Answered step by step

Verified Expert Solution

Question

1 Approved Answer

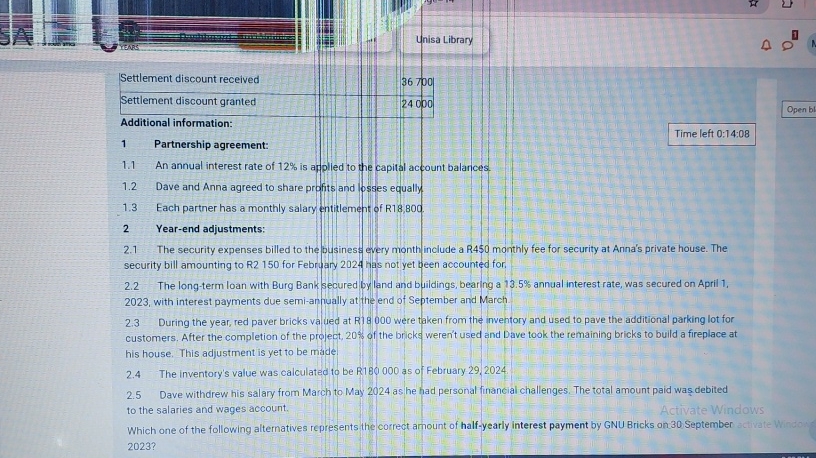

1 . 2 Dave and Anna agreed to share profits and losses equally. 1 . 3 Each partner has a monthly salary entitlement of R

Dave and Anna agreed to share profits and losses equally.

Each partner has a monthly salary entitlement of R

Yearend adjustments:

The security expenses billed to the business every month include a R monthly fee for security at Anna's private house. The security bill amounting to R for February has not yet been accounted for.

The longterm loan with Burg Bank secured by land and buildings, bearing a annual interestrate, was secured on April with interest payments due semiannually at the end of September and March.

During the year, red paver bricks va ued at R were taken from the inventory and used to pave the additional parking lot for customers. After the completion of the project, of the bricks weren't used and Dave took the remaining bricks to build a fireplace at his house. This adjustment is yet to be made.

The inventory's value was calculated to be R as of February

Dave withdrew his salary from March to May as he had personal financial challenges. The total amount paid was debited to the salaries and wages account.

Which one of the following alternatives represents the correct amount of halfyearly interest payment by GNU Bricks on September

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started

![For Mowen/hansen/heitgers Cornerstones Of Managerial Accounting, 6th Edition, [instant Access]](https://dsd5zvtm8ll6.cloudfront.net/si.question.images/book_images/2022/04/6257c87e3025b_1256257c87dcfa77.jpg)