Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) 2) Just require the correct answers no explanation necessary. Thank you. Sarah and David Johnston paid $5,500 during the year for child care for

1)

2)

Just require the correct answers no explanation necessary. Thank you.

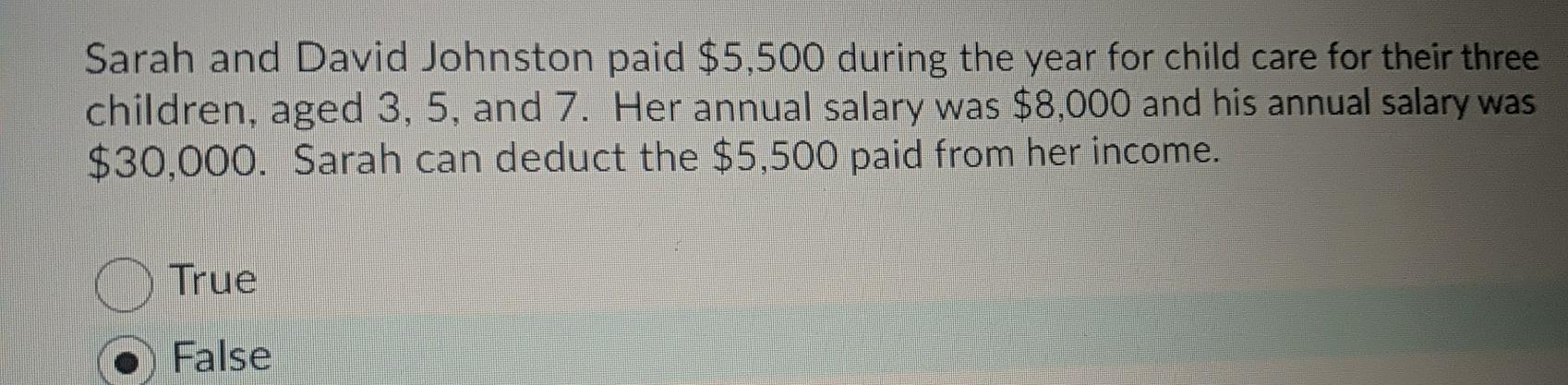

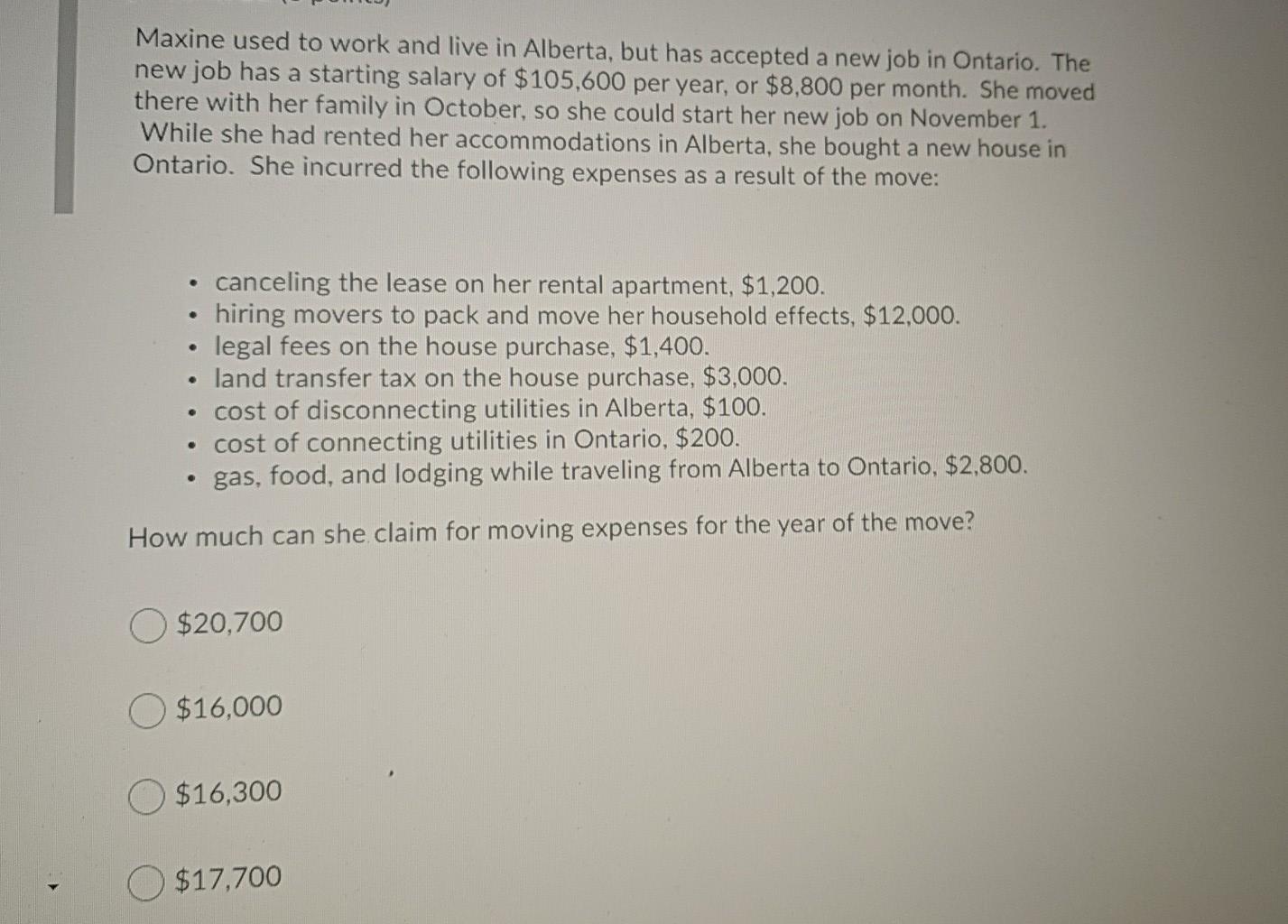

Sarah and David Johnston paid $5,500 during the year for child care for their three children, aged 3, 5, and 7. Her annual salary was $8,000 and his annual salary was $30,000. Sarah can deduct the $5,500 paid from her income. True False Maxine used to work and live in Alberta, but has accepted a new job in Ontario. The new job has a starting salary of $105,600 per year, or $8,800 per month. She moved there with her family in October, so she could start her new job on November 1. While she had rented her accommodations in Alberta, she bought a new house in Ontario. She incurred the following expenses as a result of the move: canceling the lease on her rental apartment, $1,200. hiring movers to pack and move her household effects, $12,000. legal fees on the house purchase, $1,400. land transfer tax on the house purchase, $3,000. cost of disconnecting utilities in Alberta, $100. cost of connecting utilities in Ontario, $200. gas, food, and lodging while traveling from Alberta to Ontario, $2,800. . . How much can she claim for moving expenses for the year of the move? $20,700 $16,000 $16,300 $17,700Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started