Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. SCS Co. uses activity-based costing in their manufacturing process. The company produces two products, ABC and XYZ. SCS has provided their costing

1.

2.

3.

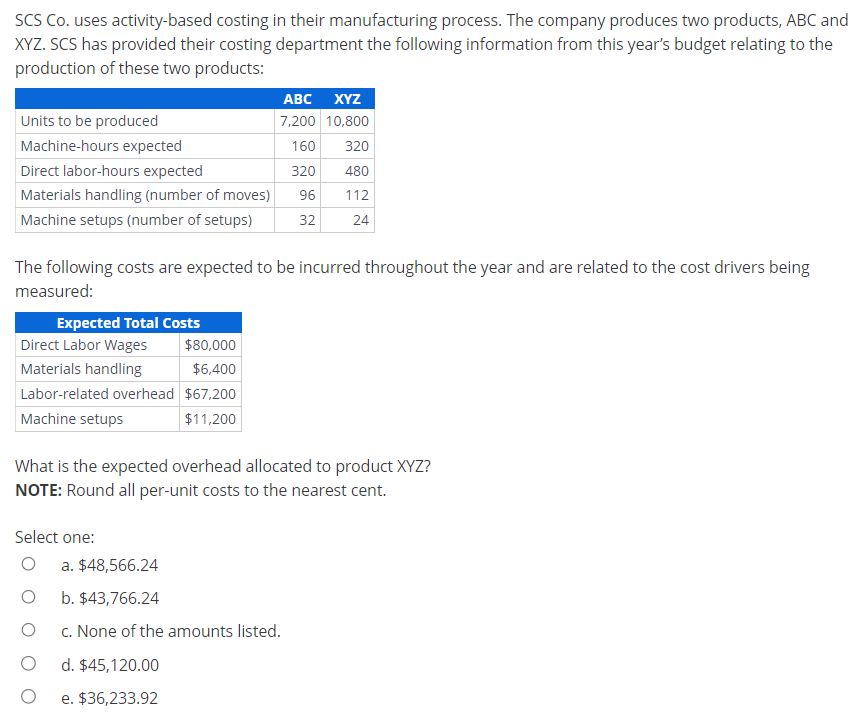

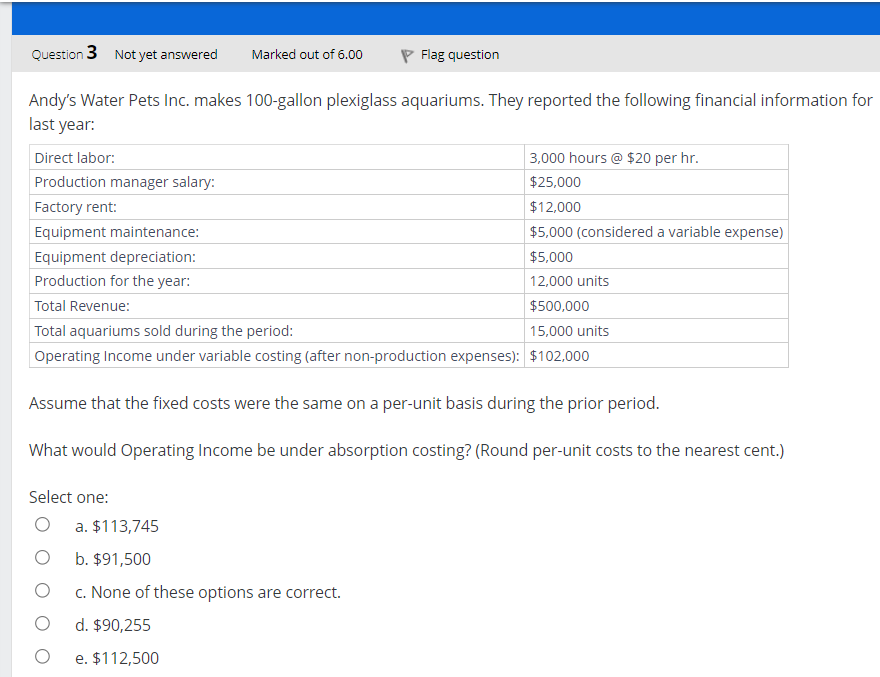

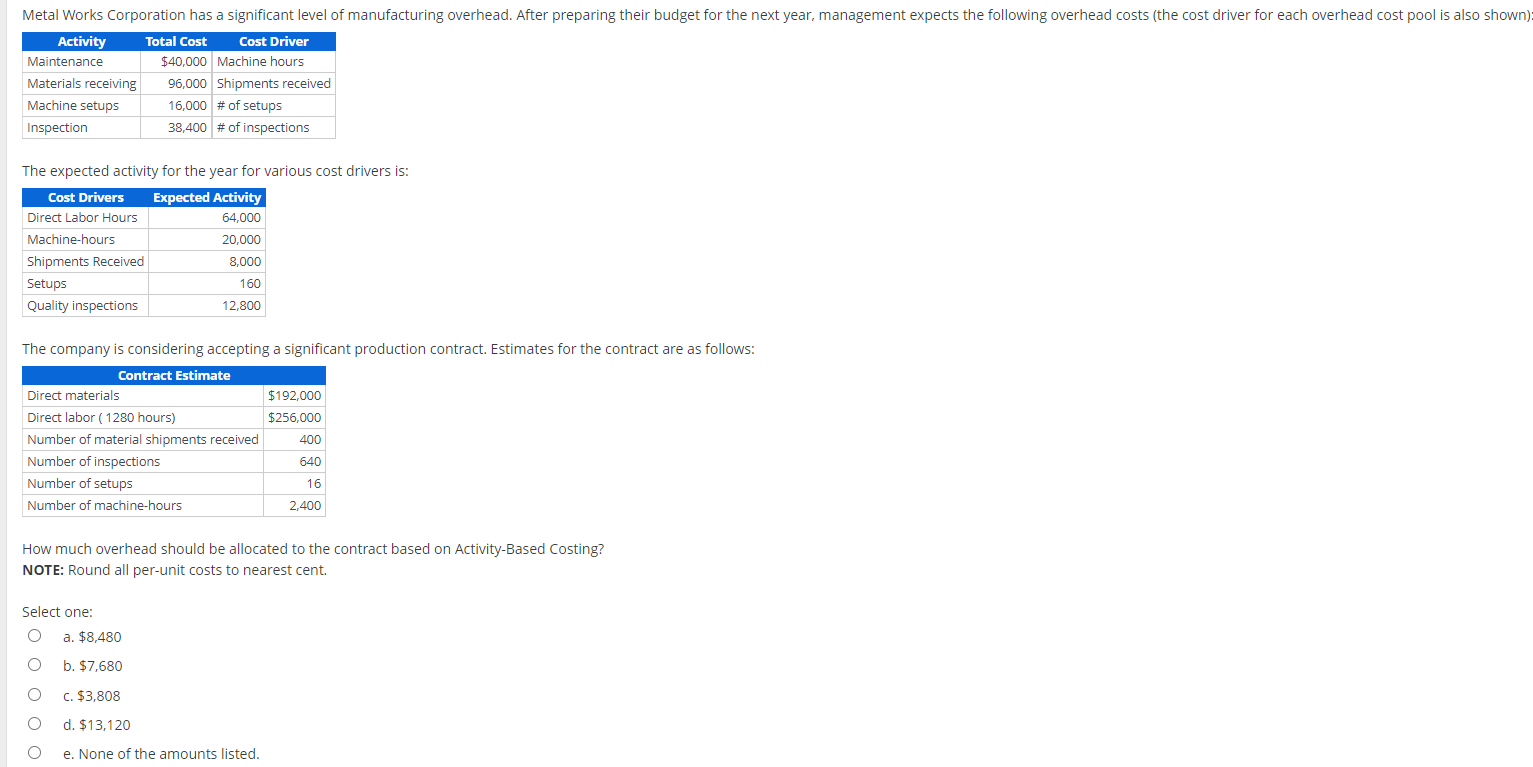

SCS Co. uses activity-based costing in their manufacturing process. The company produces two products, ABC and XYZ. SCS has provided their costing department the following information from this year's budget relating to the production of these two products: The following costs are expected to be incurred throughout the year and are related to the cost drivers being measured: What is the expected overhead allocated to product XYZ? NOTE: Round all per-unit costs to the nearest cent. Select one: a. $48,566.24 b. $43,766.24 c. None of the amounts listed. d. $45,120.00 e. $36,233.92 Andy's Water Pets Inc. makes 100-gallon plexiglass aquariums. They reported the following financial information fo last year: Assume that the fixed costs were the same on a per-unit basis during the prior period. What would Operating Income be under absorption costing? (Round per-unit costs to the nearest cent.) Select one: a. $113,745 b. $91,500 c. None of these options are correct. d. $90,255 e. $112,500 The expected activity for the year for various cost drivers is: The company is considering accepting a significant production contract. Estimates for the contra How much overhead should be allocated to the contract based on Activity-Based Costing? NOTE: Round all per-unit costs to nearest cent. Select one: a. $8,480 b. $7,680 c. $3,808 d. $13,120 e. None of the amounts listed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started