Answered step by step

Verified Expert Solution

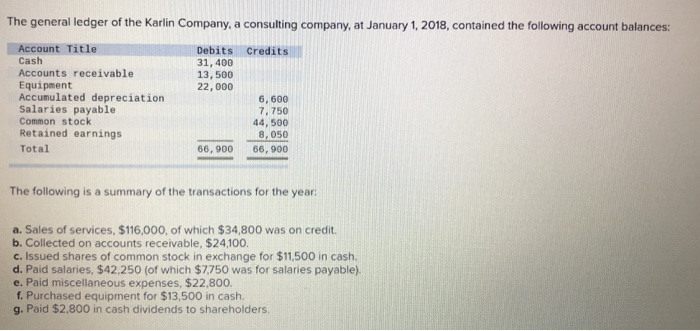

Question

1 Approved Answer

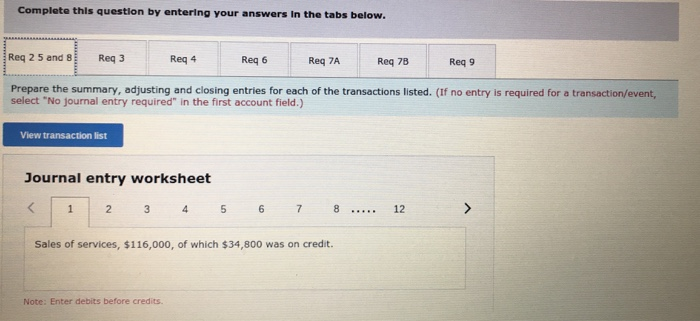

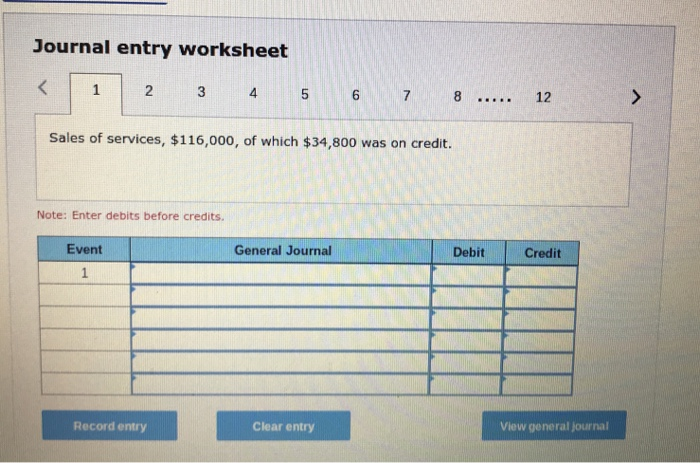

1 2 3 (same format as above) Issued shares of common stock in exchange for 11,500 in cash. 4 Paid salaries and wages, 42,250 (of

1

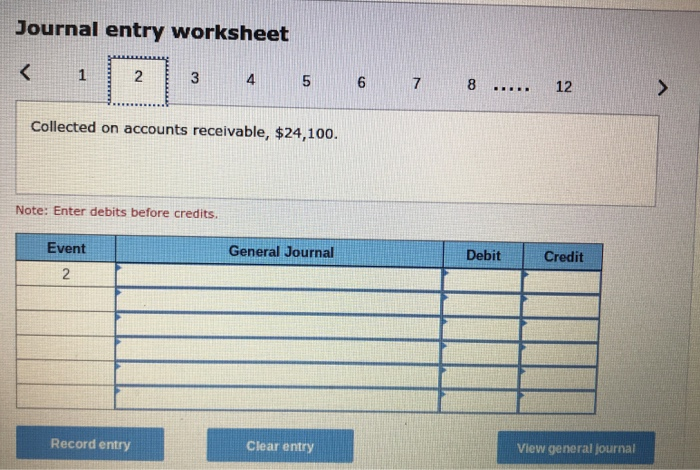

2

3

(same format as above)

Issued shares of common stock in exchange for 11,500 in cash.

4

Paid salaries and wages, 42,250 (of which 7,750 was for salaries payable)

5

Paid miscellaneous expenses, 22,800

6

Purchased equipment for 13,500 in cash

7

Paid 2,800 in cash dividends to shareholders

8

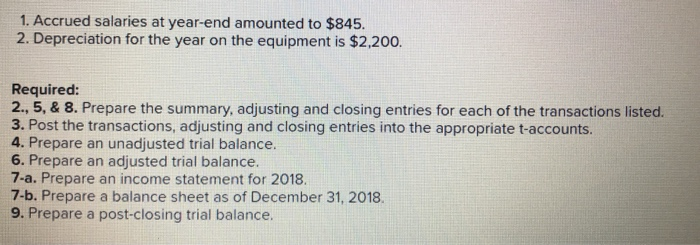

Record the adjusting journal entry for accrued salaries and wages at year end that amounted to $845

9

record the adjusting journal entry for annual depreciation of 2,200

10

record the entry to close the revenue accounts using the income summary

11

record the entry to close the expense accounts using the income summary

12

record the entry to close the income summary account

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started