Answered step by step

Verified Expert Solution

Question

1 Approved Answer

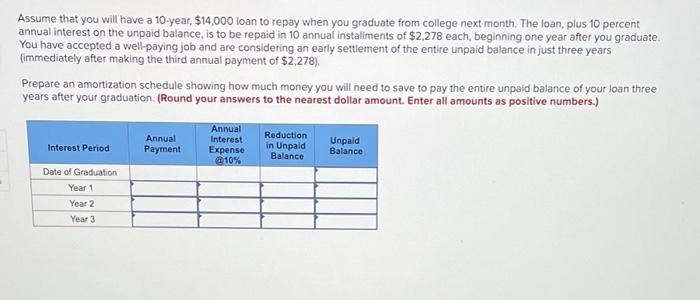

1) 2) Assume that you will have a 10-year, $14,000 loan to repay when you graduate from college next month. The loan, plus 10 percent

1)

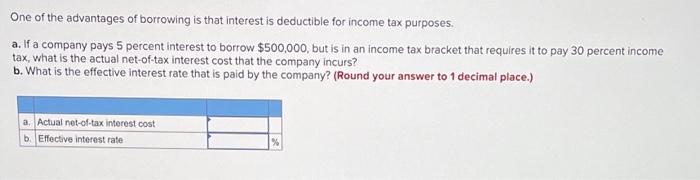

Assume that you will have a 10-year, $14,000 loan to repay when you graduate from college next month. The loan, plus 10 percent annual interest on the unpaid balance, is to be repaid in 10 annual installments of $2,278 each, beginning one year after you graduate You have accepted a well-paying job and are considering an early settlement of the entire unpaid balance in just three years (immediately after making the third annual payment of $2,278). Prepare an amortization schedule showing how much money you will need to save to pay the entire unpaid balance of your loan three years after your graduation (Round your answers to the nearest dollar amount. Enter all amounts as positive numbers.) Annual Payment Annual Interest Expense @10% Reduction in Unpaid Balance Unpaid Balance Interest Period Date of Graduation Year 1 Year 2 Year 3 One of the advantages of borrowing is that interest is deductible for income tax purposes. a. If a company pays 5 percent interest to borrow $500,000, but is in an income tax bracket that requires it to pay 30 percent income tax, what is the actual net-of-tax interest cost that the company incurs? b. What is the effective interest rate that is paid by the company? (Round your answer to 1 decimal place.) a. Actual net-of-tax interest cost b. Effective interest rate %

2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started