1)

2)

Do everhthing in red. Thank you.

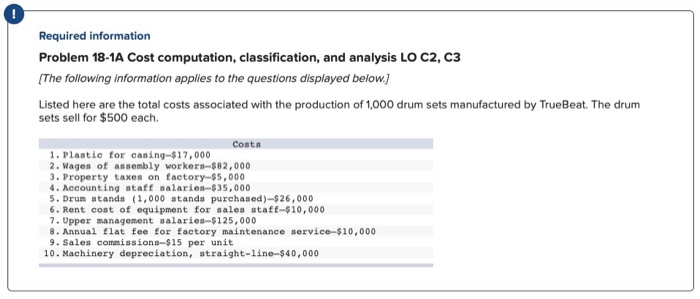

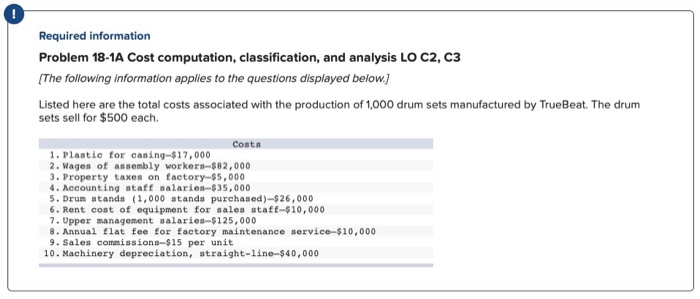

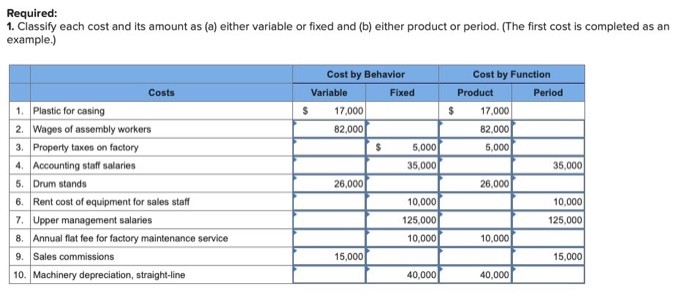

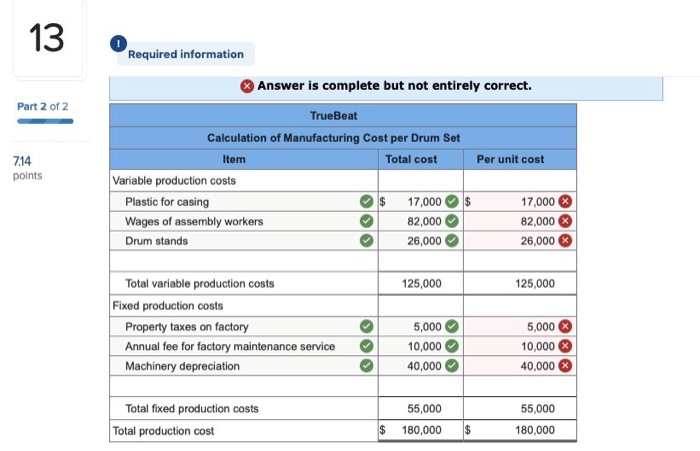

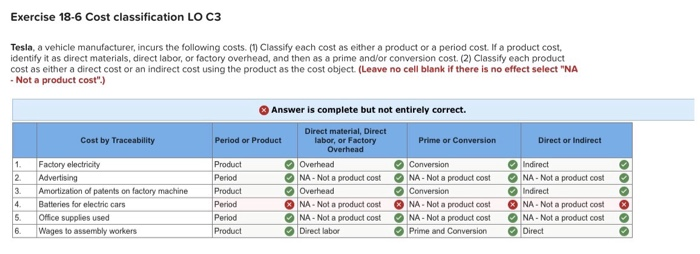

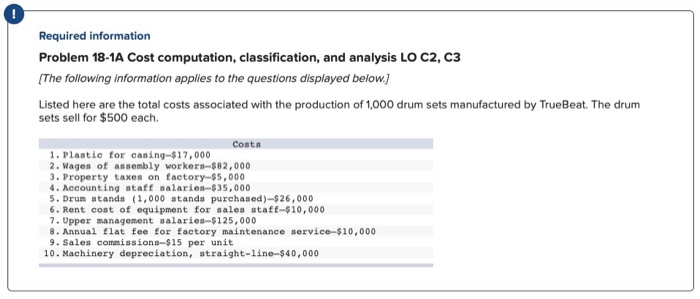

Required information Problem 18-1A Cost computation, classification, and analysis LO C2, C3 (The following information applies to the questions displayed below) Listed here are the total costs associated with the production of 1,000 drum sets manufactured by TrueBeat. The drum sets sell for $500 each. Costs 1. Plastic for casing-$17,000 2. Wages of assembly workers-$82,000 3. Property taxes on factory-$5,000 4. Accounting staff salaries-$35,000 5. Drum standa (1.000 stands purchased)-$26.000 6. Rent cost of equipment for sales staff-$10,000 7. Upper management salaries-$125,000 8. Annual flat fee for factory maintenance service-$10,000 9. Sales commissions-$15 per unit 10. Machinery depreciation, straight-line-$40,000 Required information Answer is complete but not entirely correct. Part 2 of 2 TrueBeat Per unit cost 714 points Calculation of Manufacturing Cost per Drum Set Item Total cost Variable production costs Plastic for casing 17,000 Wages of assembly workers 82,000 Drum stands 26,000 $ 17,000 X 82,000 26,000 Total variable production costs 125,000 125,000 Fixed production costs Property taxes on factory Annual fee for factory maintenance service Machinery depreciation 5,000 10,000 40,000 5,000 10,000 40,000 Total fixed production costs Total production cost 55,000 180,000 55,000 180,000 $ $ Exercise 18-6 Cost classification LO C3 Tesla, a vehicle manufacturer, incurs the following costs. (1) Classify each cost as either a product or a period cost. If a product cost, identify it as direct materials, direct labor, or factory overhead, and then as a prime and/or conversion cost. (2) Classify each product cost as either a direct cost or an indirect cost using the product as the cost object (Leave no cell blank if there is no effect select "NA - Not a product cost") Answer is complete but not entirely correct. Cost by Traceability Period or Product Direct material, Direct labor, or Factory Overhead Prime or Conversion Direct or indirect 1. 2. 3. 4. Factory electricity Advertising Amortization of patents on factory machine Batteries for electric cars Office supplies used Wages to assembly workers Product Period Product Period Period Product Overhead NA - Not a product cost Overhead NA - Not a product cost NA - Not a product cost Direct labor Conversion NA- Not a product cost Conversion NA- Not a product cost NA- Not a product cost Prime and Conversion Indirect NA- Not a product cost Indirect NA- Not a product cost A - Not a product cost Direct N 6