1 2 and 3 please. Thank you

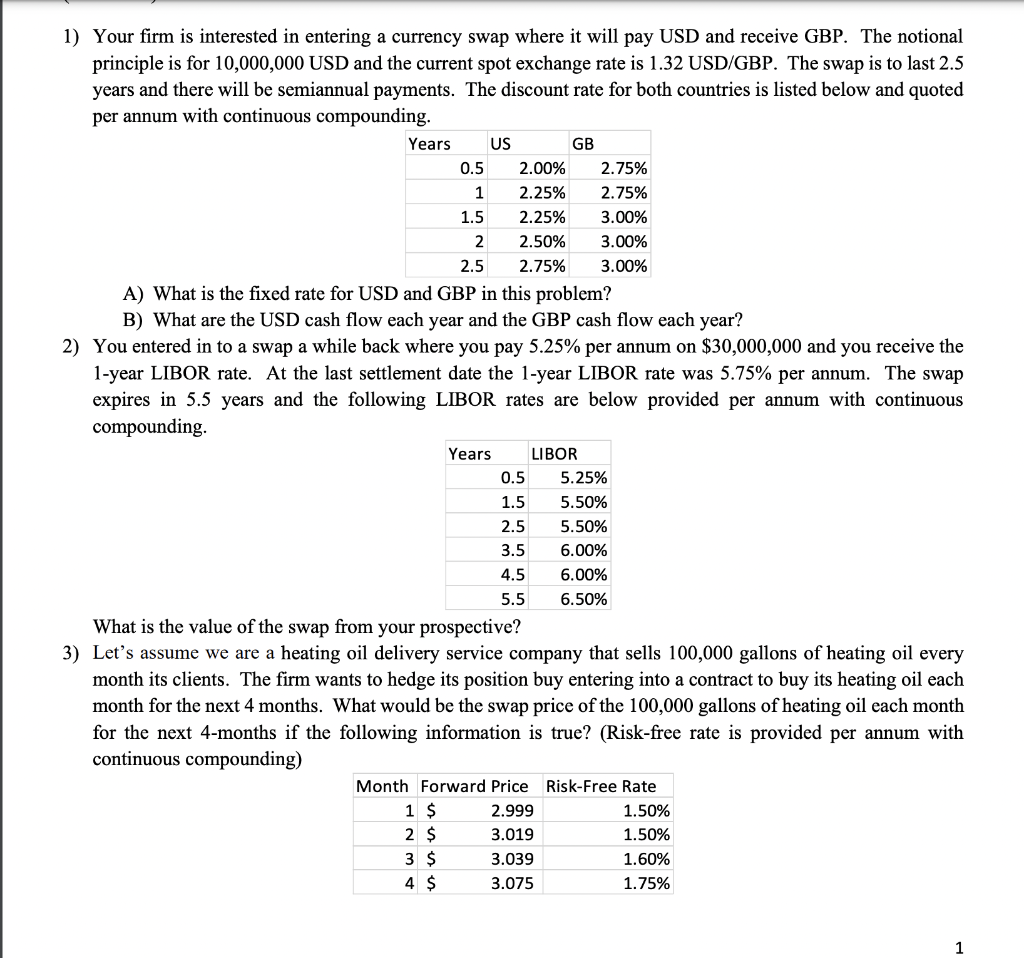

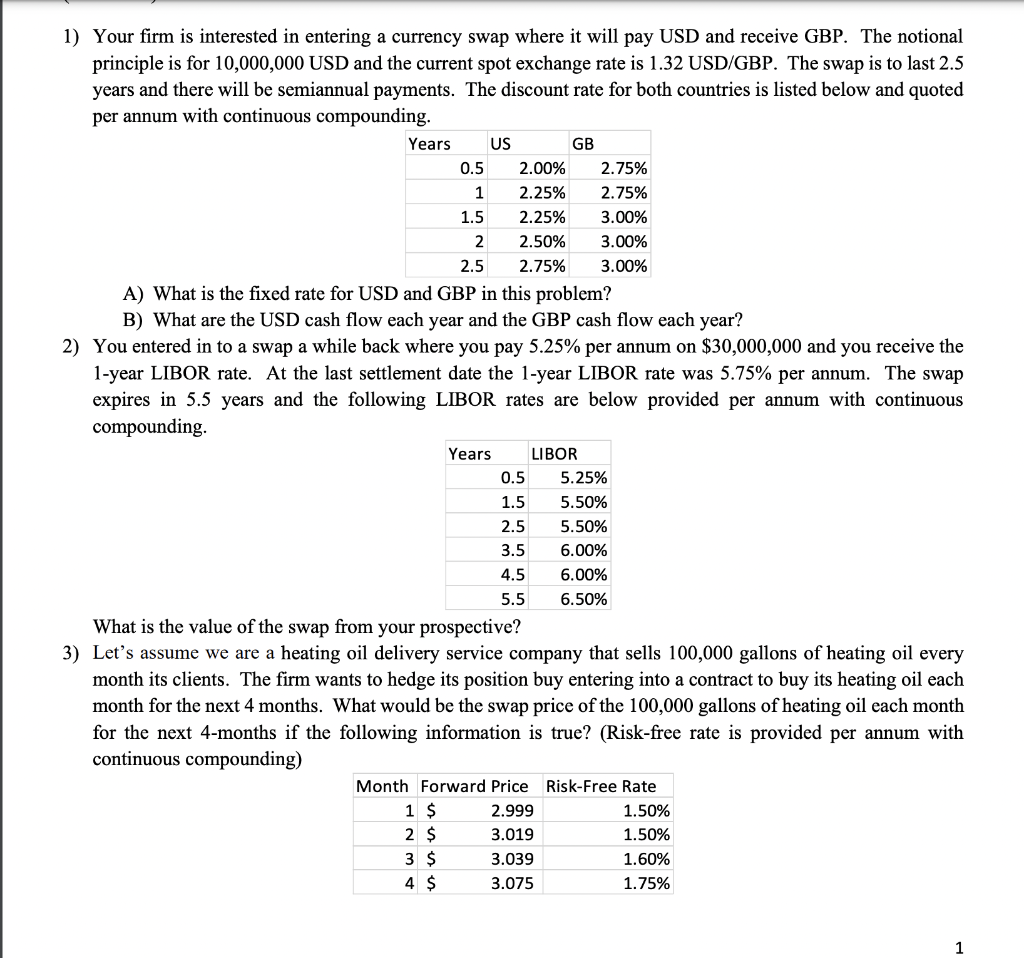

1) Your firm is interested in entering a currency swap where it will pay USD and receive GBP. The notional principle is for 10,000,000 USD and the current spot exchange rate is 1.32 USD/GBP. The swap is to last 2.5 years and there will be semiannual payments. The discount rate for both countries is listed below and quoted per annum with continuous compounding. Years US GB 0.5 2.00% 2.75% 1 2.25% 2.75% 1.5 2.25% 3.00% 2 2.50% 3.00% 2.5 2.75% 3.00% A) What is the fixed rate for USD and GBP in this problem? B) What are the USD cash flow each year and the GBP cash flow each year? 2) You entered in to a swap a while back where you pay 5.25% per annum on $30,000,000 and you receive the 1-year LIBOR rate. At the last settlement date the 1-year LIBOR rate was 5.75% per annum. The swap expires in 5.5 years and the following LIBOR rates are below provided per annum with continuous compounding. Years LIBOR 0.5 5.25% 1.5 5.50% 5.50% 3.5 6.00% 4.5 6.00% 5.5 6.50% What is the value of the swap from your prospective? 3) Lets assume we are a heating oil delivery service company that sells 100,000 gallons of heating oil every month its clients. The firm wants to hedge its position buy entering into a contract to buy its heating oil each month for the next 4 months. What would be the swap price of the 100,000 gallons of heating oil each month for the next 4-months if the following information is true? (Risk-free rate is provided per annum with continuous compounding) Month Forward Price Risk-Free Rate 1 $ 2.999 1.50% 2 $ 3.019 1.50% 3 $ 3.039 1.60% 4 $ 3.075 1.75% 2.5 1 1) Your firm is interested in entering a currency swap where it will pay USD and receive GBP. The notional principle is for 10,000,000 USD and the current spot exchange rate is 1.32 USD/GBP. The swap is to last 2.5 years and there will be semiannual payments. The discount rate for both countries is listed below and quoted per annum with continuous compounding. Years US GB 0.5 2.00% 2.75% 1 2.25% 2.75% 1.5 2.25% 3.00% 2 2.50% 3.00% 2.5 2.75% 3.00% A) What is the fixed rate for USD and GBP in this problem? B) What are the USD cash flow each year and the GBP cash flow each year? 2) You entered in to a swap a while back where you pay 5.25% per annum on $30,000,000 and you receive the 1-year LIBOR rate. At the last settlement date the 1-year LIBOR rate was 5.75% per annum. The swap expires in 5.5 years and the following LIBOR rates are below provided per annum with continuous compounding. Years LIBOR 0.5 5.25% 1.5 5.50% 5.50% 3.5 6.00% 4.5 6.00% 5.5 6.50% What is the value of the swap from your prospective? 3) Lets assume we are a heating oil delivery service company that sells 100,000 gallons of heating oil every month its clients. The firm wants to hedge its position buy entering into a contract to buy its heating oil each month for the next 4 months. What would be the swap price of the 100,000 gallons of heating oil each month for the next 4-months if the following information is true? (Risk-free rate is provided per annum with continuous compounding) Month Forward Price Risk-Free Rate 1 $ 2.999 1.50% 2 $ 3.019 1.50% 3 $ 3.039 1.60% 4 $ 3.075 1.75% 2.5 1