Answered step by step

Verified Expert Solution

Question

1 Approved Answer

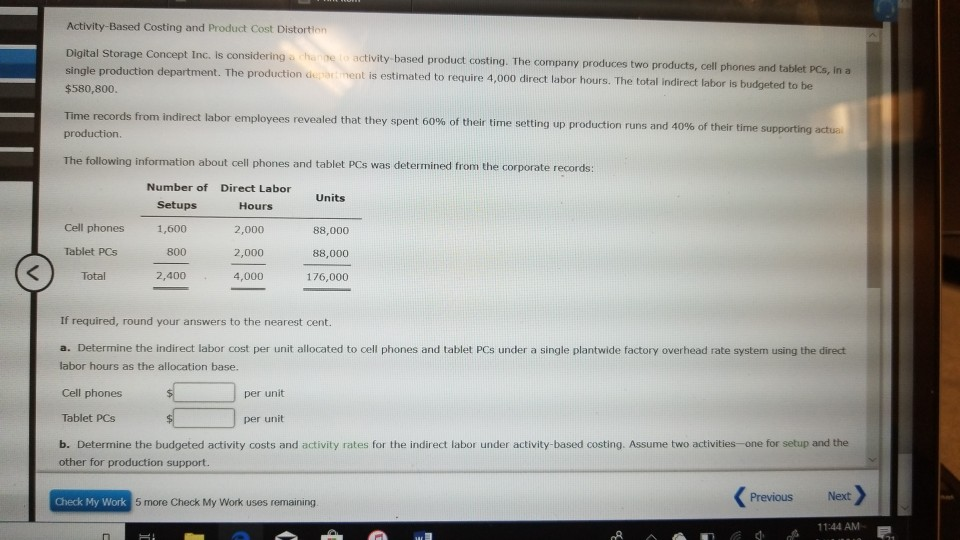

1. 2. Activity-Based Costing and Product Cost Distort Digital Storage Concept Inc. is considering a cha single production department. $580,800 tivity based product costing. The

1.

2.

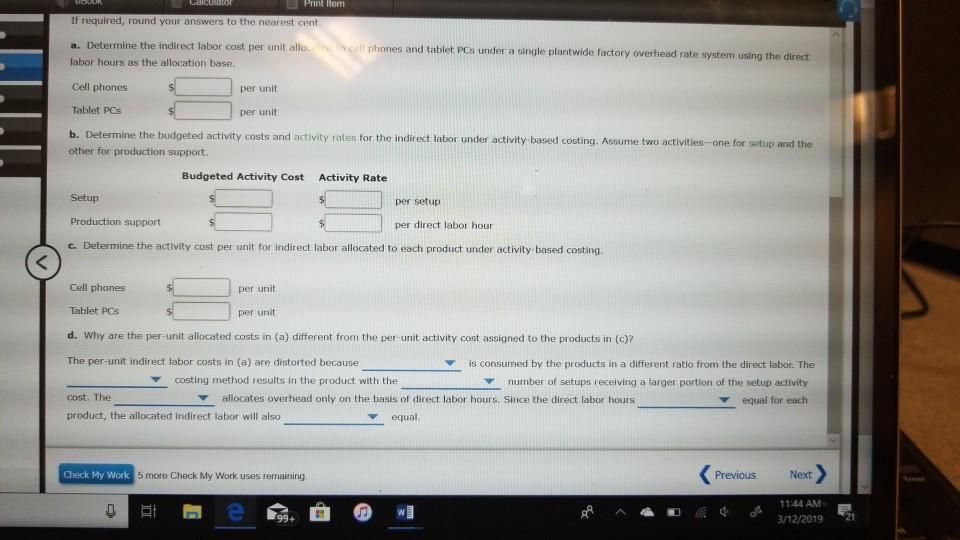

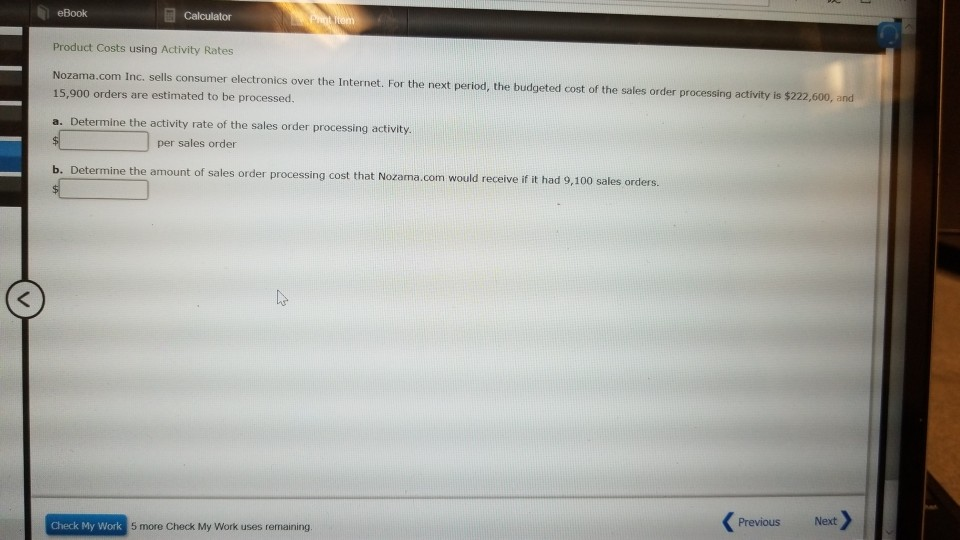

Activity-Based Costing and Product Cost Distort Digital Storage Concept Inc. is considering a cha single production department. $580,800 tivity based product costing. The company produces two products, cell phones and tablet PCs, in a The production departiment is estimated to require 4,000 direct labor hours. The total indirect labor is Time records from indirect labor employees revealed that they spent 60% of their time setting production. up production runs and 40% of their time spp orting actu The following information about cell phones and tablet PCs was determined from the corporate records: Number of Direct Labor Units Setups Hours 2,000 2,000 Cell phones 1,600 88,000 Tablet PCs 800 K) Total2,400 41.00 176,00 If required, round your answers to the nearest cent. a. Determine the indirect labor cost per unit allocated to cell phones and tablet PCs under a single plantwide factory overhead rate system using the direct labor hours as the allocation base. Cell phones per unt Tablet PCs per unit b. Determine the budgeted activity costs and activity rates for the indirect labor under activity based costing. Assume two activities-one for setup and the other for production support. Check My Work 5 more Check My Work uses remaining Previous Next 1:44 AM If required, round your answers to the nearest cent a. Determi ne the indirect labor cost per unit allo cell phones and tablet PCs under a single plantwide factory overhead rate system using the direct labor hours as the allocation base. Cell phones Tablet PCs per unit per unit b. Determine the budgeted activity costs and activity rates for the indirect labor under activity- based costing. Assume two activities-one for setup and the other for production support. Budgeted Activity Cost Activity Rate Setup per setupp Production support per direct labor hour c. Determine the activity cost per unit for indirect labor allocated to each product under activity-based costing Cell phiones per unit Tablet PCs d. Why are the per-unit allocated costs in (a) different from the per-unit activity cost assigned to the products in (o)? The per-unit indirect labor costs in (a) are distorted because per unit is consumed by the products in a different ratio from the direct labor. The costing method results in the product with the number of setups receiving a larger portion of the setup activity Y equal for each cost. The allocates overhead only on the basis of direct labor hours. Since the direct labor hours product, the allocated indirect labor will also Vequal Check My Work 5 more Check My Work uses remaining Previous Next 1144 AM 3/12/2019 eBook Calculator Product Costs using Activity Rates sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is $222,600, and Nozama.com Inc. 15,900 orders are estimated to be processed a. Determine the activity rate of the sales order processing activity per sales order ne the amount of sales order processing cost that Nozama.com would receive if t had 9,100 sales orders. eck My Work 5 more Check My Work uses remaining Previous Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started