Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#1 #2 Absorption-Costing Income Statement During the most recent year, Osterman Company had the following data: Units in beginning inventory Units produced 10,000 Units sold

#1

#2

Absorption-Costing Income Statement

During the most recent year, Osterman Company had the following data:

| Units in beginning inventory | |

| Units produced | 10,000 |

| Units sold ($47 per unit) | 9,300 |

| Variable costs per unit: | |

| Direct materials | $9 |

| Direct labor | $6 |

| Variable overhead | $4 |

| Fixed costs: | |

| Fixed overhead per unit produced | $5 |

| Fixed selling and administrative | $138,000 |

Required:

1. Calculate the cost of goods sold under absorption costing.

$

2. Prepare an income statement using absorption costing. Enter amounts as positive numbers.

| Osterman Company | |

| Income Statement under Absorption Costing | |

| For the Most Recent Year | |

| $ | |

| $ | |

| $ | |

(Please show work)

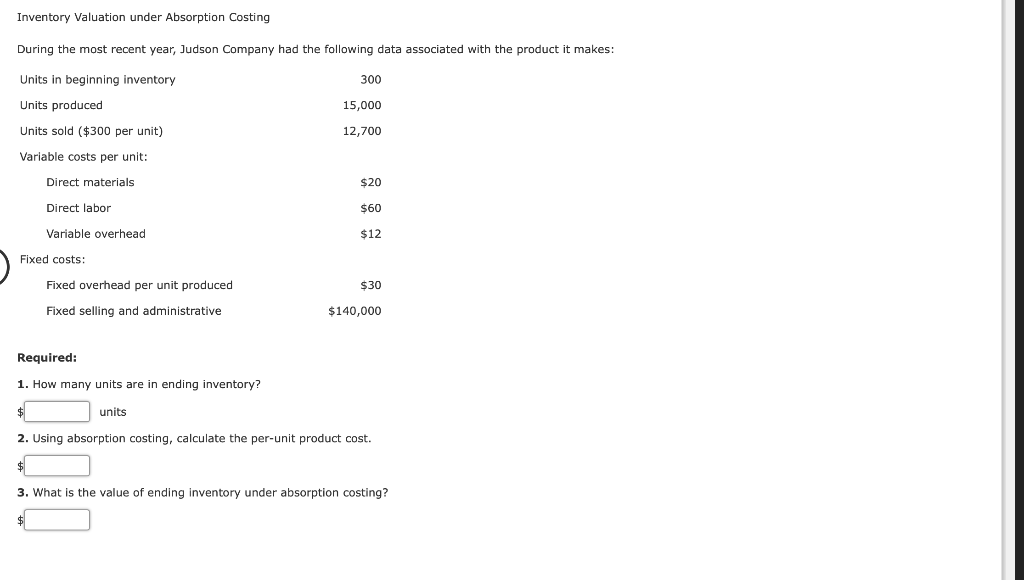

Inventory Valuation under Absorption Costing During the most recent year, Judson Company had the following data associated with the product it makes: 300 Units in beginning inventory Units produced 15,000 Units sold ($300 per unit) 12,700 Variable costs per unit: Direct materials Direct labor Variable overhead Fixed costs: Fixed overhead per unit produced $30 Fixed selling and administrative $140,000 Required: 1. How many units are in ending inventory? 2. Using absorption costing, calculate the per-unit product cost. $ 3. What is the value of ending inventory under absorption costing? $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started