1.

2.

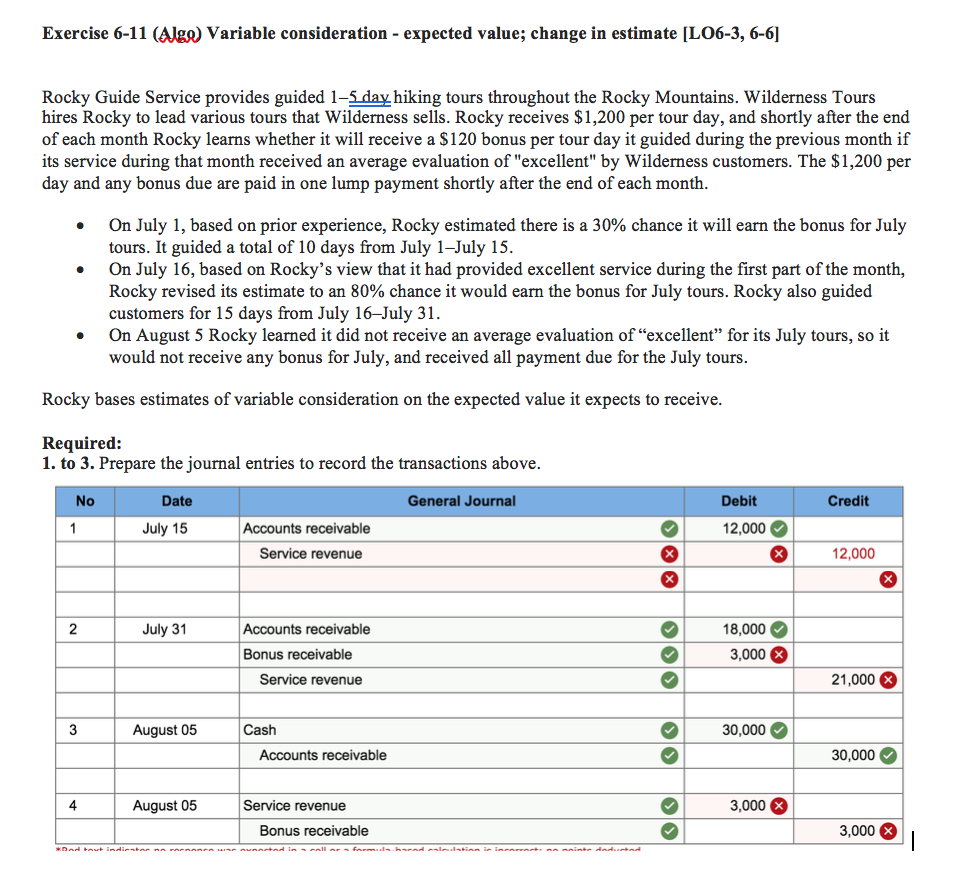

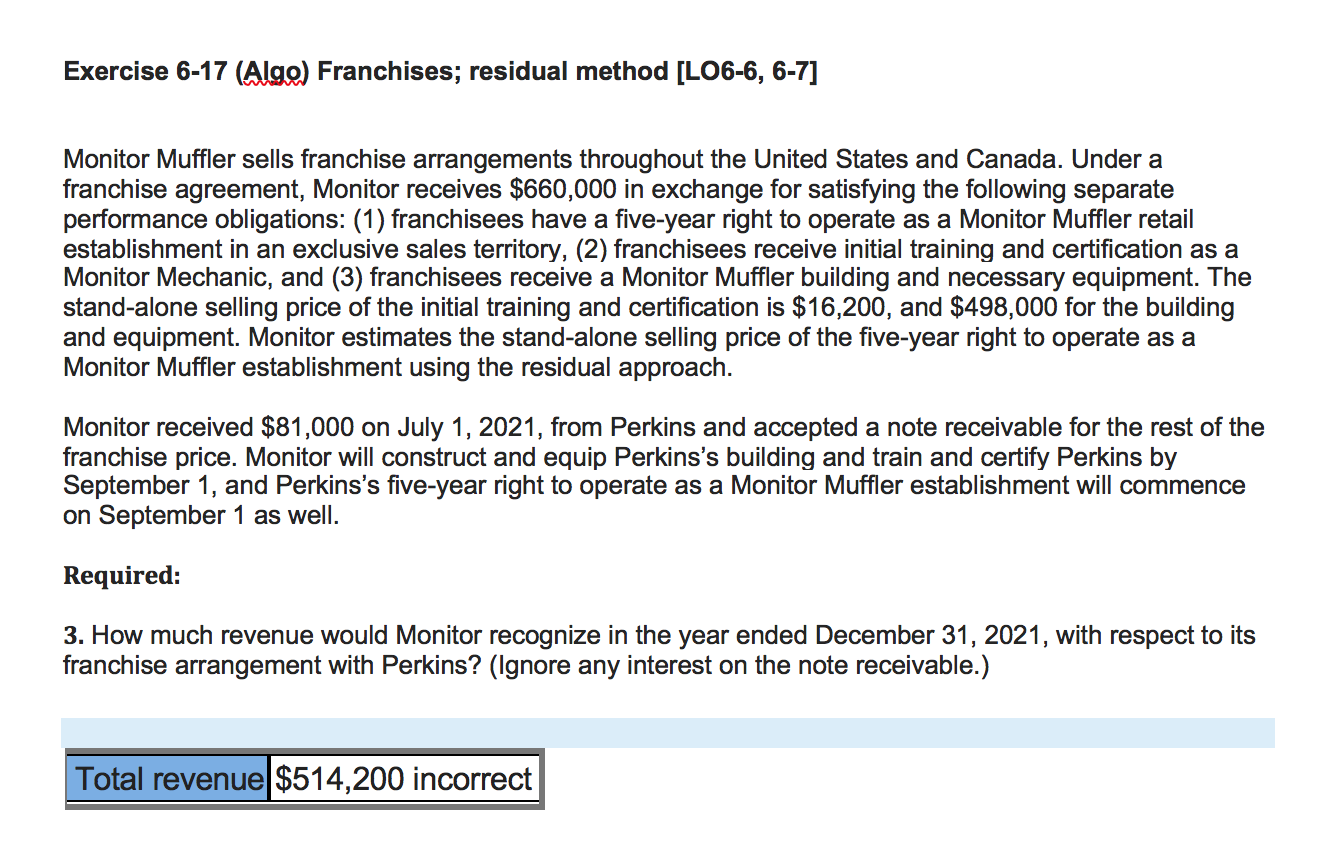

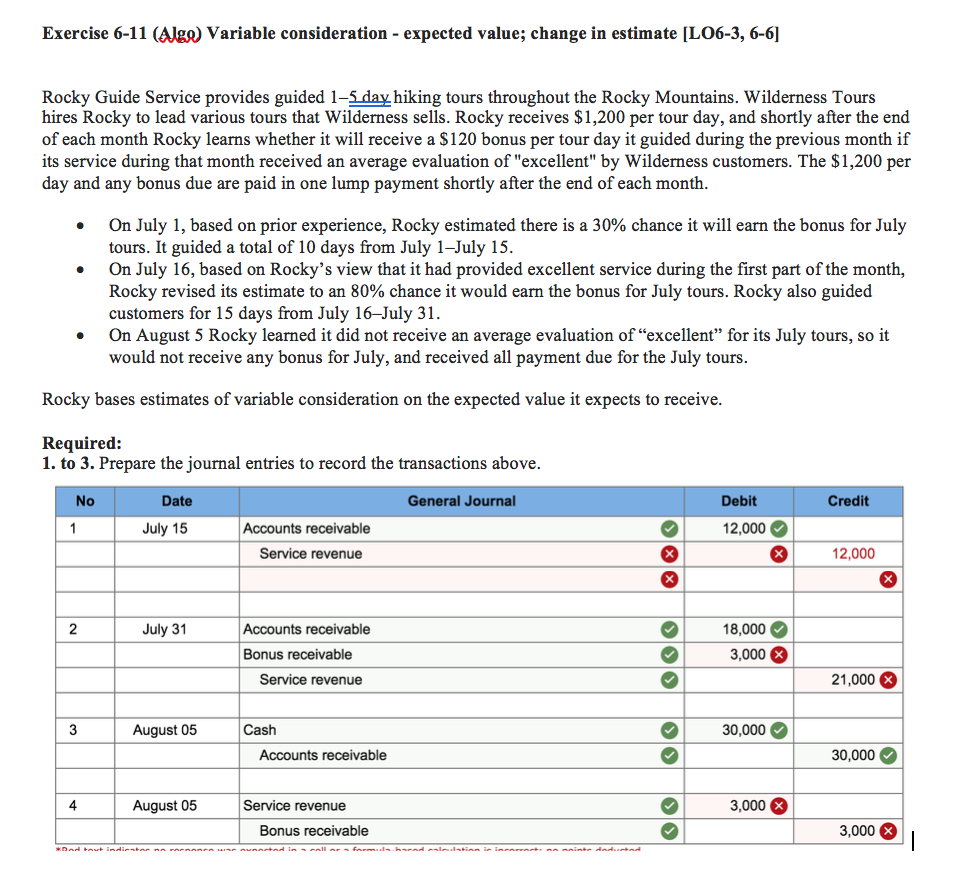

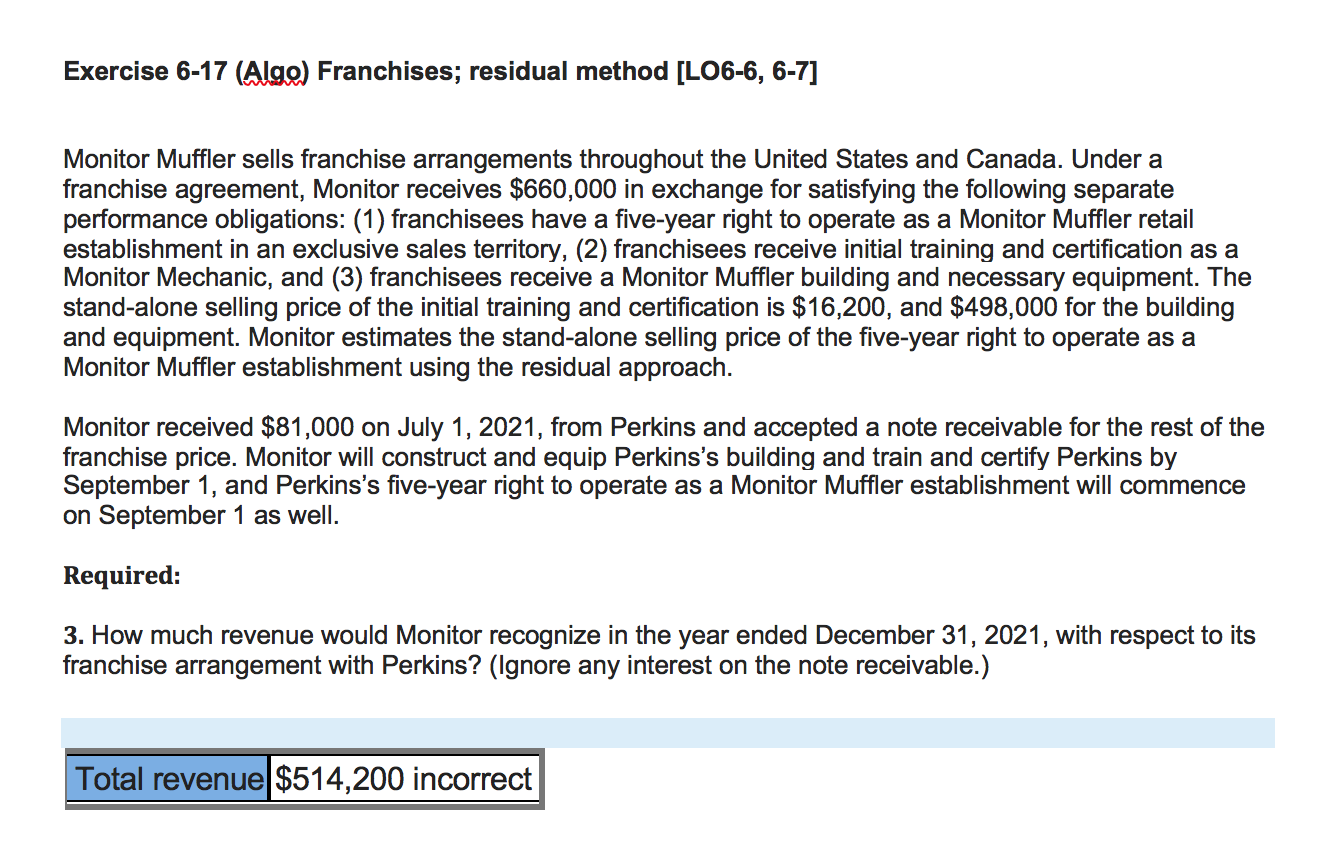

Exercise 6-11 (Algo) Variable consideration - expected value; change in estimate [LO6-3, 6-6] Rocky Guide Service provides guided 1-5 day hiking tours throughout the Rocky Mountains. Wilderness Tours hires Rocky to lead various tours that Wilderness sells. Rocky receives $1,200 per tour day, and shortly after the end of each month Rocky learns whether it will receive a $120 bonus per tour day it guided during the previous month if its service during that month received an average evaluation of "excellent" by Wilderness customers. The $1,200 per day and any bonus due are paid in one lump payment shortly after the end of each month. . On July 1, based on prior experience, Rocky estimated there is a 30% chance it will earn the bonus for July tours. It guided a total of 10 days from July 1-July 15. On July 16, based on Rocky's view that it had provided excellent service during the first part of the month, Rocky revised its estimate to an 80% chance it would earn the bonus for July tours. Rocky also guided customers for 15 days from July 16-July 31. On August 5 Rocky learned it did not receive an average evaluation of excellent" for its July tours, so it would not receive any bonus for July, and received all payment due for the July tours. Rocky bases estimates of variable consideration on the expected value it expects to receive. Required: 1. to 3. Prepare the journal entries to record the transactions above. No Date General Journal Debit Credit 1 July 15 Accounts receivable 12,000 Service revenue X X 12,000 X 2 July 31 Accounts receivable 18,000 3,000 X Bonus receivable Service revenue 21,000 X 3 August 05 Cash 30,000 > Accounts receivable 30,000 4 August 05 3,000 X Service revenue Bonus receivable 3,000 med in aller-farmadelt innt. A mint daud Exercise 6-17 (Algo) Franchises; residual method [LO6-6, 6-7] Monitor Muffler sells franchise arrangements throughout the United States and Canada. Under a franchise agreement, Monitor receives $660,000 in exchange for satisfying the following separate performance obligations: (1) franchisees have a five-year right to operate as a Monitor Muffler retail establishment in an exclusive sales territory, (2) franchisees receive initial training and certification as a Monitor Mechanic, and (3) franchisees receive a Monitor Muffler building and necessary equipment. The stand-alone selling price of the initial training and certification is $16,200, and $498,000 for the building and equipment. Monitor estimates the stand-alone selling price of the five-year right to operate as a Monitor Muffler establishment using the residual approach. Monitor received $81,000 on July 1, 2021, from Perkins and accepted a note receivable for the rest of the franchise price. Monitor will construct and equip Perkins's building and train and certify Perkins by September 1, and Perkins's five-year right to operate as a Monitor Muffler establishment will commence on September 1 as well. Required: 3. How much revenue would Monitor recognize in the year ended December 31, 2021, with respect to its franchise arrangement with Perkins? (Ignore any interest on the note receivable.) Total revenue $514,200 incorrect Exercise 6-11 (Algo) Variable consideration - expected value; change in estimate [LO6-3, 6-6] Rocky Guide Service provides guided 1-5 day hiking tours throughout the Rocky Mountains. Wilderness Tours hires Rocky to lead various tours that Wilderness sells. Rocky receives $1,200 per tour day, and shortly after the end of each month Rocky learns whether it will receive a $120 bonus per tour day it guided during the previous month if its service during that month received an average evaluation of "excellent" by Wilderness customers. The $1,200 per day and any bonus due are paid in one lump payment shortly after the end of each month. . On July 1, based on prior experience, Rocky estimated there is a 30% chance it will earn the bonus for July tours. It guided a total of 10 days from July 1-July 15. On July 16, based on Rocky's view that it had provided excellent service during the first part of the month, Rocky revised its estimate to an 80% chance it would earn the bonus for July tours. Rocky also guided customers for 15 days from July 16-July 31. On August 5 Rocky learned it did not receive an average evaluation of excellent" for its July tours, so it would not receive any bonus for July, and received all payment due for the July tours. Rocky bases estimates of variable consideration on the expected value it expects to receive. Required: 1. to 3. Prepare the journal entries to record the transactions above. No Date General Journal Debit Credit 1 July 15 Accounts receivable 12,000 Service revenue X X 12,000 X 2 July 31 Accounts receivable 18,000 3,000 X Bonus receivable Service revenue 21,000 X 3 August 05 Cash 30,000 > Accounts receivable 30,000 4 August 05 3,000 X Service revenue Bonus receivable 3,000 med in aller-farmadelt innt. A mint daud Exercise 6-17 (Algo) Franchises; residual method [LO6-6, 6-7] Monitor Muffler sells franchise arrangements throughout the United States and Canada. Under a franchise agreement, Monitor receives $660,000 in exchange for satisfying the following separate performance obligations: (1) franchisees have a five-year right to operate as a Monitor Muffler retail establishment in an exclusive sales territory, (2) franchisees receive initial training and certification as a Monitor Mechanic, and (3) franchisees receive a Monitor Muffler building and necessary equipment. The stand-alone selling price of the initial training and certification is $16,200, and $498,000 for the building and equipment. Monitor estimates the stand-alone selling price of the five-year right to operate as a Monitor Muffler establishment using the residual approach. Monitor received $81,000 on July 1, 2021, from Perkins and accepted a note receivable for the rest of the franchise price. Monitor will construct and equip Perkins's building and train and certify Perkins by September 1, and Perkins's five-year right to operate as a Monitor Muffler establishment will commence on September 1 as well. Required: 3. How much revenue would Monitor recognize in the year ended December 31, 2021, with respect to its franchise arrangement with Perkins? (Ignore any interest on the note receivable.) Total revenue $514,200 incorrect