Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. Ory Company paid $5,000 cash for wages of production workers. This business event would: a. increase total assets and total equity. b. increase

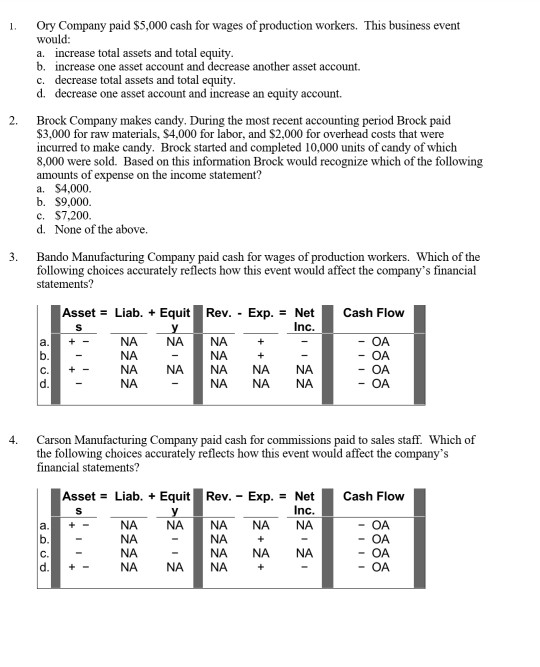

1. 2. Ory Company paid $5,000 cash for wages of production workers. This business event would: a. increase total assets and total equity. b. increase one asset account and decrease another asset account. c. decrease total assets and total equity. d. decrease one asset account and increase an equity account. Brock Company makes candy. During the most recent accounting period Brock paid $3,000 for raw materials, S4,000 for labor, and $2,000 for overhead costs that were incurred to make candy. Brock started and completed 10,000 units of candy of which 8,000 were sold. Based on this information Brock would recognize which of the following amounts of expense on the income statement? a. $4,000 b. $9,000. c. $7,200 d. None of the above. Bando Manufacturing Company paid cash for wages of production workers. Which of the following choices accurately reflects how this event would affect the company's financial statements? 3. Cash Flow a. b c. d. Asset = Liab. + Equit Rev. - Exp. = Net Inc. NA NA NA + NA NA NA NA NA NA NA NA NA NA NA + - OA - OA - OA - OA 4. Carson Manufacturing Company paid cash for commissions paid to sales staff. Which of the following choices accurately reflects how this event would affect the company's financial statements? Asset = Liab. + Equit Rev. - Exp. = Net Cash Flow Inc. NA NA NA NA NA - OA NA NA NA NA NA NA - OA d. NA NA NA - OA s a. b c. + +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started