1.

2.

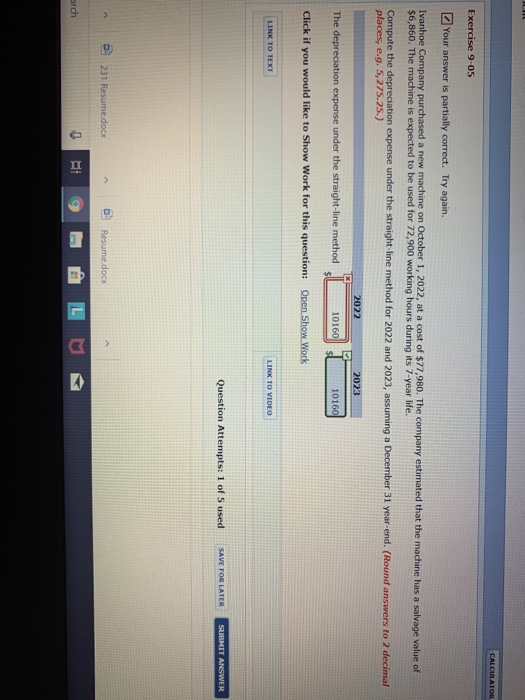

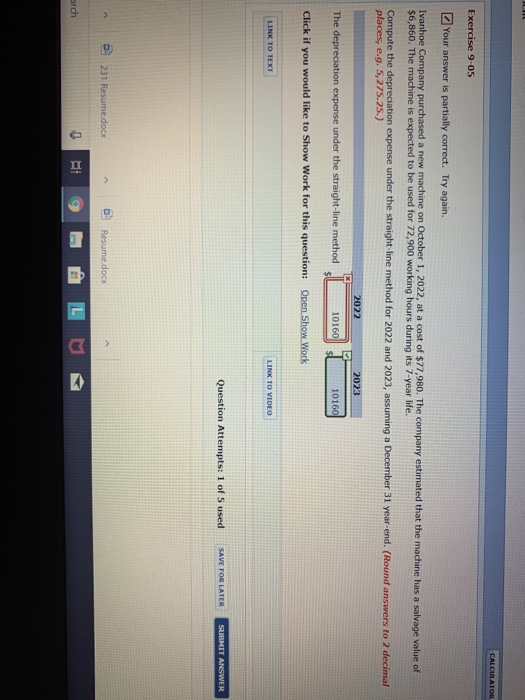

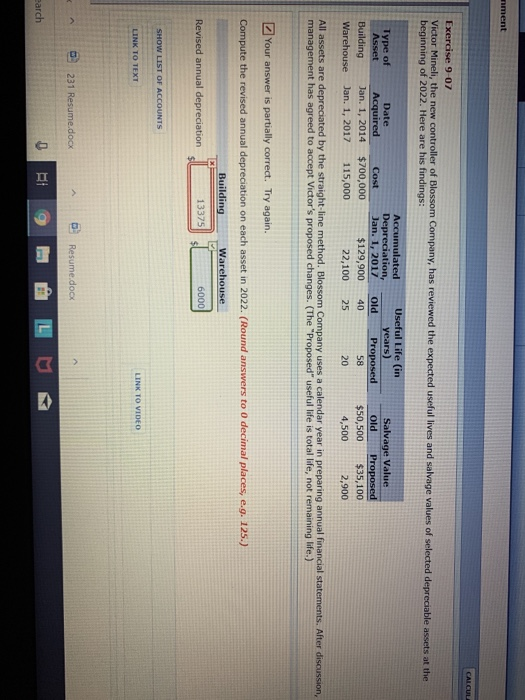

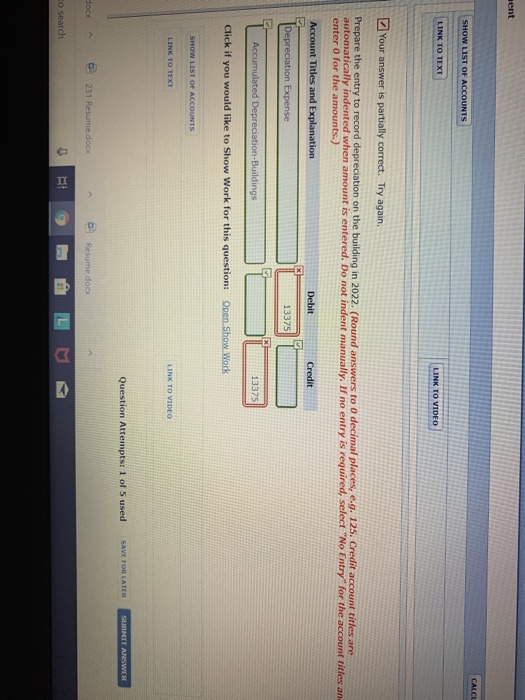

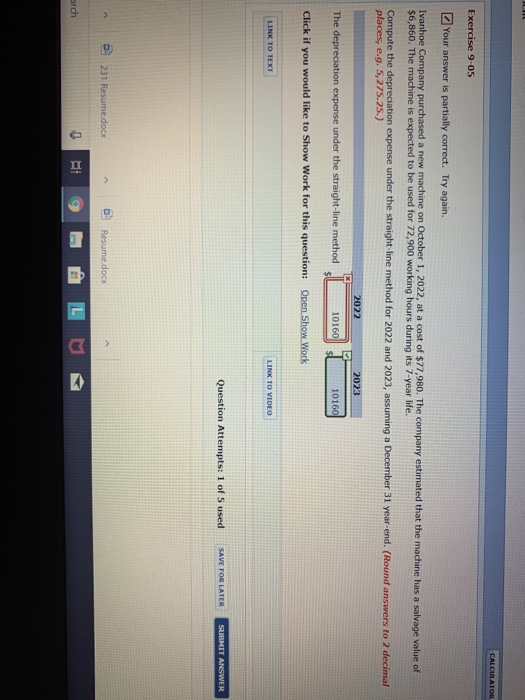

CALCULATOR Exercise 9-05 Your answer is partially correct. Try again. Ivanhoe Company purchased a new machine on October 1, 2022, at a cost of $77,980. The company estimated that the machine has a salvage value of $6,860. The machine is expected to be used for 72,900 working hours during its 7-year life. Compute the depreciation expense under the straight-line method for 2022 and 2023, assuming a December 31 year-end. (Round answers to 2 decimal places, e.g. 5,275.25.) 2022 2023 The depreciation expense under the straight-line method 10160 10160 Click if you would like to Show Work for this question: Open Show Work LINK TO TEXT LINK TO VIDEO Question Attempts: 1 of 5 used SAVE FOR LATER SUBMIT ANSWER 231 Resume.docx Resume.docx arch nment CALCULA Exercise 9-07 Victor Mineli, the new controller of Blossom Company, has reviewed the expected useful lives and salvage values of selected depreciable assets at the beginning of 2022. Here are his findings: Type of Asset Date Acquired Accumulated Depreciation, Jan. 1, 2017 Useful Life (in years) Salvage Value Cost Old Proposed Old Proposed $35,100 Building Jan. 1, 2014 $700,000 $129,900 40 58 $50,500 Warehouse Jan. 1, 2017 115,000 22,100 25 20 4,500 2,900 All assets are depreciated by the straight-line method. Blossom Company uses a calendar year in preparing annual financial statements. After discussion, management has agreed to accept Victor's proposed changes. (The "Proposed" useful life is total life, not remaining life.) Your answer is partially correct. Try again. Compute the revised annual depreciation on each asset in 2022. (Round answers to 0 decimal places, e.g. 125.) Building Warehouse Revised annual depreciation 13375 6000 SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO VIDEO 231 Resume.docx Resume.docx A earch ent CALCL SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO VIDEO Your answer is partially correct. Try again. Prepare the entry to record depreciation on the building in 2022. (Round answers to 0 decimal places, e.g. 125. Credit account titles are automatically indented when amount is entered. Do not indent manually, If no entry is required, select "No Entry" for the account titles an enter 0 for the amounts.) Account Titles and Explanation Debit Credit Depreciation Expense 13375 Accumulated Depreciation-Buildings 13375 Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO VIDEO Question Attempts: 1 of 5 used SAVE FOR LATER SUBNIT ANSWER docx 231 Resume.docx Resume.doc o search