1)

2)

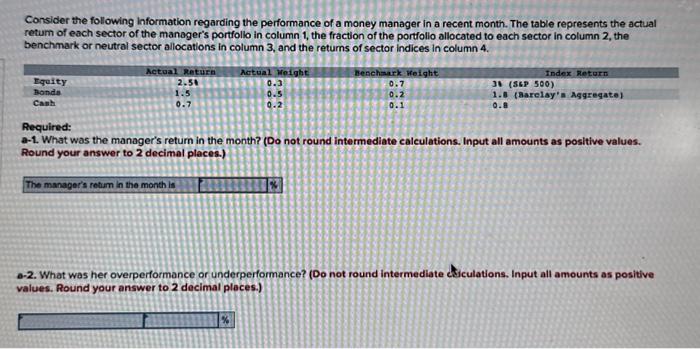

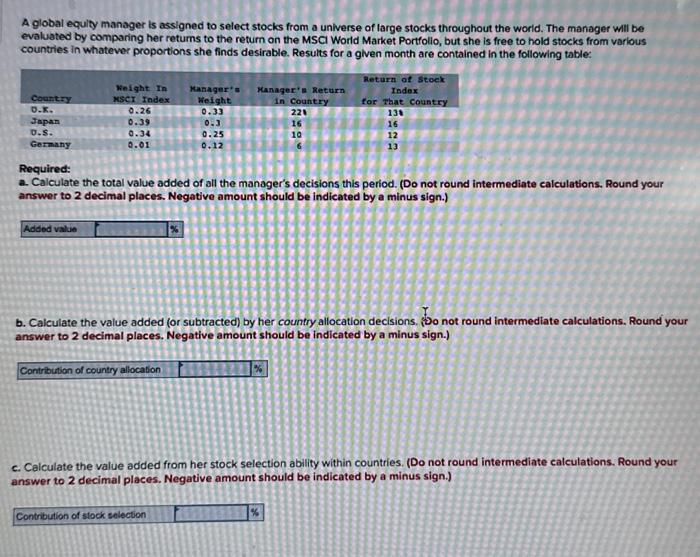

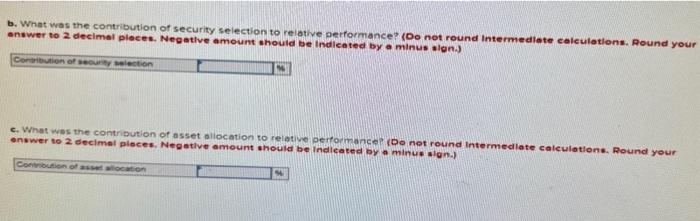

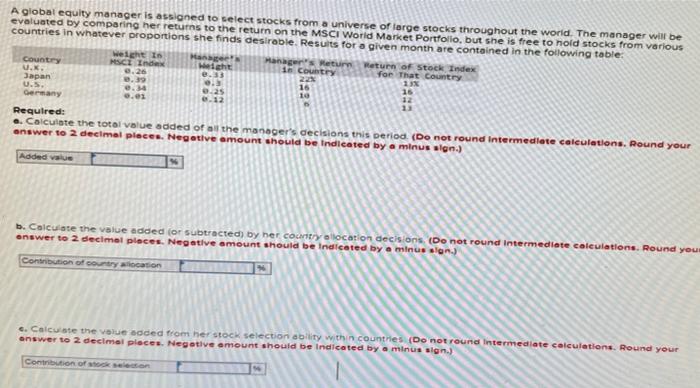

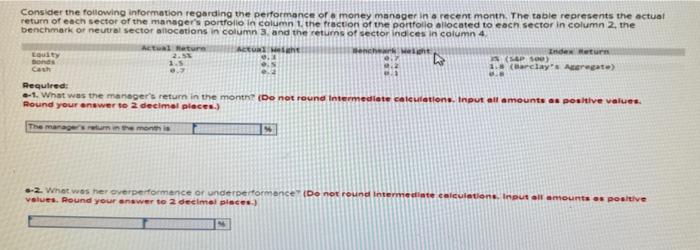

Consider the following information regarding the performance of a money manager in a recent month. The table represents the actual retum of each sector of the manager's portfollo in column 1, the fraction of the portfollo allocated to each sector in column 2 , the benchmark or neutral sector allocations in column 3, and the retums of sector indices in column 4. Required: a-1. What was the manager's refurn in the month? (Do not round intermediate calculations. Input all amounts as positive values. Round your answer to 2 decimal places.) a-2. What was her overperformance or underperformance? (Do not round intermediate dkiculations. Input all amounts as positive values. Round your answer to 2 decimal pleces.) A global equily manager is assigned to select stocks from a universe of large stocks throughout the world. The manager will be evaluated by comparing her retums to the return on the MSC World Market Portfollo, but she is free to hold stocks from various countries in whatever proportions she finds desirable. Results for a given month are contained in the following table: Required: a. Calculate the total value added of all the manager's decisions this period. (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) b. Calculate the value added (or subtracted) by her country allocation decisions. o not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) c. Calculate the value added from her stock selection ability within countries. (Do not round intermediate calculations. Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) Consider the following information regarding the peiformance of a money manoger in a recent month. The table represents the actual return of each sector of the manager's portfolio in column 1. the fraction of the portfolio ollocated to each sector in column 2 , the benchmark or neutral sector aitocotions in column 3 , and the retums of sector ind ces in column 4 Pequired: a-1. What was the mansger's refurn in the month? (Do not round Intermediate caleulations. Input all amounts an poultive valuea. Round your answer to 2 declmal piaces.) velues. Aound your anwwer to 2 decimel places.) b. What was the contribution of security selection to relative performance? (Oo not round Intermedlate caleulations. Round your answer to 2 declmel ploces. Negatlve amoumt should be Indleated by a minus alond) c. What wos the contribution of asset aliocation to reiative perfopmance? (Do not round Intermedlate caleulatlona. Round your. onswer so 2 becimel pleces. Negathe amount would be Indleated by a minu: algn.) A giobal equity manager is assigned to select stocks from a universe of large stocks throughout the world. The manager will be evaluated by comparing her returns to the return on the MSCI World Mariket Portfolio, but she is free to hold stocks from various a. Caiculate the totolvblue added of all the manoger's decisions this period. (Do not round Intermedlote caleulations. Round your onswer to 2 declmal pleces. Negative amount ahould be indleated by a minus algn.) b. Calculate the value added (or subtracted) by her cochriy allocation decis lons, (Do not round Intermediate caleulatlons. Round you onswer to 2 declmel pleces. Negative amount ahould be lnelceted by a minus alga.) 6. Calcu bte the value odded from her stock selection ability wi thin countries (Do not round intermediate calculations. Round your onswer to 2 declmel ploces. Negotlve emount should be Indicated by a minus algn.)