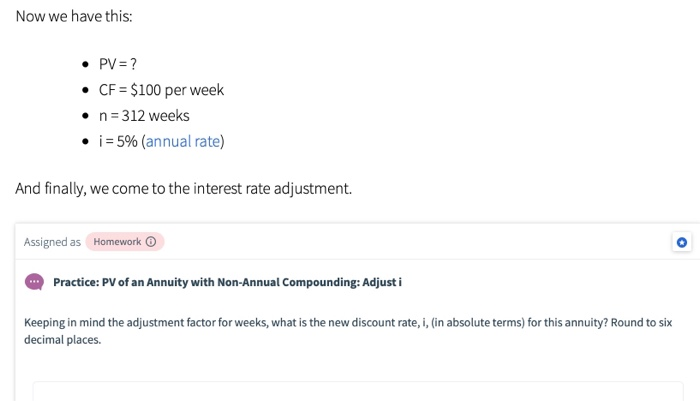

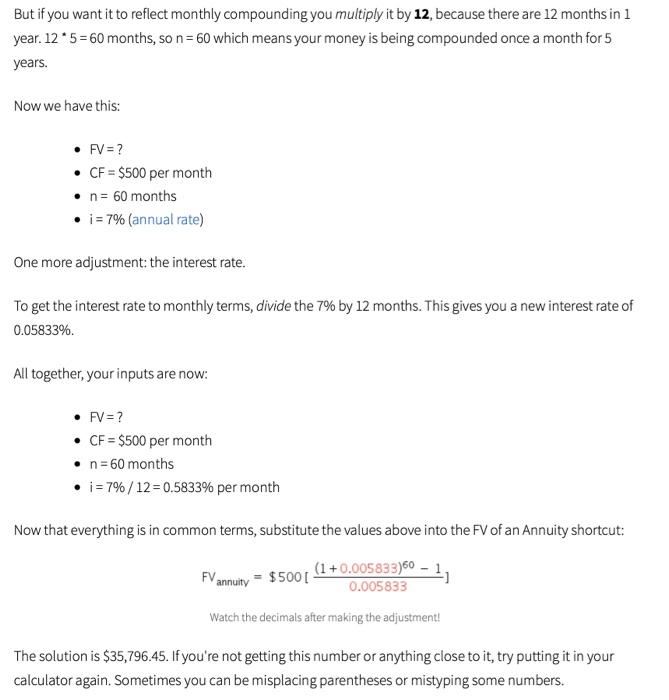

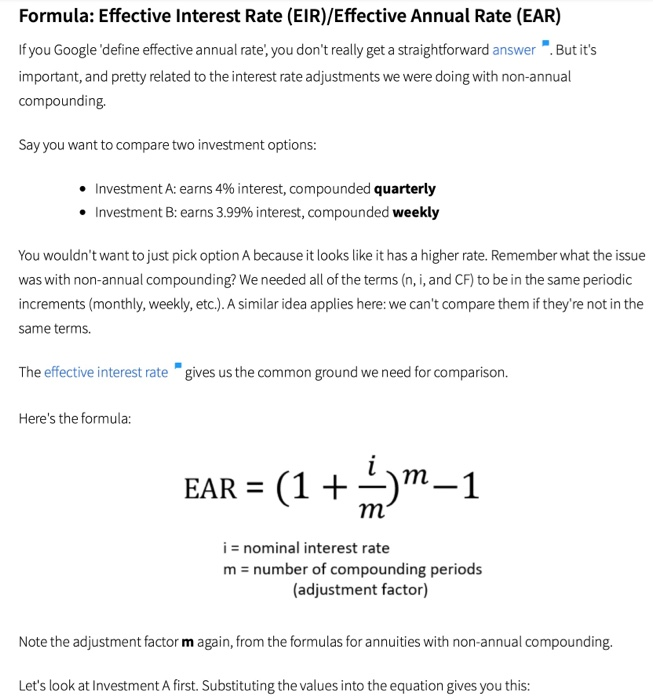

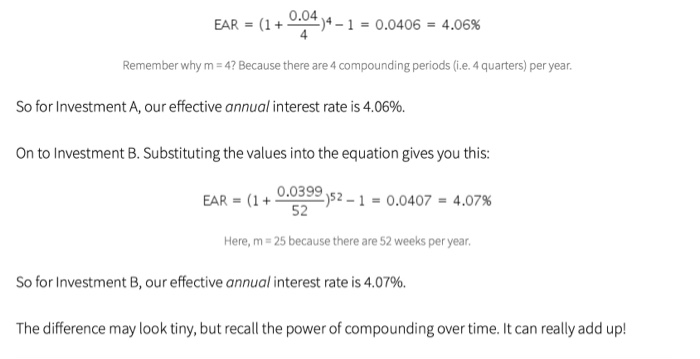

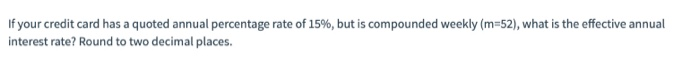

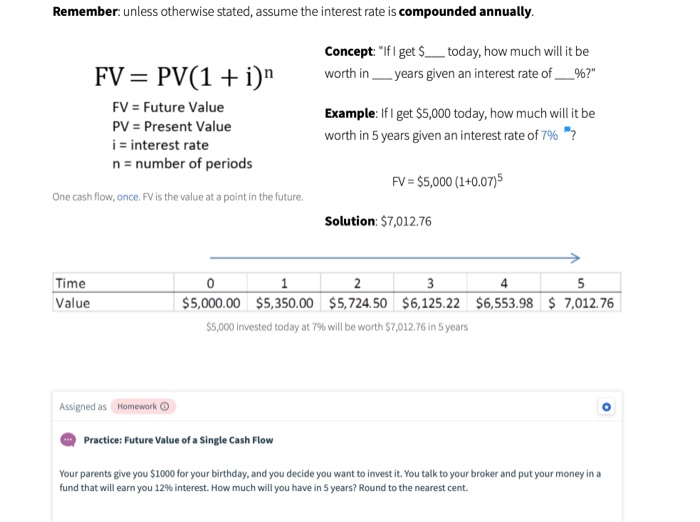

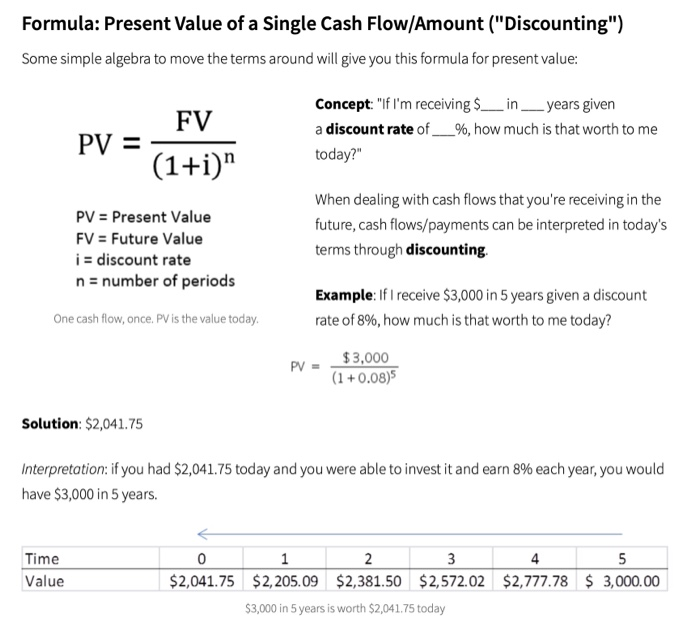

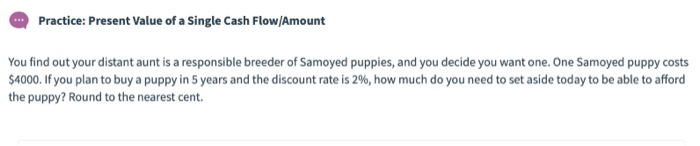

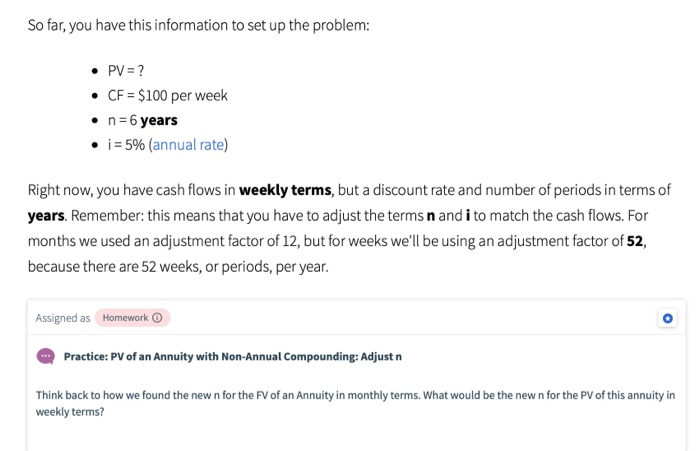

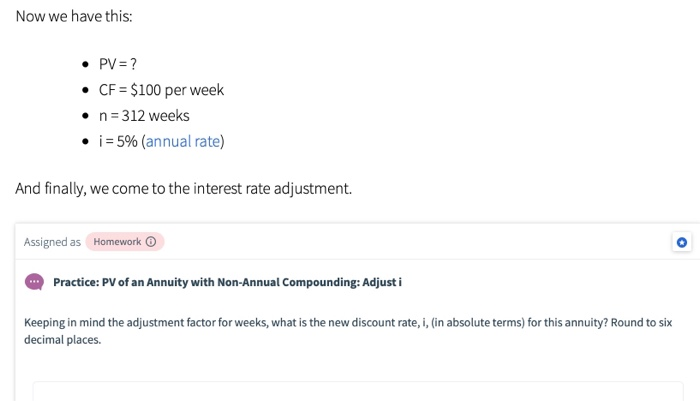

But if you want it to reflect monthly compounding you multiply it by 12, because there are 12 months in 1 year. 12 5-60 months, so n 60 which means your money is being compounded once a month for5 years. Now we have this: FV-? . CF $500 per month n 60 months i : 7% (annual rate) . One more adjustment: the interest rate. To get the interest rate to monthly terms, divide the 7% by 12 months. This gives you a new interest rate of 0.0583396 All together, your inputs are now: FV-? CF $500 per month . n 60 months . 1-796 / 12-0.5833% per month Now that everything is in common terms, substitute the values above into the FV of an Annuity shortcut: 0.005833 Watch the decimals after making the adjustment! The solution is $35,796.45. If you're not getting thisnumberor anything close to it, try putting it in your calculator again. Sometimes you can be misplacing parentheses or mistyping some numbers. You land a babysitting job that promises to pay $100 per month. If you expect to have the job for the next 4 years and earn interest of 496, how much will you have in 4 years? Round to the nearest cent. Formula: Effective Interest Rate (EIR)/Effective Annual Rate (EAR) If you Google'define effective annual rate, you don't really get a straightforward answer . But it's compounding. Say you want to compare two investment options: imporant andprety rlaothwth no aa Investment A: earns 4% interest, compounded quarterly Investment B: earns 3.99% interest, compounded weekly . . You wouldn't want to just pick option A because it looks like it has a higher rate. Remember what the issue was with non-annual compounding? We needed all of the terms (n, i, and CF) to be in the same periodic increments (monthly, weekly, etc.). A similar idea applies here: we can't compare them if they're not in the same terms. The effective interest rate gives us the common ground we need for comparison. Here's the formula: EAR (1 +-)m-1 inominal interest rate m number of compounding periods (adjustment factor) Note the adjustment factor m again, from the formulas for annuities with non-annual compounding. Let's look at Investment A first. Substituting the values into the equation gives you this: EARs (1 + 044)4-1-0.0406-4.06% Remember why m 4? Because there are 4 compounding periods (i.e. 4 quarters) per year. So for Investment A, our effective annual interest rate is 4.06%. On to Investment B. Substituting the values into the equation gives you this: EAR-(. 0.0399)52-1-0.0407-4.07% 52 Here, m 25 because there are 52 weeks per year So for Investment B, our effective annual interest rate is 4.07%. The difference may look tiny, but recall the power of compounding over time. It can really add up! If your credit card has a quoted annual percentage rate of 15%, but is compounded weekly (m=52), what is the effective annual interest rate? Round to two decimal places. Formula: Present Value of a Single Cash Flow/Amount ("Discounting") Some simple algebra to move the terms around will give you this formula for present value: FV Concept: "ifI'mreceiving S in_years given a discount rate of %, how much is that worth to me PV - today?" (1+1)" PV- Present Value FV Future Value i discount rate n number of periods When dealing with cash flows that you're receiving in the future, cash flows/payments can be interpreted in today's terms through discounting Example: If I receive $3,000 in 5 years given a discount rate of 8%, how much is that worth to me today? One cash flow,once. PV is the value today $3,000 (1 +0.08)5 Solution: $2,041.75 Interpretation: if you had $2,041.75 today and you were able to invest it and earn 8% each year, you would have $3,000 in 5 years. Time Value 0 4 2,041.75 $2,205.09 $2,381.50 $2,572.02 $2,777.78 $3,000.00 $3,000 in 5 years is worth $2,041.75 today Practice: Present Value of a Single Cash Flow/Amount You find out your distant aunt is a responsible breeder of Samoyed puppies, and you decide you want one. One Samoyed puppy costs $4000. If you plan to buy a puppy in 5 years and the discount rate is 2%, how much do you need to set aside today to be able to afford the puppy? Round to the nearest cent. So far, you have this information to set up the problem: CF $100 per week n 6 years . i-5% (annual rate) Right now, you have cash flows in weekly terms, but a discount rate and number of periods in terms of years. Remember: this means that you have to adjust the terms n and i to match the cash flows. For months we used an adjustment factor of 12, but for weeks we'll be using an adjustment factor of 52, because there are 52 weeks, or periods, per year. Assigned as Homework Practice: PV of an Annuity with Non-Annual Compounding: Adjust n Think back to how we found the new n for the FV of an Annuity in monthly terms. What would be the new n for the PV of this annuity in weekly terms? Now we have this: CF $100 per week n 312 weeks . 1-5% (annual rate) And finally, we come to the interest rate adjustment. Assined as (Homework O Practice: PV of an Annuity with Non-Annual Compounding: Adjust i Keeping in mind the adjustment factor for weeks, what is the new discount rate, i, (in absolute terms) for this annuity? Round to six decimal places

2.

3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started