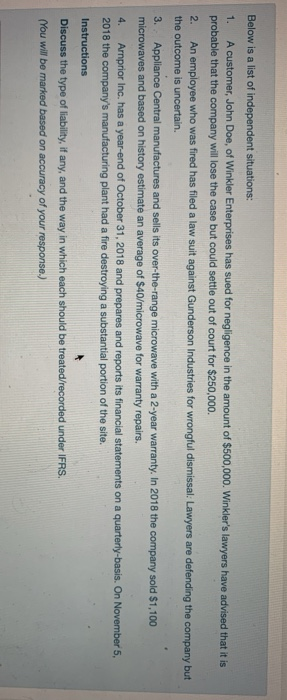

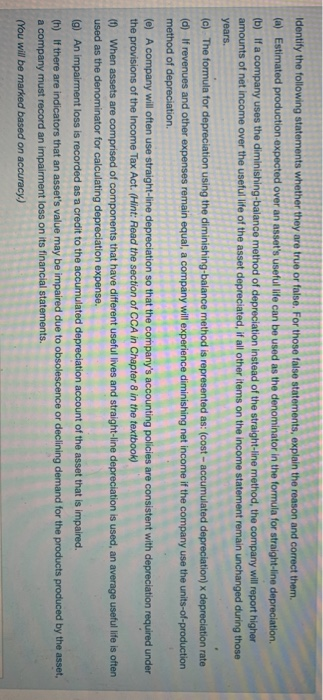

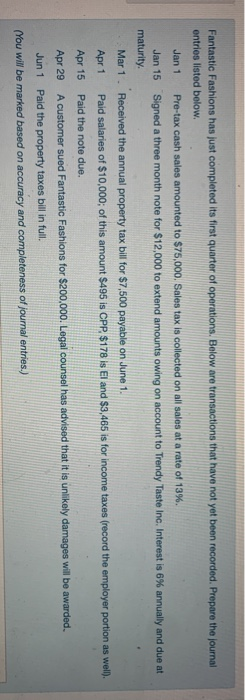

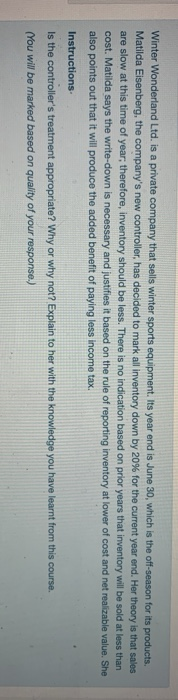

1. 2. Below is a list of independent situations: A customer, John Doe, of Winkler Enterprises has sued for negligence in the amount of $500,000. Winkler's lawyers have advised that it is probable that the company will lose the case but could settle out of court for $250,000. An employee who was fired has filed a law suit against Gunderson Industries for wrongful dismissal: Lawyers are defending the company but the outcome is uncertain. 3. Appliance Central manufactures and sells its over-the-range microwave with a 2-year warranty. In 2018 the company sold $1,100 microwaves and based on history estimate an average of $40/microwave for warranty repairs. 4. Arnprior Inc. has a year-end of October 31, 2018 and prepares and reports its financial statements on a quarterly-basis. On November 5, 2018 the company's manufacturing plant had a fire destroying a substantial portion of the site. Instructions Discuss the type of liability, if any, and the way in which each should be treated/recorded under IFRS. (You will be marked based on accuracy of your response.) Identify the following statements whether they are true or false. For those false statements, explain the reason and correct them. (a) Estimated production expected over an asset's useful life can be used as the denominator in the formula for straight-line depreciation (b) If a company uses the diminishing-balance method of depreciation instead of the straight-line method, the company will report higher amounts of net income over the useful life of the asset depreciated, if all other items on the income statement remain unchanged during those years. (c) The formula for depreciation using the diminishing-balance method is represented as: (cost-accumulated depreciation) x depreciation rate (d) If revenues and other expenses remain equal, a company will experience diminishing net income if the company use the units-of-production method of depreciation. (e) A company will often use straight-line depreciation so that the company's accounting policies are consistent with depreciation required under the provisions of the Income Tax Act. (Hint: Read the section of CCA in Chapter 8 in the textbook) ( When assets are comprised of components that have different useful lives and straight-line depreciation is used, an average useful life is often used as the denominator for calculating depreciation expense. (a) An impairment loss is recorded as a credit to the accumulated depreciation account of the asset that is impaired. (h) If there are indicators that an asset's value may be impaired due to obsolescence or declining demand for the products produced by the asset, a company must record an impairment loss on its financial statements. (You will be marked based on accuracy.) Fantastic Fashions has just completed its first quarter of operations. Below are transactions that have not yet been recorded. Prepare the journal entries listed below. Jan 1 Pre-tax cash sales amounted to $75,000. Sales tax is collected on all sales at a rate of 13% Jan 15 Signed a three month note for $12,000 to extend amounts owing on account to Trendy Taste Inc. Interest is 6% annually and due at maturity Mar 1. Received the annual property tax bill for $7,500 payable on June 1. Apr 1 Paid salaries of $10,000; of this amount $495 is CPP $178 is El and $3,465 is for income taxes (record the employer portion as well). Apr 15 Paid the note due. Apr 29 A customer sued Fantastic Fashions for $200,000. Legal counsel has advised that it is unlikely damages will be awarded Jun 1 Paid the property taxes bill in full. (You will be marked based on accuracy and completeness of journal entries.) Winter Wonderland Ltd. is a private company that sells winter sports equipment. Its year end is June 30, which is the off-season for its products. Matilda Eisenberg, the company's new controller, has decided to mark all inventory down by 20% for the current year end. Her theory is that sales are slow at this time of year, therefore, inventory should be less. There is no indication based on prior years that inventory will be sold at less than cost. Matilda says the write-down is necessary and justifies it based on the rule of reporting inventory at lower of cost and net realizable value. She also points out that it will produce the added benefit of paying less income tax. Instructions Is the controller's treatment appropriate? Why or why not? Explain to her with the knowledge you have learnt from this course. (You will be marked based on quality of your response.)