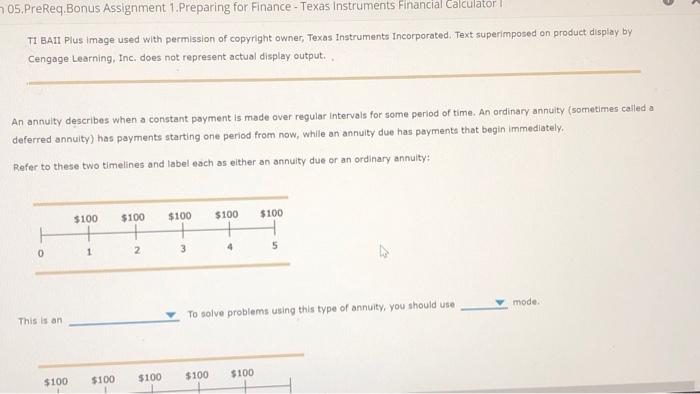

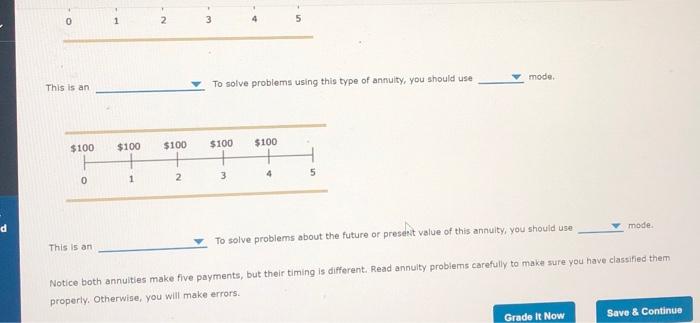

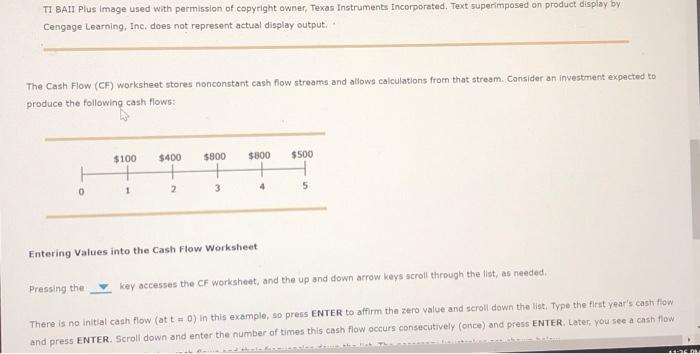

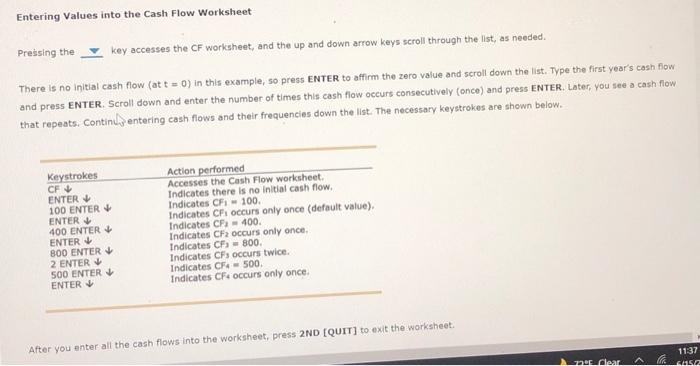

705. PreReq.Bonus Assignment 1. Preparing for Finance - Texas Instruments Financial Calculator TI BAII Plus Image used with permission of copyright owner, Texas Instruments Incorporated. Text superimposed on product display by Cengage Learning, Inc. does not represent actual display output. An annuity describes when a constant payment is made over regular intervals for some period of time. An ordinary annuity (sometimes called a deferred annuity) has payments starting one period from now, while an annuity due has payments that begin immediately. Refer to these two timelines and label each as either an annuity due or an ordinary annulty: $100 $100 $100 $100 $100 + 0 1 2 3 mode To solve problems using this type of annuity, you should use This is an $100 $100 $100 $100 $100 . 2 0 3 mode, This is an To solve problems using this type of annuity, you should use $100 $100 $100 $100 $100 + + 4 3 5 0 1 2 mode To solve problems about the future or present value of this annuity, you should use This is an Notice both annulties make five payments, but their timing is different. Read annuity problems carefully to make sure you have classified them properly. Otherwise, you will make errors. Grade It Now Save & Continue TI BAII Plus Image used with permission of copyright owner, Texas Instruments Incorporated. Text superimposed on product display by Cengage Learning, Inc. does not represent actual display output. The Cash Flow (CF) worksheet stores nonconstant cash flow streams and allows calculations from that stream. Consider an investment expected to produce the following cash flows: $400 $100 $800 $800 $500 + + 0 2 4 1 3 5 Entering Values into the Cash Flow Worksheet Pressing the key accesses the CF worksheet, and the up and down arrow keys scroll through the list, as needed There is no initial cash flow (att - 0) in this example, so press ENTER to affirm the zero value and scroll down the list. Type the first year's cash flow and press ENTER. Scroll down and enter the number of times this cash flow occurs consecutively (once) and press ENTER. Later, you see a cash flow TO Entering Values into the Cash Flow Worksheet Pressing the key accesses the CF worksheet, and the up and down arrow keys scroll through the list, as needed. There is no initial cash flow (at t = 0) in this example, so press ENTER to affirm the zero value and scroll down the list. Type the first year's cash flow and press ENTER. Scroll down and enter the number of times this cash flow occurs consecutively (once) and press ENTER. Later, you see a cash flow that repeats. Continuly entering cash flows and their frequencies down the list. The necessary keystrokes are shown below. Keystrokes CF ENTER 100 ENTER ENTER 400 ENTER ENTER 800 ENTER 2 ENTER 500 ENTER ENTER Action performed Accesses the Cash Flow worksheet. Indicates there is no Initial cash flow. Indicates CF - 100. Indicates CF occurs only once (default value) Indicates CF = 400. Indicates CF occurs only once Indicates CF) = 800 Indicates CFs occurs twice Indicates CF 500 Indicates CF occurs only once. After you anter all the cash flows into the worksheet, press 2ND [QUIT] to exit the worksheet. 1137 A Derdlear 2012