Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. 3. Yaz buys 100 shares of Bee Corp stock at $5/ share in 2015. In 2021, she still holds the 100 shares which

1.

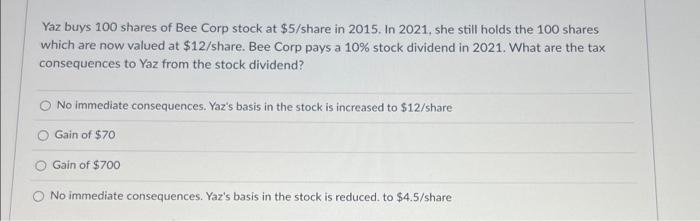

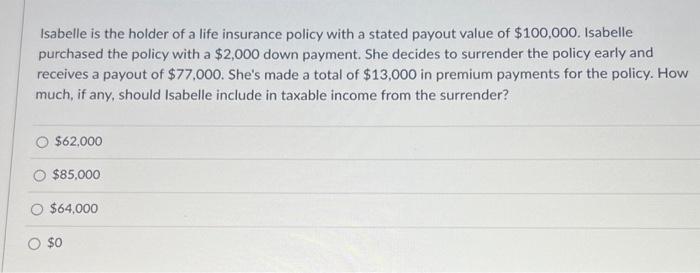

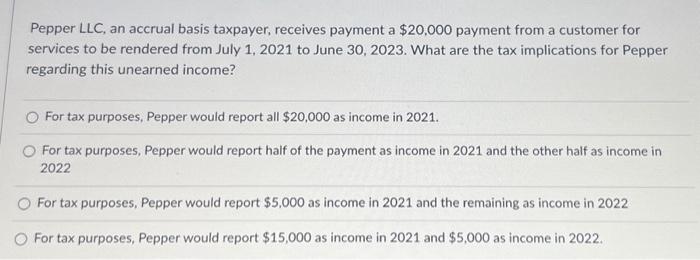

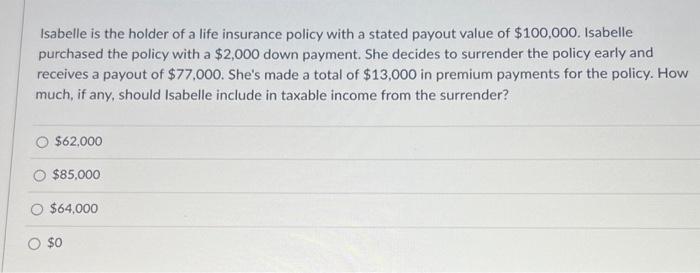

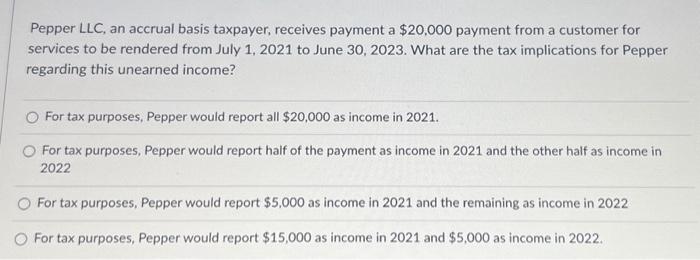

Yaz buys 100 shares of Bee Corp stock at $5/ share in 2015. In 2021, she still holds the 100 shares which are now valued at $12/ share. Bee Corp pays a 10% stock dividend in 2021 . What are the tax consequences to Yaz from the stock dividend? No immediate consequences. Yaz's basis in the stock is increased to $12/ share Gain of $70 Gain of $700 No immediate consequences. Yaz's basis in the stock is reduced. to $4.5/ share Isabelle is the holder of a life insurance policy with a stated payout value of $100,000. Isabelle purchased the policy with a $2,000 down payment. She decides to surrender the policy early and receives a payout of $77,000. She's made a total of $13,000 in premium payments for the policy. How much, if any, should Isabelle include in taxable income from the surrender? $62,000 $85,000 $64,000 $0 Pepper LLC, an accrual basis taxpayer, receives payment a $20,000 payment from a customer for services to be rendered from July 1, 2021 to June 30,2023 . What are the tax implications for Pepper regarding this unearned income? For tax purposes, Pepper would report all $20,000 as income in 2021. For tax purposes, Pepper would report half of the payment as income in 2021 and the other half as income in 2022 For tax purposes, Pepper would report $5,000 as income in 2021 and the remaining as income in 2022 For tax purposes, Pepper would report $15,000 as income in 2021 and $5,000 as income in 2022

2.

3.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started