Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. .................................................................. 2. Pharoah Corporation provides the following information about its defined benefit pension plan (in hundreds of thousands of dollars) for 2020: Actual return

1.

..................................................................

2.

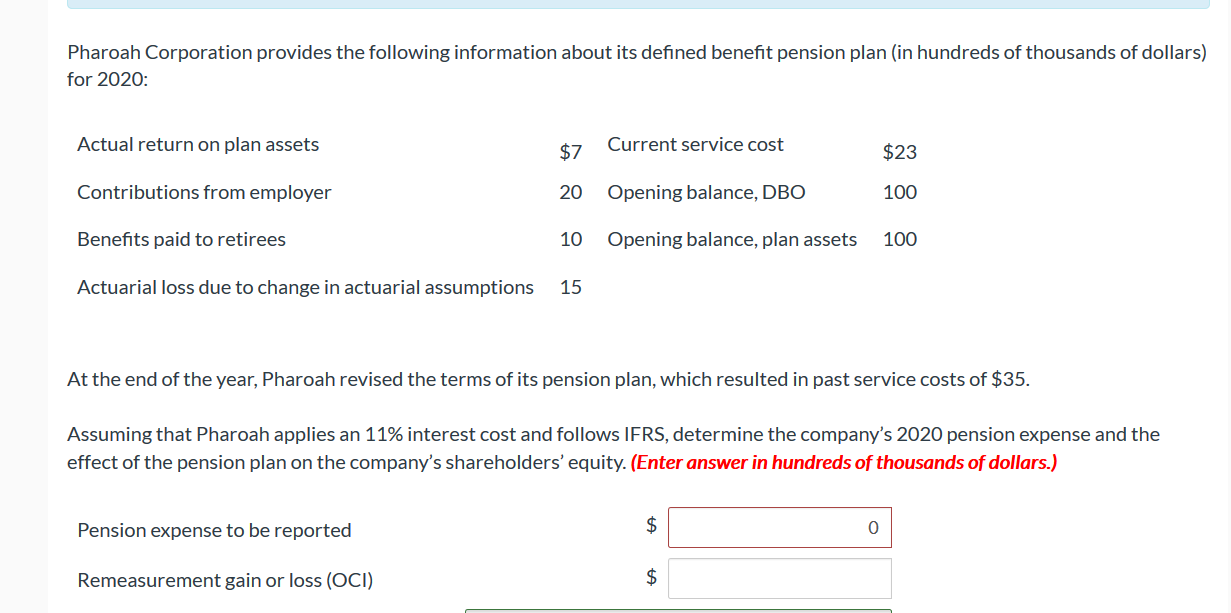

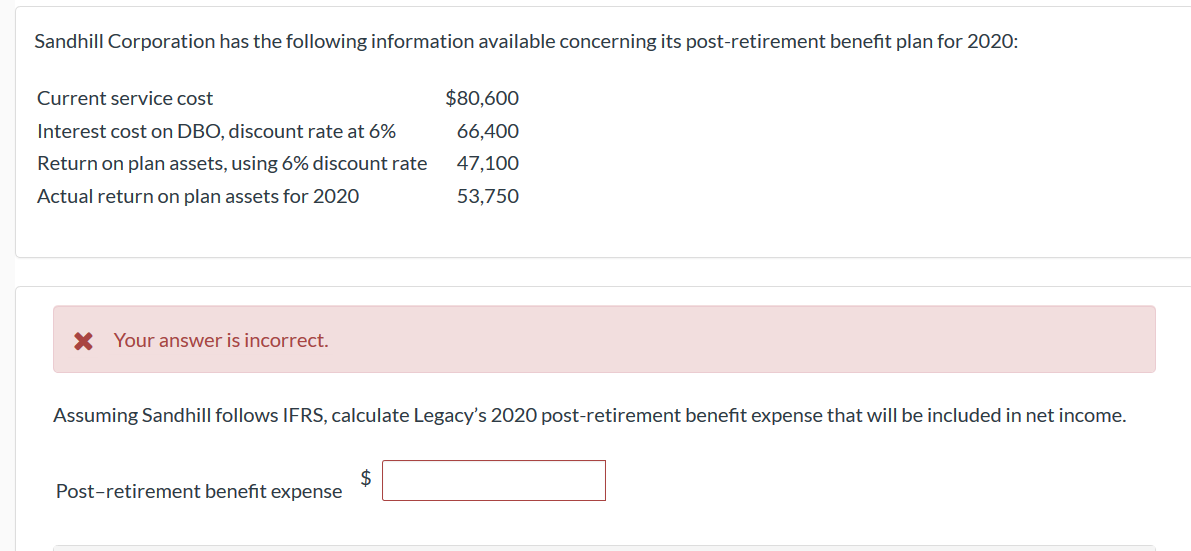

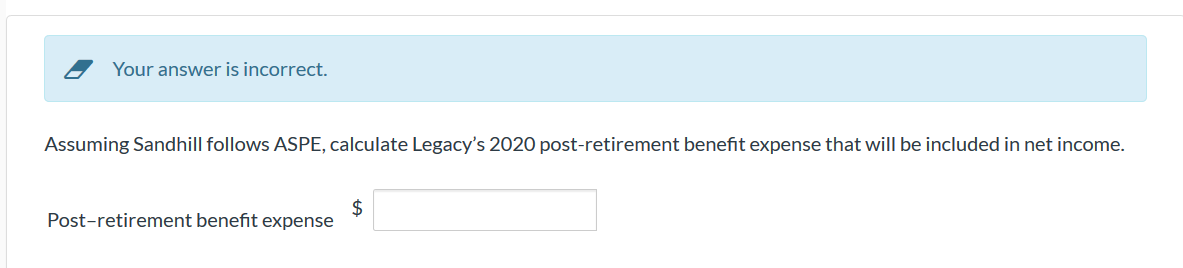

Pharoah Corporation provides the following information about its defined benefit pension plan (in hundreds of thousands of dollars) for 2020: Actual return on plan assets $7 Current service cost $23 Contributions from employer 20 Opening balance, DBO 100 Benefits paid to retirees 10 Opening balance, plan assets 100 Actuarial loss due to change in actuarial assumptions 15 At the end of the year, Pharoah revised the terms of its pension plan, which resulted in past service costs of $35. Assuming that Pharoah applies an 11% interest cost and follows IFRS, determine the company's 2020 pension expense and the effect of the pension plan on the company's shareholders' equity. (Enter answer in hundreds of thousands of dollars.) Pension expense to be reported $ 0 Remeasurement gain or loss (OCI) $ Sandhill Corporation has the following information available concerning its post-retirement benefit plan for 2020: Current service cost Interest cost on DBO, discount rate at 6% Return on plan assets, using 6% discount rate Actual return on plan assets for 2020 $80,600 66,400 47,100 53,750 X Your answer is incorrect. Assuming Sandhill follows IFRS, calculate Legacy's 2020 post-retirement benefit expense that will be included in net income. $ Post-retirement benefit expense Your answer is incorrect. Assuming Sandhill follows ASPE, calculate Legacy's 2020 post-retirement benefit expense that will be included in net income. $ Post-retirement benefit expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started