Question

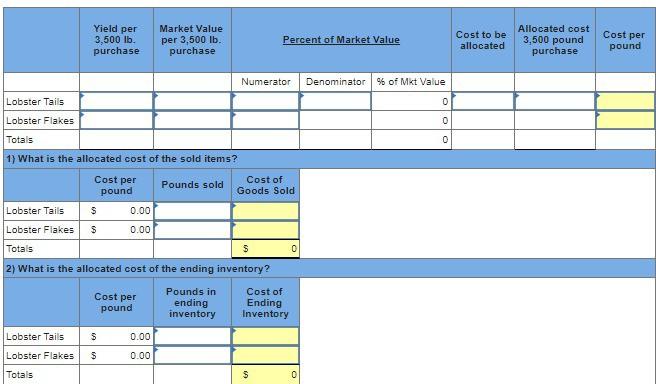

1. 2. Pirate Seafood Company purchases lobsters and processes them into tails and flakes. It sells the lobster tails for $19.70 per pound and the

1.

2. Pirate Seafood Company purchases lobsters and processes them into tails and flakes. It sells the lobster tails for $19.70 per pound and the flakes for $15.00 per pound. On average, 100 pounds of lobster are processed into 52 pounds of tails and 24 pounds of flakes, with 24 pounds of waste. Assume that the company purchased 3,500 pounds of lobster for $4 per pound and processed the lobsters with an additional labor cost of $7,600. No materials or labor costs are assigned to the waste. If 1,678 pounds of tails and 763 pounds of flakes are sold, calculate the allocated cost of the sold items and the allocated cost of the ending inventory. The company allocates joint costs on a value basis. (Round your answers to nearest whole number. Round cost per pound answers to 2 decimal places.)

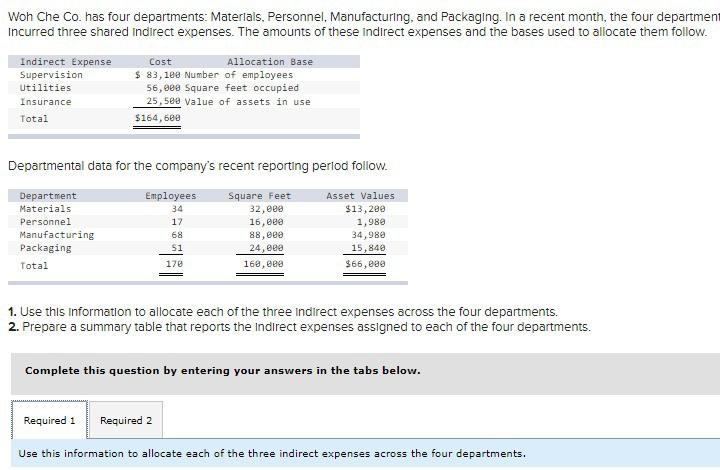

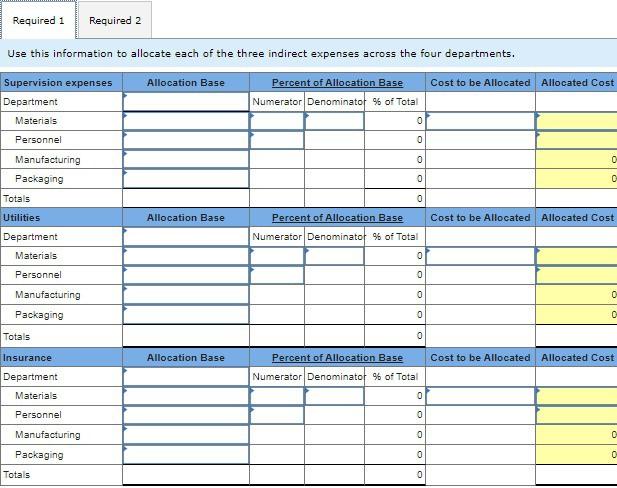

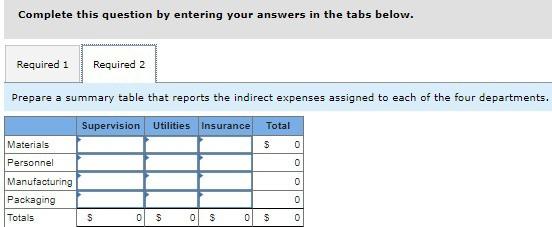

Woh Che Co. has four departments: Materials, Personnel, Manufacturing, and Packaging. In a recent month, the four department Incurred three shared Indirect expenses. The amounts of these indirect expenses and the bases used to allocate them follow. Indirect Expense Supervision Utilities Insurance Total Cost Allocation Base $ 83,188 Number of employees 56,000 square feet occupied 25,588 Value of assets in use $164,688 Departmental data for the company's recent reporting period follow. Department Materials Personnel Manufacturing Packaging Total Employees 34 17 68 51 178 Square Feet 32, eee 16, eee 88, cee 24, eee 169,000 Asset Values $13,280 1,980 34,980 15,840 $66,00 1. Use this information to allocate each of the three Indirect expenses across the four departments. 2. Prepare a summary table that reports the Indirect expenses assigned to each of the four departments. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Use this information to allocate each of the three indirect expenses across the four departments, Required 1 Required 2 Use this information to allocate each of the three indirect expenses across the four departments. Supervision expenses Allocation Base Percent of Allocation Base Cost to be Allocated Allocated Cost Department Numerator Denominato % of Total Materials 0 Personnel 0 0 0 Manufacturing Packaging 0 0 Totals 0 Utilities Allocation Base Percent of Allocation Base Cost to be Allocated Allocated Cost Numerator Denominato % of Total Department Materials 0 0 Personnel Manufacturing 0 0 Packaging 0 0 Totals 0 Allocation Base Percent of Allocation Base Cost to be Allocated Allocated Cost Insurance Department Materials Numerator Denominator % of Total Personnel Manufacturing Packaging OOOOO 0 0 Totals Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a summary table that reports the indirect expenses assigned to each of the four departments. Supervision Utilities Insurance Total $ 0 Materials Personnel 0 Manufacturing Packaging Totals Oolo S 0 s S 0 S Yield per 3,500 lb purchase Market Value per 3,500 lb. purchase Percent of Market Value Cost to be allocated Allocated cost 3,500 pound purchase Cost per pound Numerator Denominator % of Mkt Value Lobster Tails Olo 0 Lobster Flakes Totals 1) What is the allocated cost of the sold items? Cost per Cost of Pounds sold pound Goods Sold Lobster Tails $ 0.00 $ 0.00 Lobster Flakes Totals $ 0 2) What is the allocated cost of the ending inventory? Cost per pound Pounds in ending inventory Cost of Ending Inventory Lobster Tails s 0.00 Lobster Flakes s 0.00 Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started