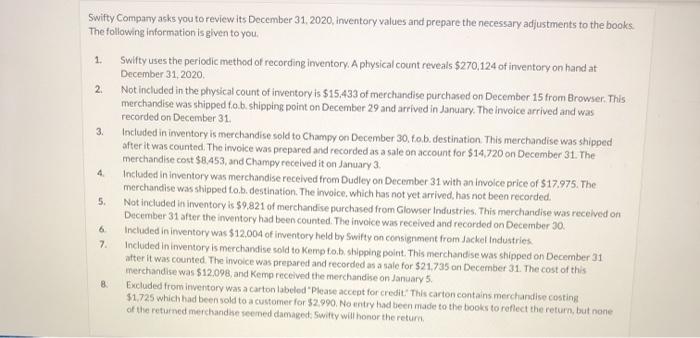

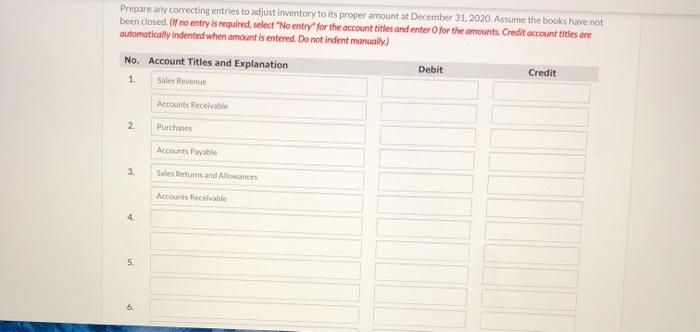

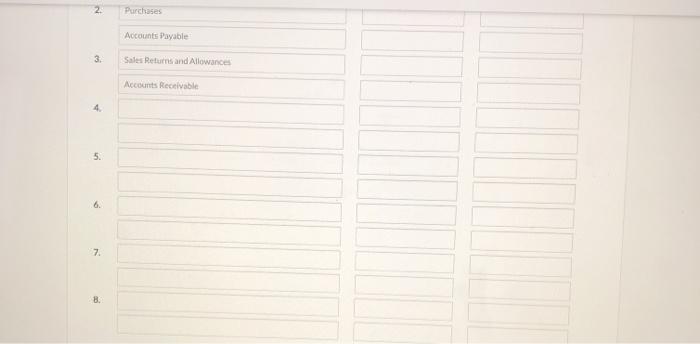

1. 2. 3. Swifty Company asks you to review its December 31, 2020, inventory values and prepare the necessary adjustments to the books The following information is given to you. Swifty uses the periodic method of recording inventory. A physical count reveals $270,124 of inventory on hand at December 31, 2020 Not included in the physical count of inventory is $15,433 of merchandise purchased on December 15 from Browser. This merchandise was shipped to.b.shipping point on December 29 and arrived in January. The involce arrived and was recorded on December 31 Included in inventory is merchandise sold to Champy on December 30, fo.b.destination. This merchandise was shipped after it was counted. The invoice was prepared and recorded as a sale on account for $14.720 on December 31. The merchandise cost $8.453, and Champy received it on January 3. Included in inventory was merchandise recelved from Dudley on December 31 with an involce price of $17.975. The merchandise was shipped to.b. destination. The invoice, which has not yet arrived, has not been recorded. Not included in inventory is 59,821 of merchandise purchased from Glowser Industries. This merchandise was received on December 31 after the inventory had been counted. The invoice was received and recorded on December 30, Included in inventory was $12.004 of inventory held by Swifty on consignment from Jacket Industries Included in Inventory is merchandise sold to Kempton shipping point. This merchandise was shipped on December 31 after it was counted. The invoice was prepared and recorded as a sale for $21.735 on December 31. The cost of this merchandise was $12.098, and Kemp received the merchandise on January 5. Excluded from inventory was a carton labeled Please accept for credit. This carton contains merchandise costing $1.725 which had been sold to a customer for $2.990. No entry had been made to the books to reflect the return, but none of the returned merchandke seemed damaged Swifty will honor the return 4 5. 6 7 8. Prepare any correcting entries to adjust inventory to its proper amount at December 31, 2020. Assume the books have not been dosed. (If no entry is required, select "No entry for the account titles and enter for the amounts Credit account titles are automatically indented when amount is entered. Do not indent manually) No. Account Titles and Explanation Credit Debit 1. Sales Revenue Accounts Receivable 2 Purchases Accounts Payable Sales Retums and Allowances Accounts Receivable 4 5. 2. Purchases Accounts Payable 3. Sales Returns and Allowances Accounts Receivable 4 5. 7