1.  2.

2.

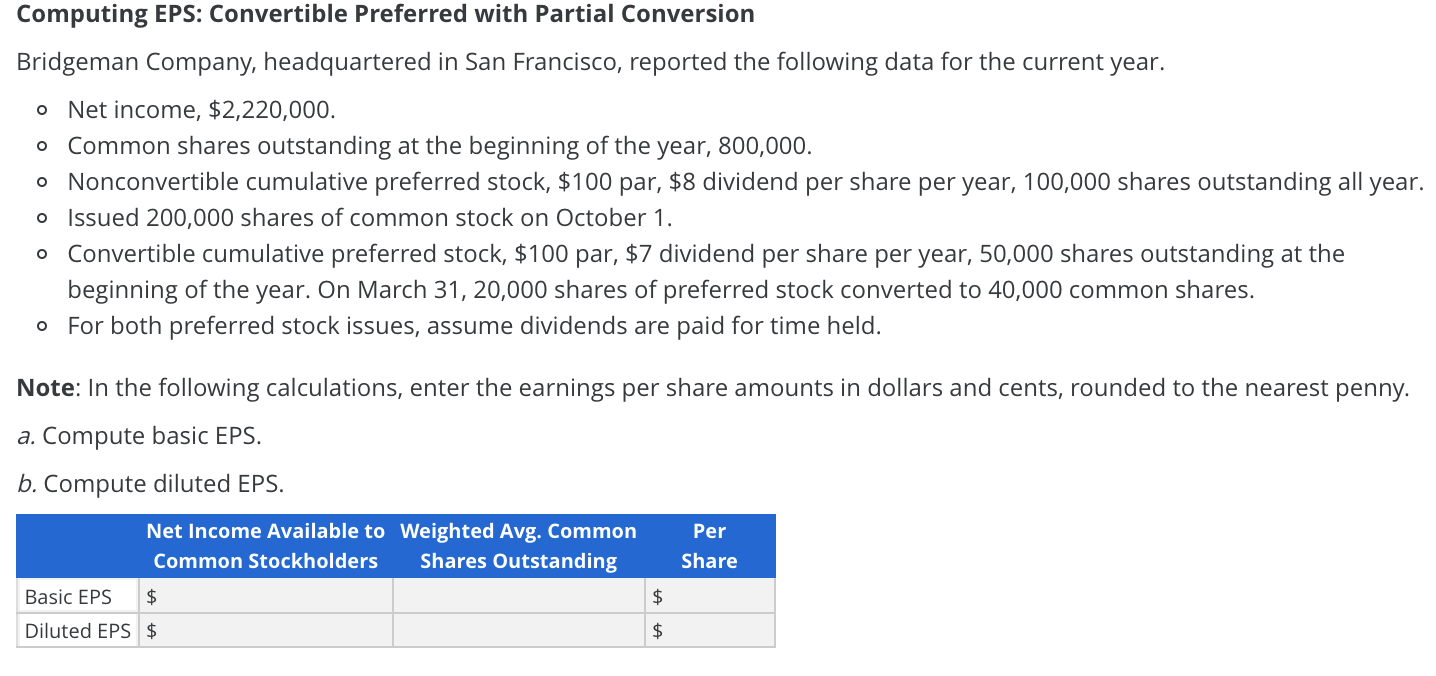

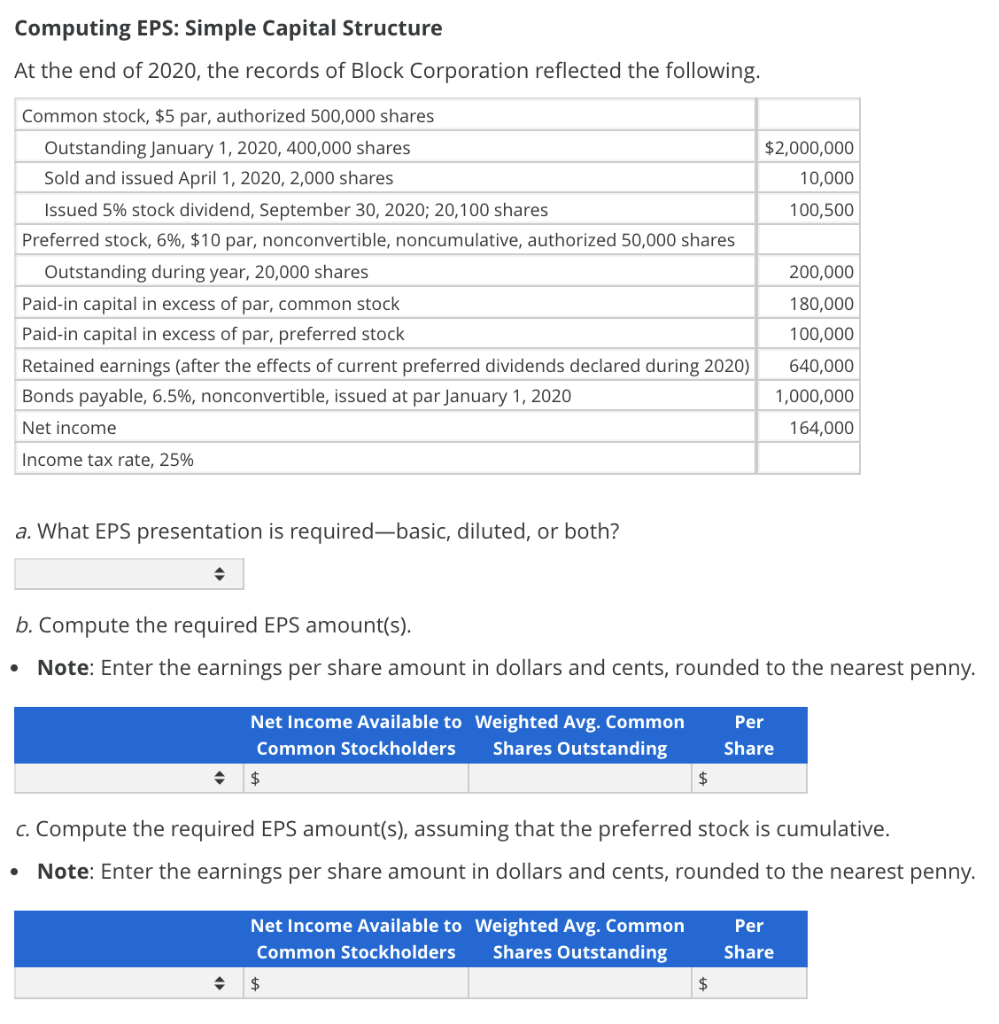

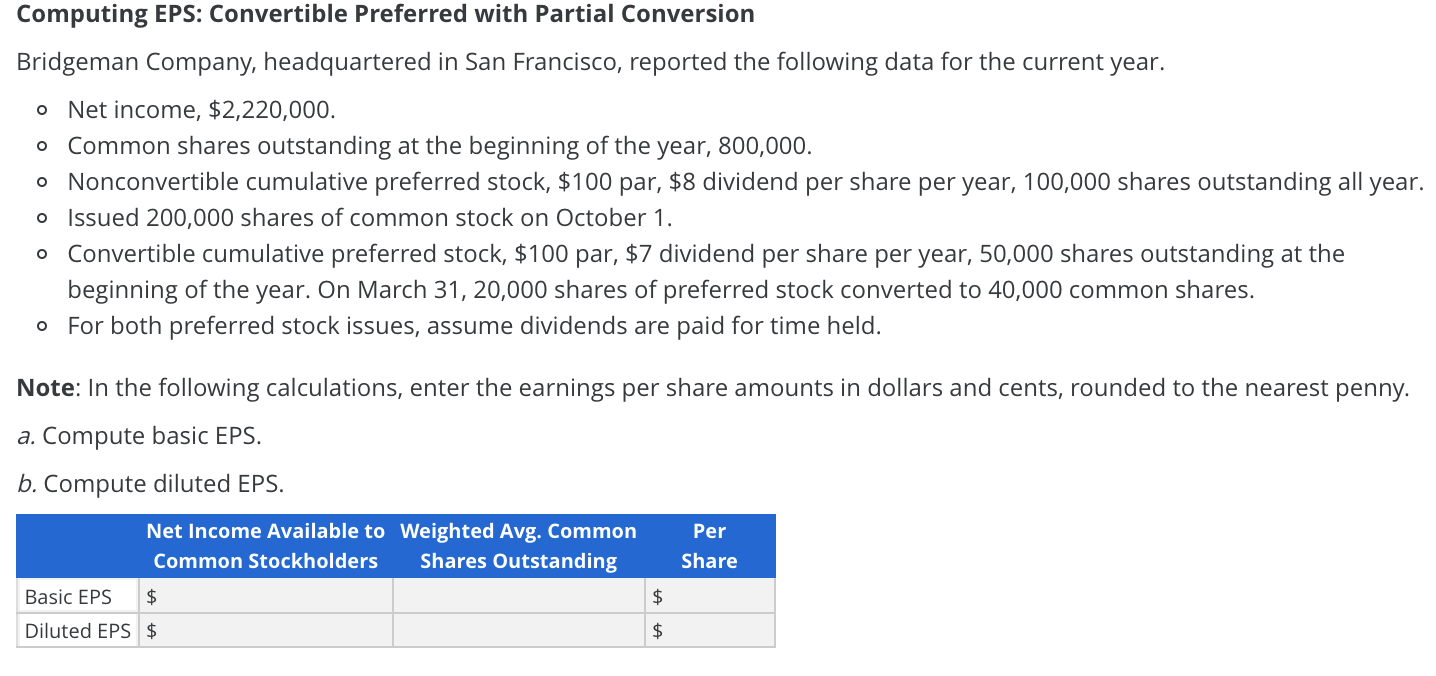

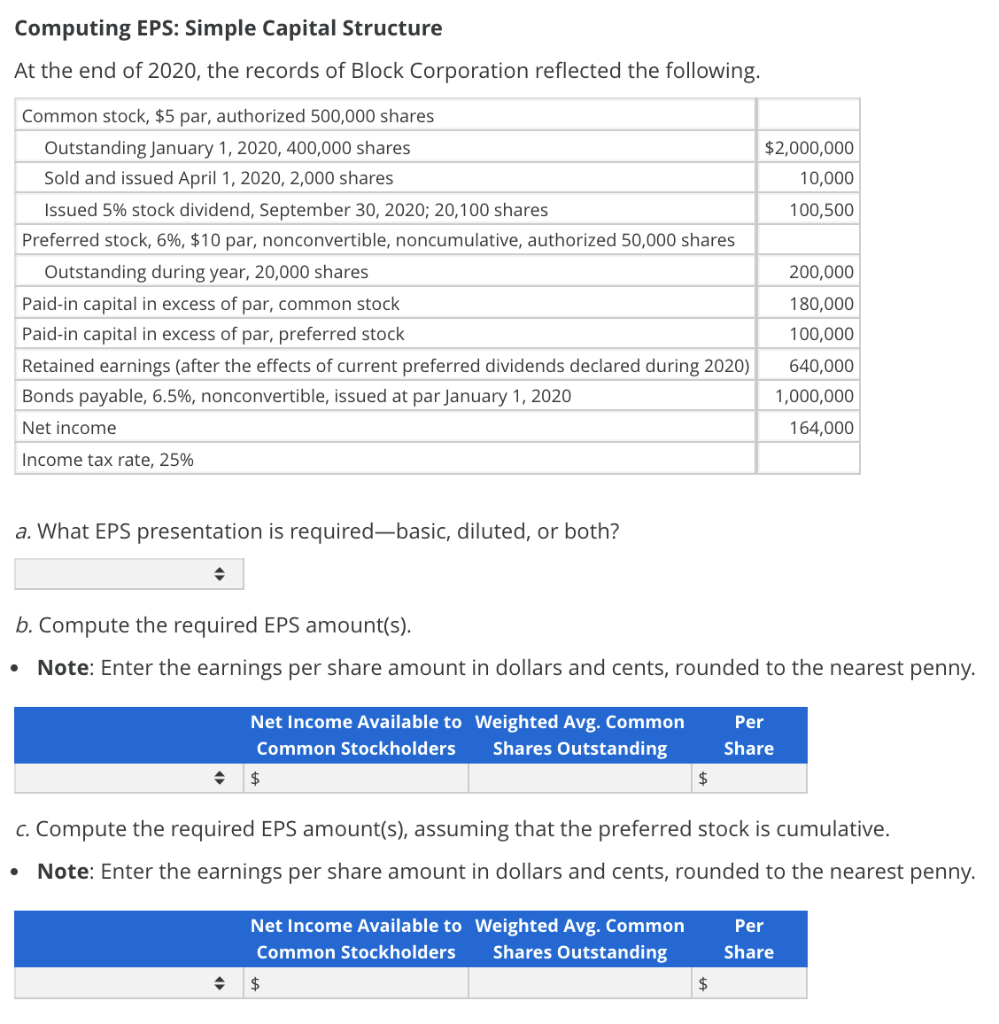

Computing EPS: Simple Capital Structure At the end of 2020, the records of Block Corporation reflected the following. $2,000,000 10,000 100,500 Common stock, $5 par, authorized 500,000 shares Outstanding January 1, 2020, 400,000 shares Sold and issued April 1, 2020, 2,000 shares Issued 5% stock dividend, September 30, 2020; 20,100 shares Preferred stock, 6%, $10 par, nonconvertible, noncumulative, authorized 50,000 shares Outstanding during year, 20,000 shares Paid-in capital in excess of par, common stock Paid-in capital in excess of par, preferred stock Retained earnings (after the effects of current preferred dividends declared during 2020) Bonds payable, 6.5%, nonconvertible, issued at par January 1, 2020 Net income 200,000 180,000 100,000 640,000 1,000,000 164,000 Income tax rate, 25% a. What EPS presentation is required-basic, diluted, or both? b. Compute the required EPS amount(s). Note: Enter the earnings per share amount in dollars and cents, rounded to the nearest penny. . Net Income Available to Weighted Avg. Common Common Stockholders Shares Outstanding $ Per Share $ C. Compute the required EPS amount(s), assuming that the preferred stock is cumulative. Note: Enter the earnings per share amount in dollars and cents, rounded to the nearest penny. . Per Net Income Available to Weighted Avg. Common Common Stockholders Shares Outstanding $ Share $ Computing EPS: Convertible Preferred with Partial Conversion Bridgeman Company, headquartered in San Francisco, reported the following data for the current year. o Net income, $2,220,000. o Common shares outstanding at the beginning of the year, 800,000. o Nonconvertible cumulative preferred stock, $100 par, $8 dividend per share per year, 100,000 shares outstanding all year. o Issued 200,000 shares of common stock on October 1. o Convertible cumulative preferred stock, $100 par, $7 dividend per share per year, 50,000 shares outstanding at the beginning of the year. On March 31, 20,000 shares of preferred stock converted to 40,000 common shares. o For both preferred stock issues, assume dividends are paid for time held. Note: In the following calculations, enter the earnings per share amounts in dollars and cents, rounded to the nearest penny. a. Compute basic EPS. b. Compute diluted EPS. Net Income Available to Weighted Avg. Common Common Stockholders Shares Outstanding $ Per Share Basic EPS $ Diluted EPS $ $

2.

2.