Answered step by step

Verified Expert Solution

Question

1 Approved Answer

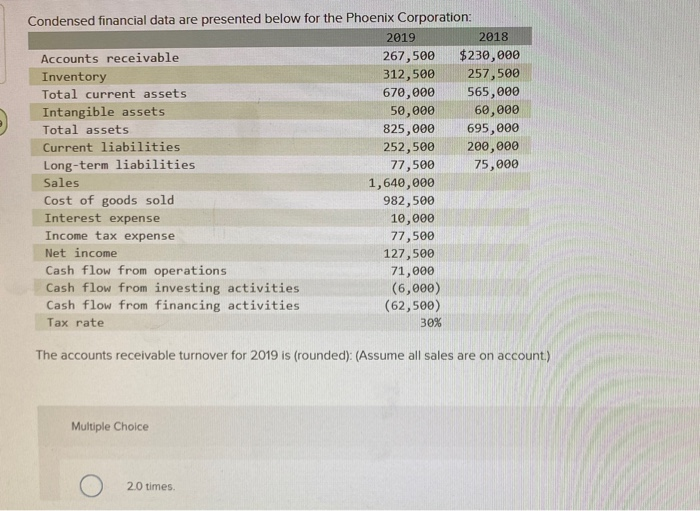

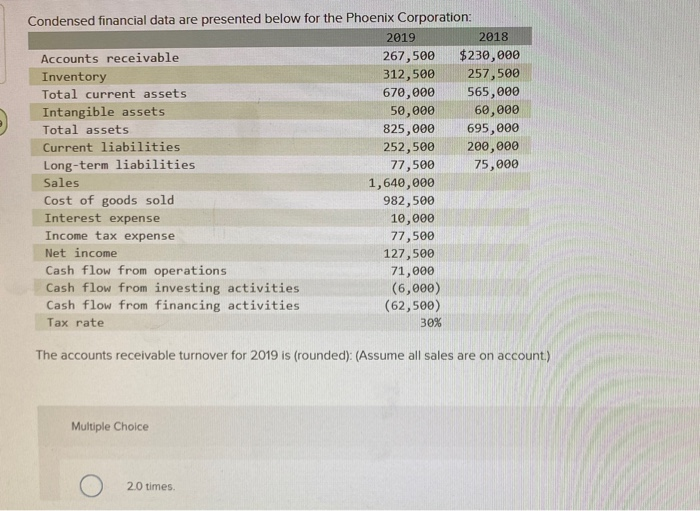

1 2 3 Condensed financial data are presented below for the Phoenix Corporation: 2019 2018 Accounts receivable 267,500 $230,000 Inventory 312,500 257,500 Total current assets

1

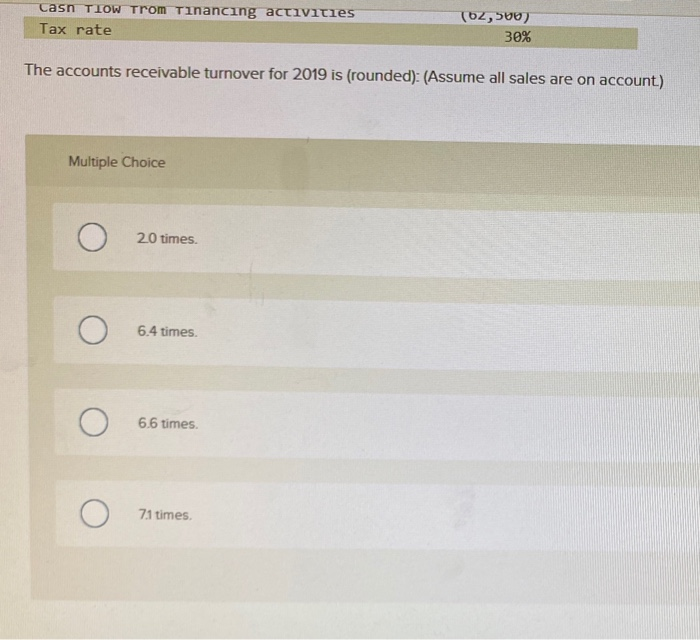

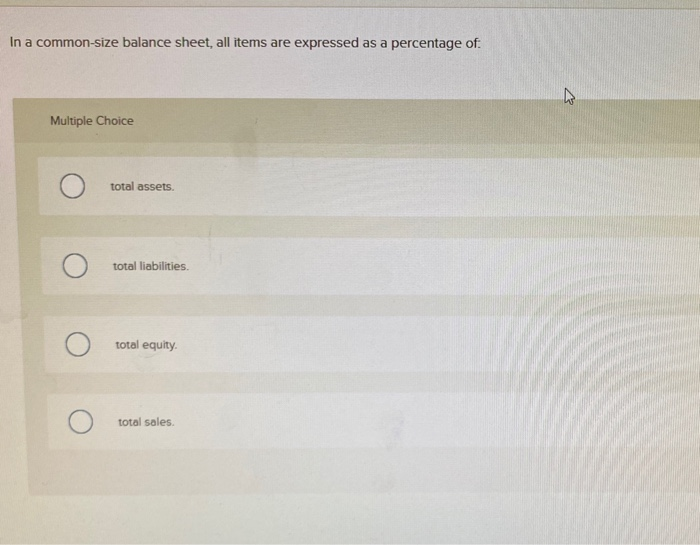

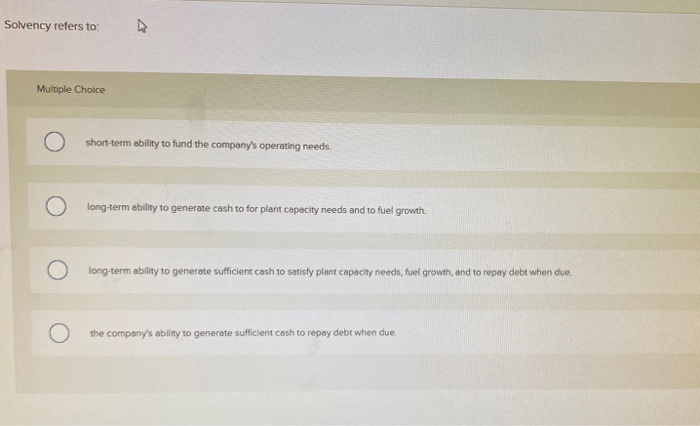

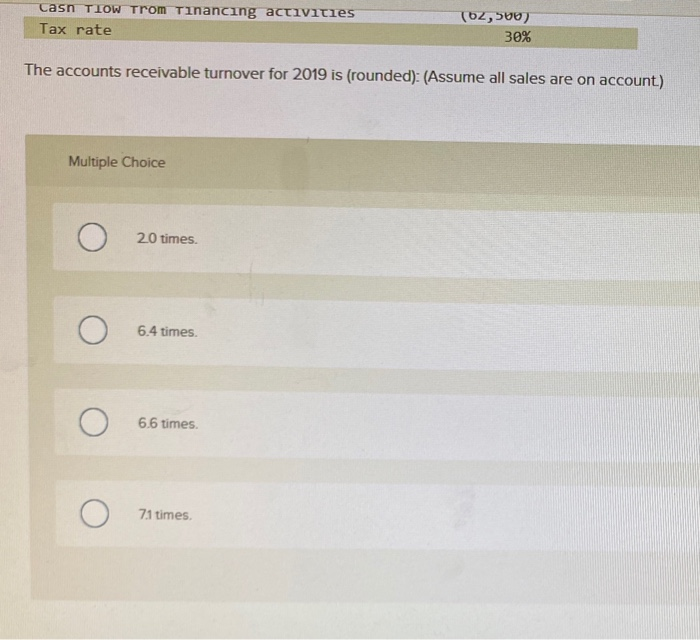

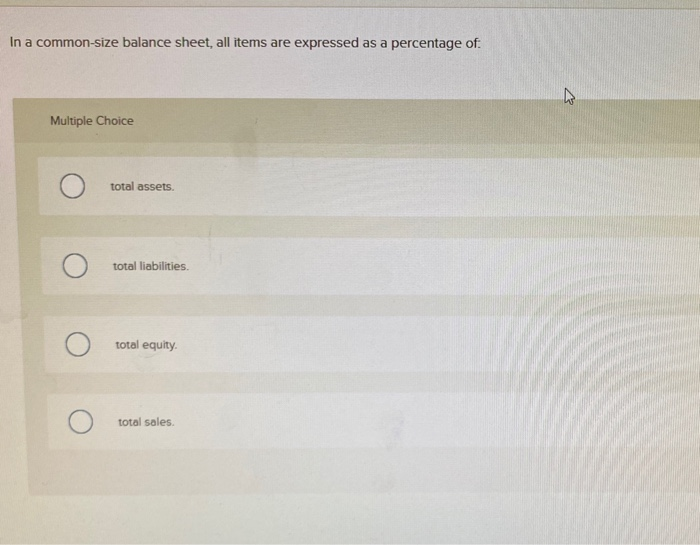

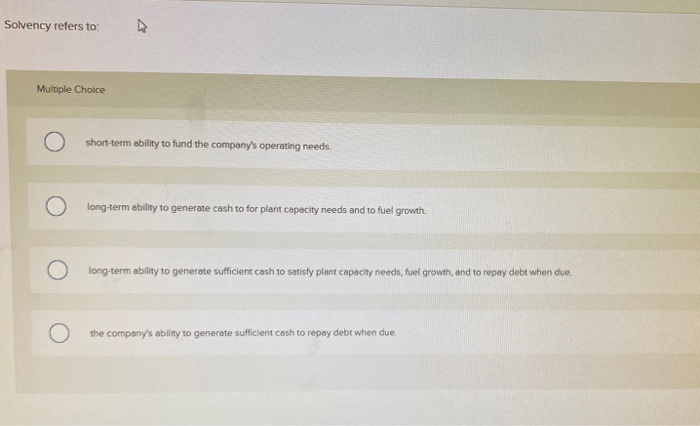

Condensed financial data are presented below for the Phoenix Corporation: 2019 2018 Accounts receivable 267,500 $230,000 Inventory 312,500 257,500 Total current assets 670,000 565,000 Intangible assets 50,000 60,000 Total assets 825,000 695,000 Current liabilities 252,500 200,000 Long-term liabilities 77,500 75,000 Sales 1,640,000 Cost of goods sold 982,500 Interest expense 10,000 Income tax expense 77,500 Net income 127,500 Cash flow from operations 71,000 Cash flow from investing activities (6,000) Cash flow from financing activities (62,500) Tax rate 30% The accounts receivable turnover for 2019 is (rounded): (Assume all sales are on account.) Multiple Choice 20 times Casn tiow Trom Tinancing activities Tax rate (62,500) 30% The accounts receivable turnover for 2019 is (rounded): (Assume all sales are on account.) Multiple Choice 20 times. 6.4 times 6.6 times 7.1 times In a common-size balance sheet, all items are expressed as a percentage of w Multiple Choice total assets total liabilities. total equity total sales. Solvency refers to Multiple Choice short-term ability to fund the company's operating needs. long-term ability to generate cosh to for plant capacity needs and to fuel growth. long-term ability to generate sufficient cash to satisfy plant capacity needs, fuel growth, and to repay debt when due the company's ability to generate sufficient cash to repay debt when due

2

3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started