Answered step by step

Verified Expert Solution

Question

1 Approved Answer

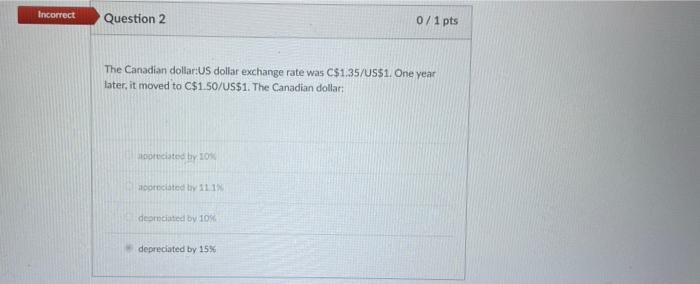

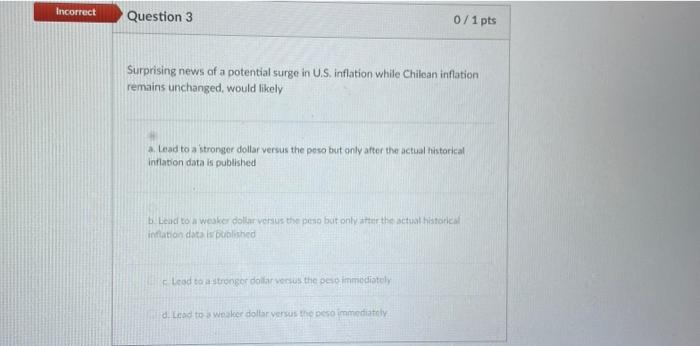

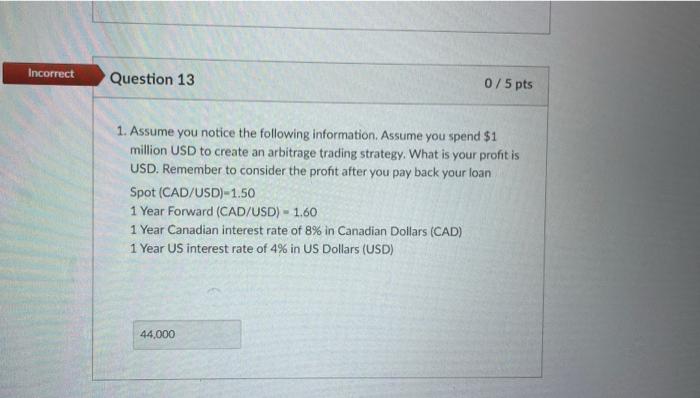

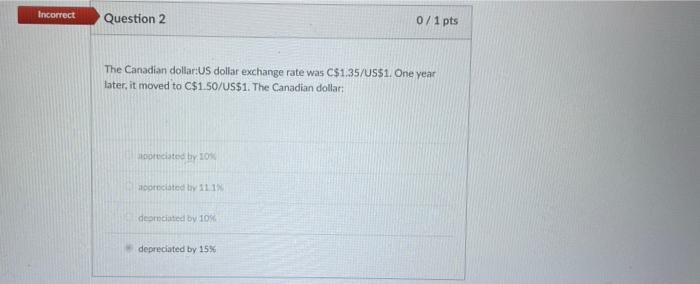

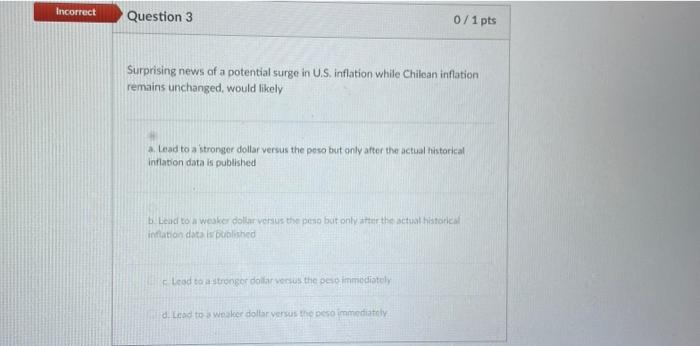

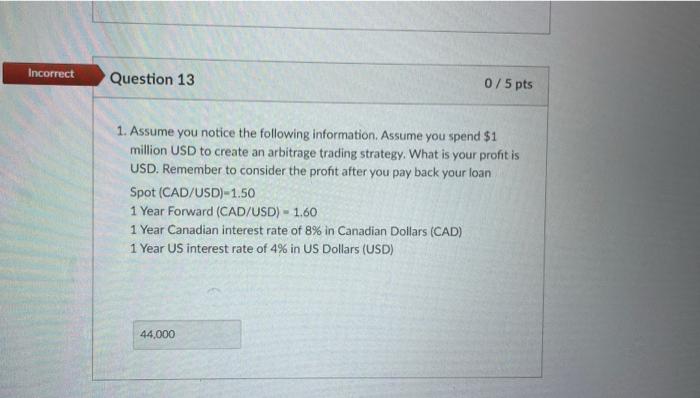

1. 2. 3. what is the value of A? B? C? D? 4. The Canadian dollar:US dollar exchange rate was C$1.35/US$1.One year later, it moved

1.

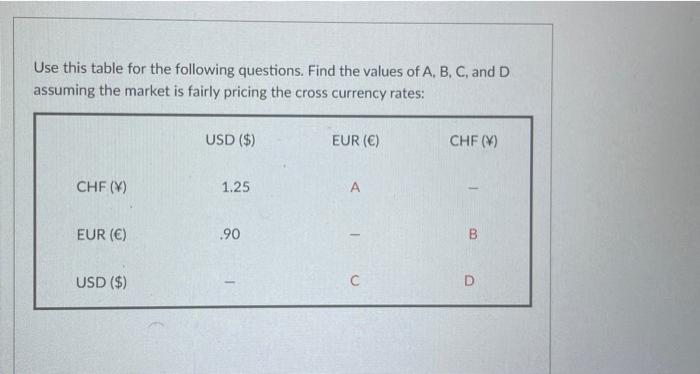

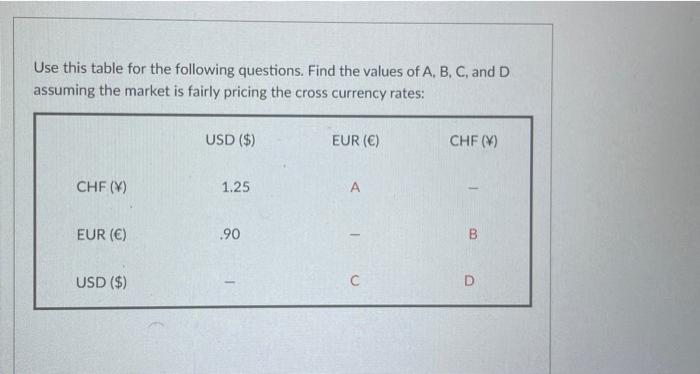

what is the value of A? B? C? D?

what is the value of A? B? C? D?

The Canadian dollar:US dollar exchange rate was C\$1.35/US\$1.One year later, it moved to C\$1.50/US\$1. The Canadian dollar: iosteciated brions aporeciated by 11.1N desmeriated by 10% depreciated by 15% Surprising news of a potential surge in U.S. inflation while Chilean inflation remains unchanged, would likely a. Lead to a stronger dollar versus the peso but only after the actual historical intlation data is published b. Lead to a wesker dollar versus the peso bot onky atter the actual historical inflation data is pribliched d. Lead to a weaker doltar versus the pero immentiattly Use this table for the following questions. Find the values of A, B, C, and D assuming the market is fairly pricing the cross currency rates: 1. Assume you notice the following information. Assume you spend $1 million USD to create an arbitrage trading strategy. What is your profit is USD. Remember to consider the profit after you pay back your loan Spot (CAD/USD) =1.50 1 Year Forward (CAD/USD) =1.60 1 Year Canadian interest rate of 8% in Canadian Dollars (CAD) 1 Year US interest rate of 4% in US Dollars (USD)

2.

3.

what is the value of A? B? C? D?

what is the value of A? B? C? D?4.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started