Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. JK Corporation's capital structure includes $2,000,000 face value of 8%,20-year bonds with a current market price of $110. The company also has 300,000

1.

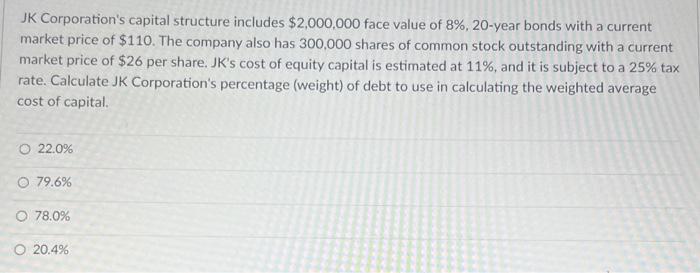

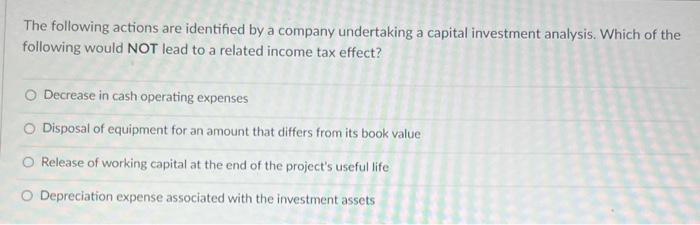

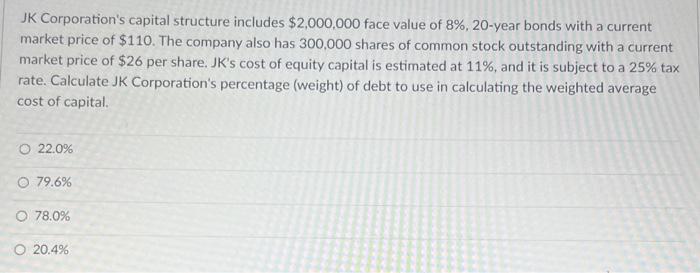

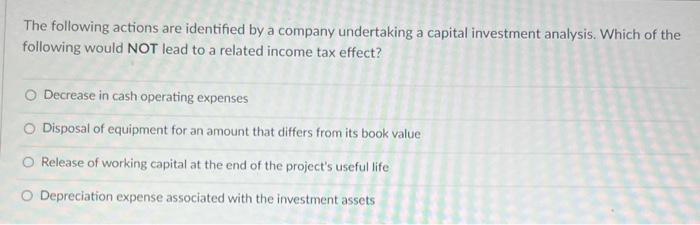

JK Corporation's capital structure includes $2,000,000 face value of 8%,20-year bonds with a current market price of $110. The company also has 300,000 shares of common stock outstanding with a current market price of $26 per share. JK's cost of equity capital is estimated at 11%, and it is subject to a 25% tax rate. Calculate JK Corporation's percentage (weight) of debt to use in calculating the weighted average cost of capital. 22.0% 79.6% 78.0% 20.4% The following actions are identified by a company undertaking a capital investment analysis. Which of the following would NOT lead to a related income tax effect? Decrease in cash operating expenses Disposal of equipment for an amount that differs from its book value Release of working capital at the end of the project's useful life Depreciation expense associated with the investment assets

2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started