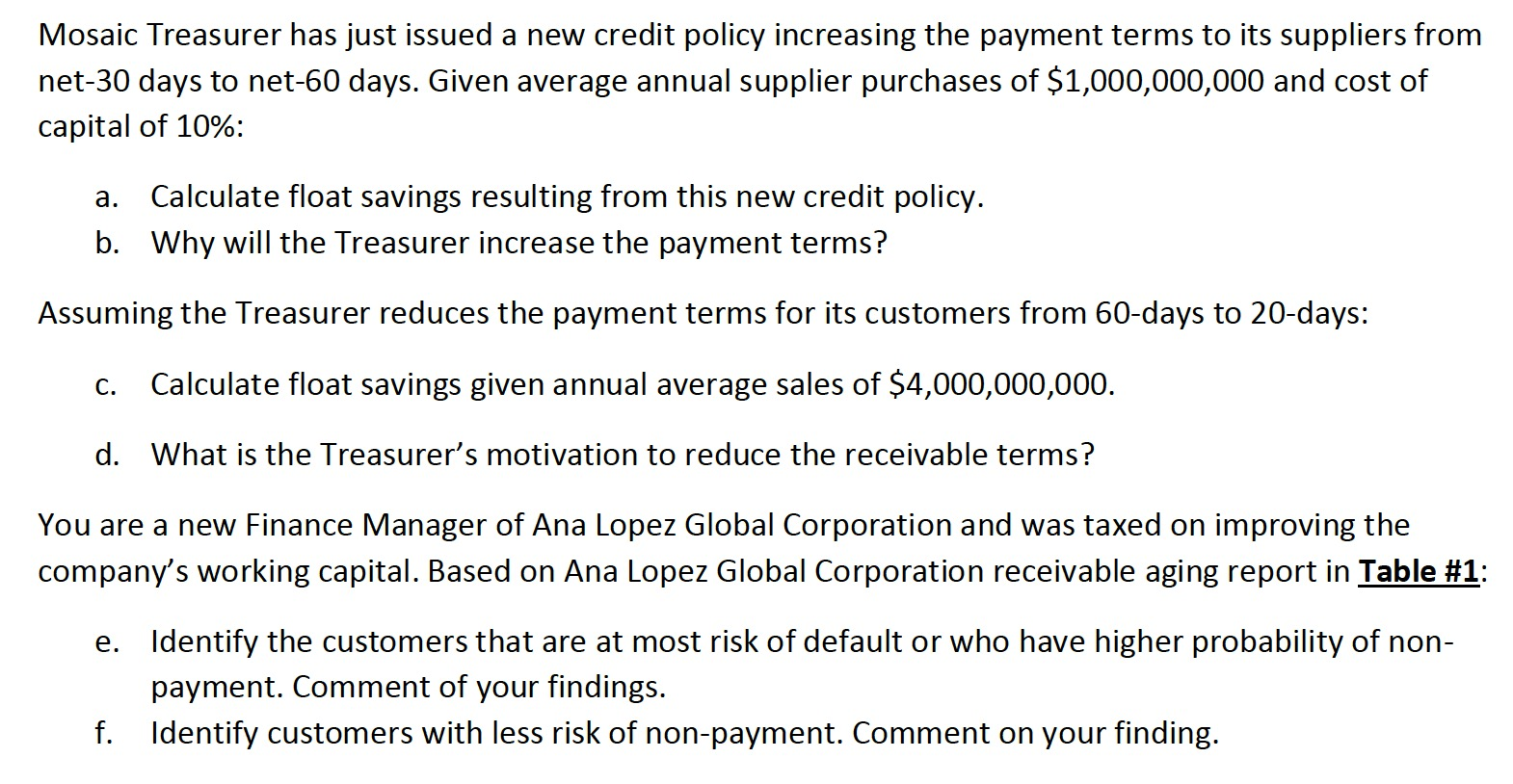

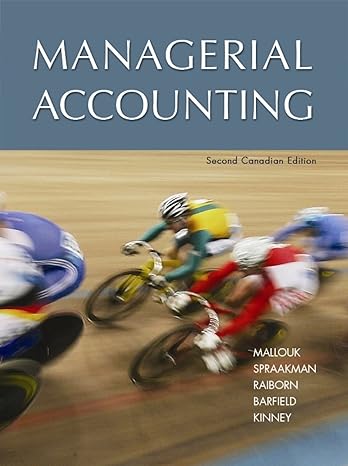

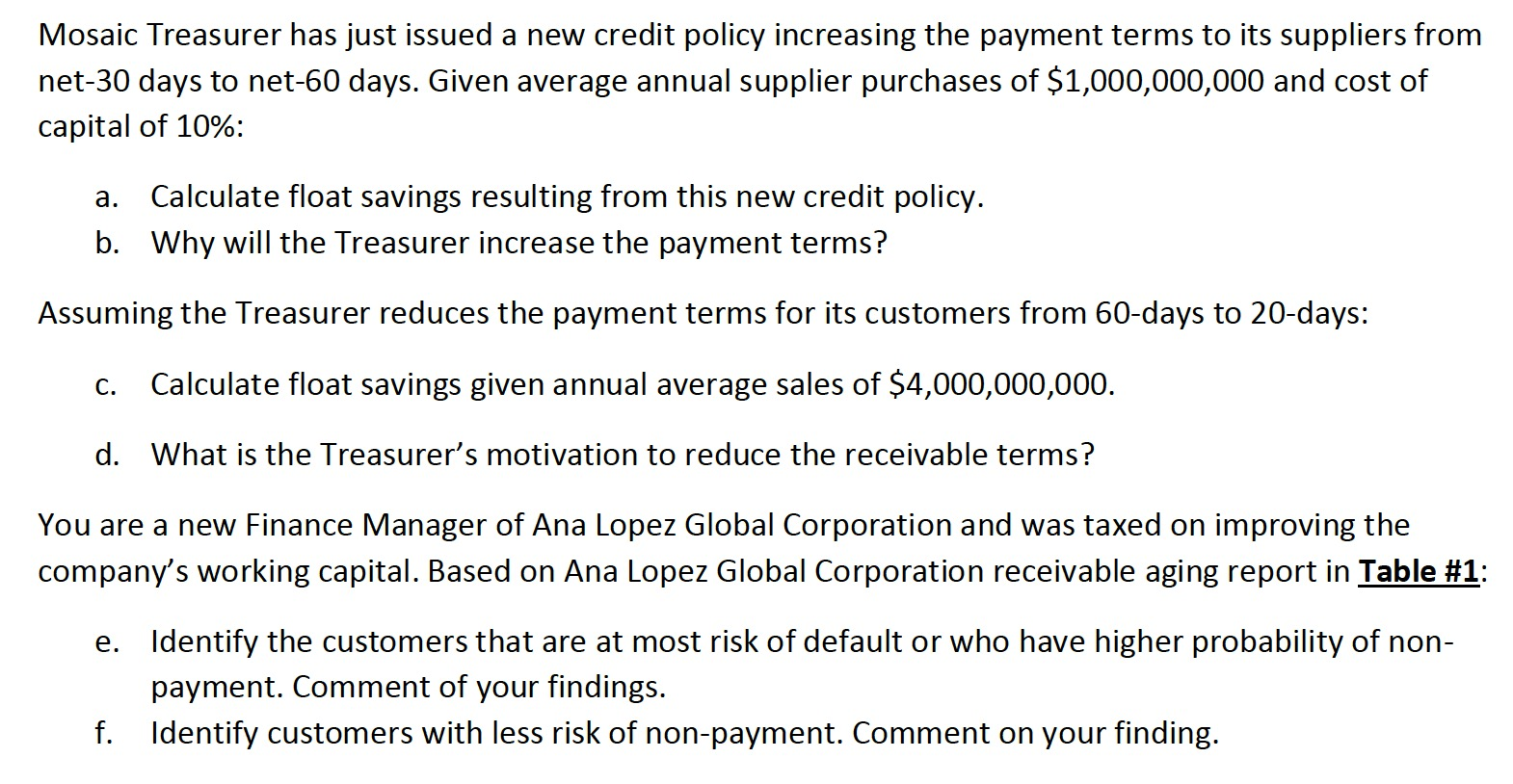

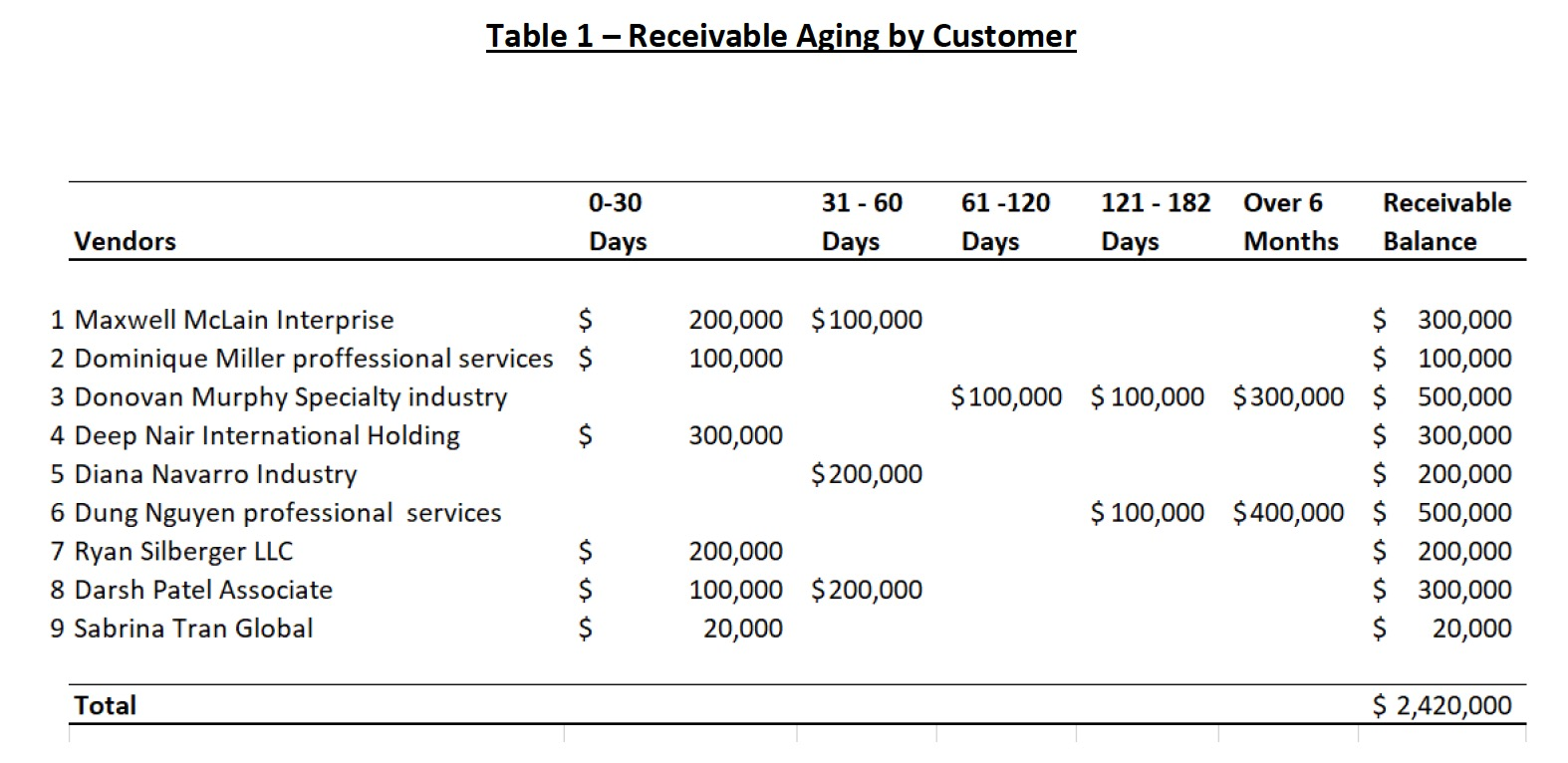

Mosaic Treasurer has just issued a new credit policy increasing the payment terms to its suppliers from net-30 days to net-60 days. Given average annual supplier purchases of $1,000,000,000 and cost of capital of 10%: a. Calculate float savings resulting from this new credit policy. b. Why will the Treasurer increase the payment terms? Assuming the Treasurer reduces the payment terms for its customers from 60-days to 20-days: C. Calculate float savings given annual average sales of $4,000,000,000. d. What is the Treasurer's motivation to reduce the receivable terms? You are a new Finance Manager of Ana Lopez Global Corporation and was taxed on improving the company's working capital. Based on Ana Lopez Global Corporation receivable aging report in Table #1: e. Identify the customers that are at most risk of default or who have higher probability of non- payment. Comment of your findings. f. Identify customers with less risk of non-payment. Comment on your finding. Table 1 - Receivable Aging by Customer 0-30 31 -60 Days 61-120 Days 121 - 182 Over 6 Days Months Receivable Balance Vendors Days 200,000 $100,000 100,000 $ 100,000 $ 100,000 $300,000 300,000 1 Maxwell McLain Interprise 2 Dominique Miller proffessional services $ 3 Donovan Murphy Specialty industry 4 Deep Nair International Holding 5 Diana Navarro Industry 6 Dung Nguyen professional services 7 Ryan Silberger LLC 8 Darsh Patel Associate 9 Sabrina Tran Global $200,000 $ 300,000 $ 100,000 $ 500,000 $ 300,000 $ 200,000 $ 500,000 $ 200,000 $ 300,000 $ 20,000 $ 100,000 $400,000 200,000 100,000 $200,000 20,000 Total $ 2,420,000 Mosaic Treasurer has just issued a new credit policy increasing the payment terms to its suppliers from net-30 days to net-60 days. Given average annual supplier purchases of $1,000,000,000 and cost of capital of 10%: a. Calculate float savings resulting from this new credit policy. b. Why will the Treasurer increase the payment terms? Assuming the Treasurer reduces the payment terms for its customers from 60-days to 20-days: C. Calculate float savings given annual average sales of $4,000,000,000. d. What is the Treasurer's motivation to reduce the receivable terms? You are a new Finance Manager of Ana Lopez Global Corporation and was taxed on improving the company's working capital. Based on Ana Lopez Global Corporation receivable aging report in Table #1: e. Identify the customers that are at most risk of default or who have higher probability of non- payment. Comment of your findings. f. Identify customers with less risk of non-payment. Comment on your finding. Table 1 - Receivable Aging by Customer 0-30 31 -60 Days 61-120 Days 121 - 182 Over 6 Days Months Receivable Balance Vendors Days 200,000 $100,000 100,000 $ 100,000 $ 100,000 $300,000 300,000 1 Maxwell McLain Interprise 2 Dominique Miller proffessional services $ 3 Donovan Murphy Specialty industry 4 Deep Nair International Holding 5 Diana Navarro Industry 6 Dung Nguyen professional services 7 Ryan Silberger LLC 8 Darsh Patel Associate 9 Sabrina Tran Global $200,000 $ 300,000 $ 100,000 $ 500,000 $ 300,000 $ 200,000 $ 500,000 $ 200,000 $ 300,000 $ 20,000 $ 100,000 $400,000 200,000 100,000 $200,000 20,000 Total $ 2,420,000