Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. Unanswered Question 1 0/1 pts Which of the following statements is CORRECT? Corporations generally are subject to less regulations than proprietorships. One

1.

2.

3.

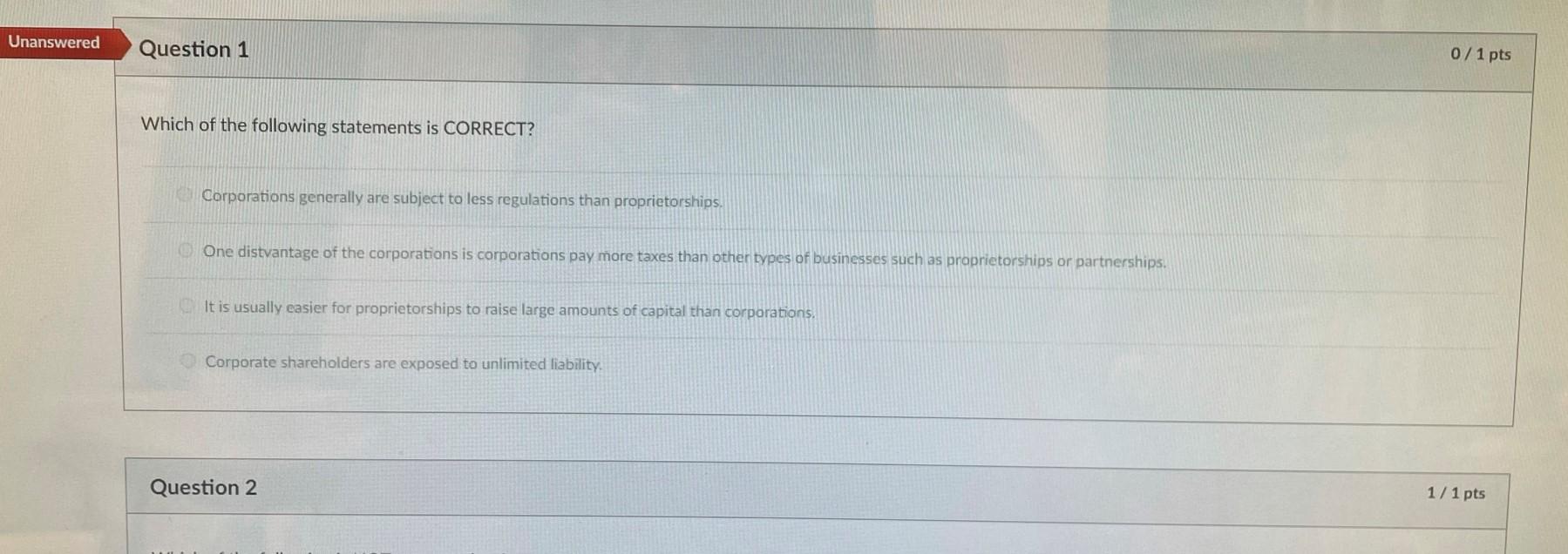

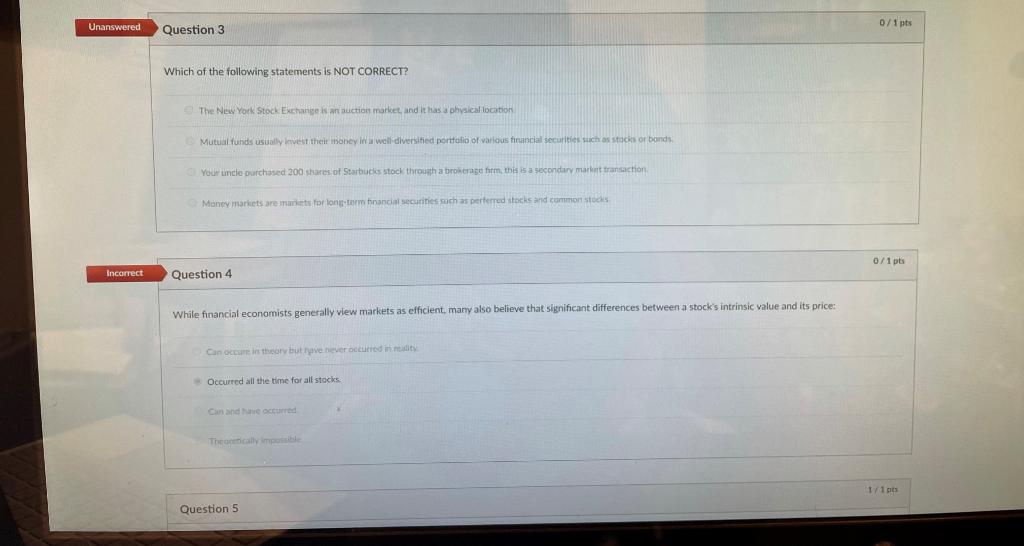

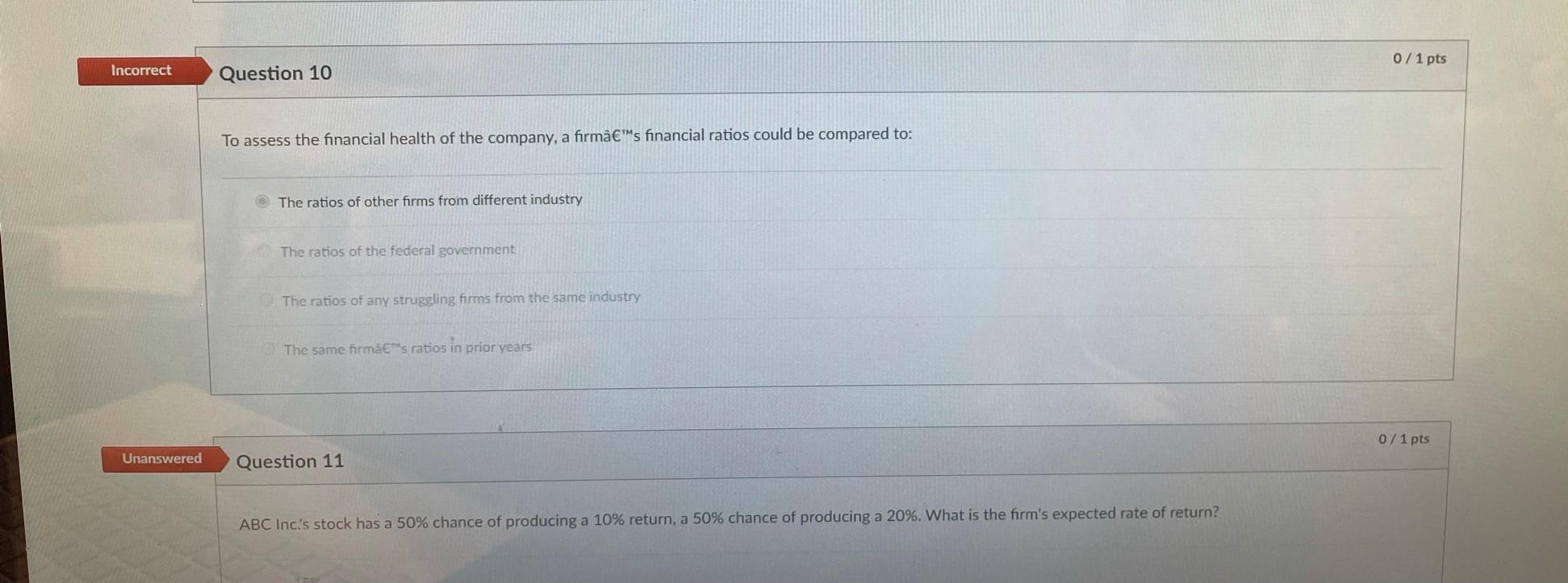

Unanswered Question 1 0/1 pts Which of the following statements is CORRECT? Corporations generally are subject to less regulations than proprietorships. One distvantage of the corporations is corporations pay more taxes than other types of businesses such as proprietorships or partnerships. It is usually easier for proprietorships to raise large amounts of capital than corporations, Corporate shareholders are exposed to unlimited liability Question 2 1/1 pts Unanswered 0/1 pts Question 3 Which of the following statements is NOT CORRECT? The New York Stock Exchanges and suction market, and it has a physical location Mutual funds usually invest the money in a well-diversified portfolio of various financial securities such as stocks or bonds Your uncle purchased 200 shares of Starbucks stock through a brokerage for this is a secondary market transaction Money markets are mans for long term hinancial securities such as perferred stocks and common to 0/1 pts Incorrect Question 4 While financial economists generally view markets as efficient, many also believe that significant differences between a stock's intrinsic value and its price: Cance in theory but have never occated in Occurred all the time for all stocks Canande occurred Theoretically imposible 1 / 1 Question 5 0 / 1 pts Incorrect Question 10 To assess the financial health of the company, a firmTMs financial ratios could be compared to: The ratios of other forms from different industry The ratios of the federal government The ratios of any struggling firms from the same industry The same firme's ratios in prior years 0/1 pts Unanswered Question 11 ABC Inc's stock has a 50% chance of producing a 10% return, a 50% chance of producing a 20%. What is the firm's expected rate of returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started