Answered step by step

Verified Expert Solution

Question

1 Approved Answer

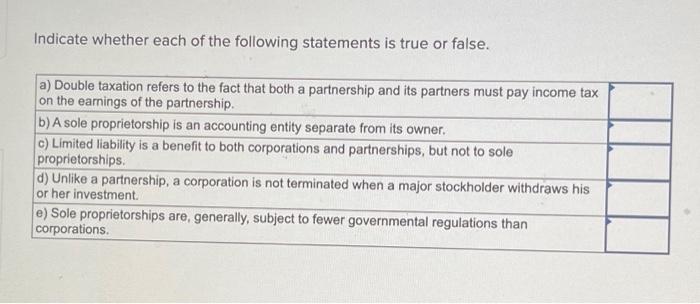

Indicate whether each of the following statements is true or false. a) Double taxation refers to the fact that both a partnership and its partners

Indicate whether each of the following statements is true or false. a) Double taxation refers to the fact that both a partnership and its partners must pay income tax on the earnings of the partnership. b) A sole proprietorship is an accounting entity separate from its owner. c) Limited liability is a benefit to both corporations and partnerships, but not to sole proprietorships. d) Unlike a partnership, a corporation is not terminated when a major stockholder withdraws his or her investment. e) Sole proprietorships are, generally, subject to fewer governmental regulations than corporations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started

![For Mowen/hansen/heitgers Cornerstones Of Managerial Accounting, 6th Edition, [instant Access]](https://dsd5zvtm8ll6.cloudfront.net/si.question.images/book_images/2022/04/6257c87e3025b_1256257c87dcfa77.jpg)