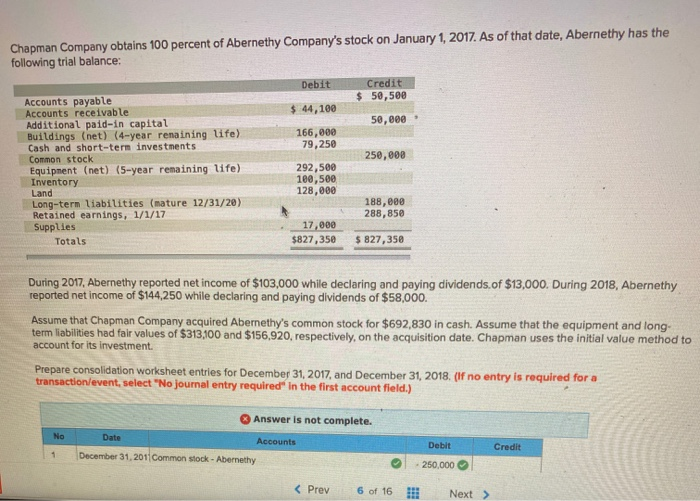

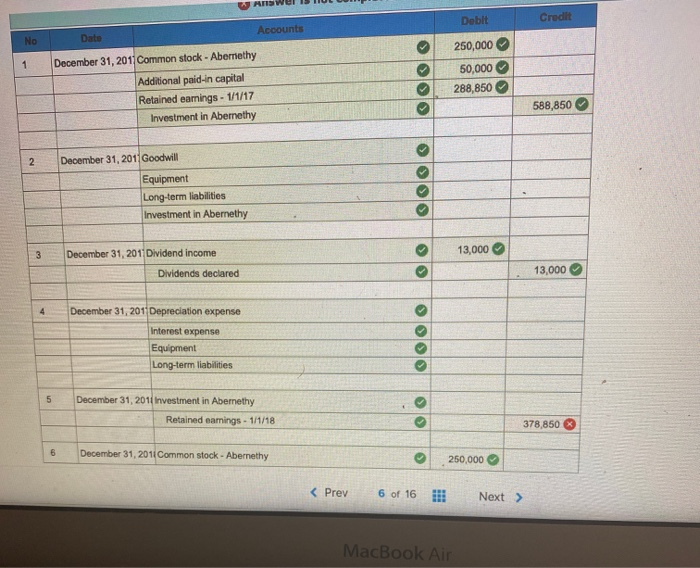

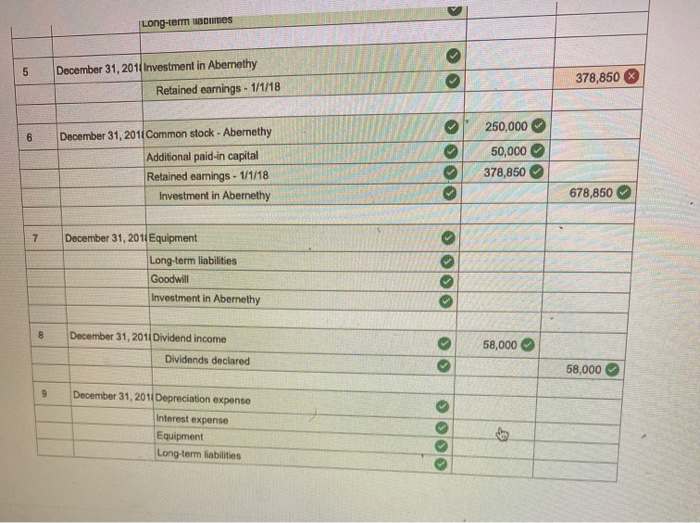

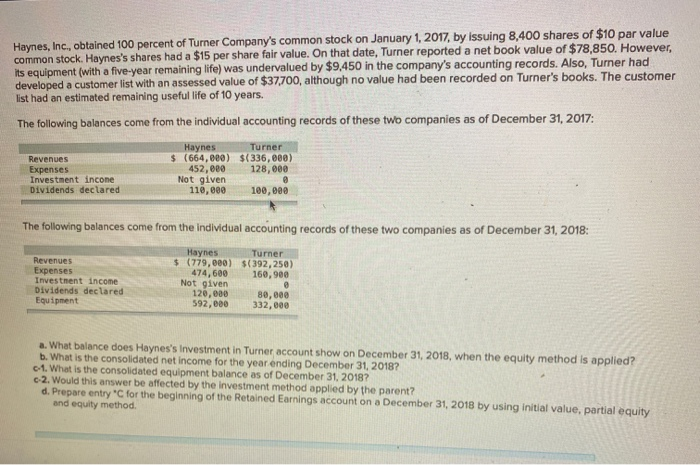

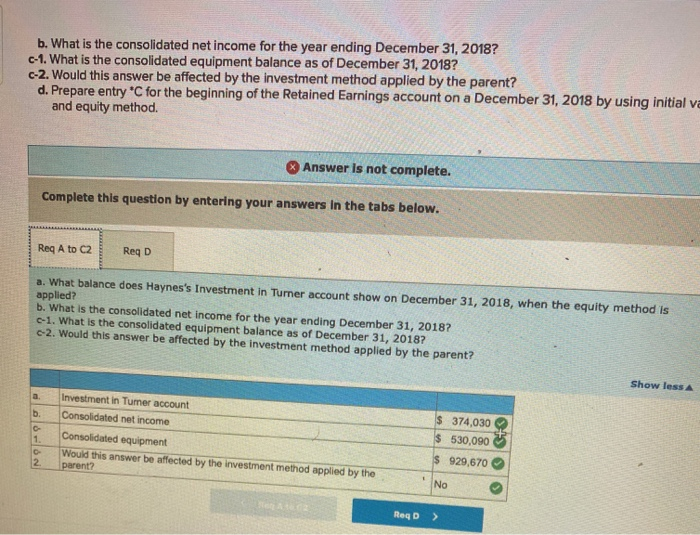

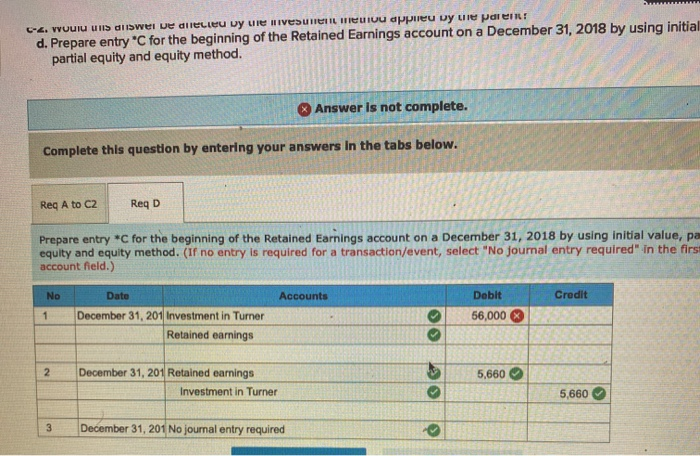

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2017. As of that date, Abernethy has the following trial balance: Debit Credit $ 50,500 $ 44,100 50,000 166,000 79,250 250,000 Accounts payable Accounts receivable Additional paid-in capital Buildings (net) (4-year renaining life) Cash and short-term investments Common stock Equipment (net) (5-year remaining life) Inventory Land Long-term liabilities (mature 12/31/20) Retained earnings, 1/1/17 Supplies Totals 292,500 100,500 128,000 188,888 288,850 17,000 $827,350 $ 827,350 During 2017, Abernethy reported net income of $103,000 while declaring and paying dividends.of $13,000. During 2018, Abernethy reported net income of $144,250 while declaring and paying dividends of $58,000. Assume that Chapman Company acquired Abernethy's common stock for $692,830 in cash. Assume that the equipment and long- term liabilities had fair values of $313,100 and $156,920, respectively, on the acquisition date. Chapman uses the initial value method to account for its investment. Prepare consolidation worksheet entries for December 31, 2017, and December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is not complete. No Date Accounts Debit Credit 1 December 31, 201 Common stock - Abernethy 250,000 Awer Debit Credit Accounts No Date 1 December 31, 2017 Common stock - Abernethy Additional paid-in capital Retained eamings - 1/1/17 Investment in Abernethy 250,000 50,000 288,850 588,850 2 December 31, 2011 Goodwill Equipment Long-term liabilities Investment in Abernethy 13,000 3 December 31, 2011 Dividend income Dividends declared >> 13,000 > 4 December 31, 201 Depreciation expense Interest expense Equipment Long-term liabilities 5 December 31, 2011 Investment in Abernethy Retained oamings - 1/1/18 378,850 6 December 31, 2011 Common stock - Abernethy 250,000 Prev 6 of 16 Next > MacBook Air Long-term names 5 December 31, 2011 Investment in Abernethy Retained earnings - 1/1/18 378,850 250,000 6 December 31, 2011 Common stock - Abernethy Additional paid-in capital Retained earnings - 1/1/18 Investment in Abernethy 50,000 378,850 678,850 7 December 31, 2011 Equipment Long-term liabilities Goodwill Investment in Abernethy December 31, 2011 Dividend income > 58,000 Dividends declared 58,000 9 December 31, 2011 Depreciation expense Interest expense Equipment Long-term liabilities Haynes, Inc., obtained 100 percent of Turner Company's common stock on January 1, 2017, by issuing 8,400 shares of $10 par value common stock. Haynes's shares had a $15 per share fair value. On that date, Turner reported a net book value of $78,850. However, its equipment (with a five-year remaining life) was undervalued by $9.450 in the company's accounting records. Also, Turner had developed a customer list with an assessed value of $37,700, although no value had been recorded on Turner's books. The customer list had an estimated remaining useful life of 10 years. The following balances come from the individual accounting records of these two companies as of December 31, 2017: Haynes Turner $ (664,000) $(336,000) Expenses 452,800 128,000 Investment income Not given Dividends declared 110,000 100,000 Revenues @ The following balances come from the individual accounting records of these two companies as of December 31, 2018: Revenues Expenses Investment income Dividends declared Equipment Haynes Turner $ (779,000) $(392,250) 474,600 160,900 Not given 120,000 80,000 592,000 332,000 a. What balance does Haynes's Investment in Turner account show on December 31, 2018, when the equity method is applied? b. What is the consolidated net income for the year ending December 31, 2018? 1. What is the consolidated equipment balance as of December 31, 2018? c. 2. Would this answer be affected by the investment method applied by the parent? d. Prepare entry "C for the beginning of the Retained Earnings account on a December 31, 2018 by using initial value, partial equity and equity method b. What is the consolidated net income for the year ending December 31, 2018? c-1. What is the consolidated equipment balance as of December 31, 2018? c-2. Would this answer be affected by the investment method applied by the parent? d. Prepare entry *C for the beginning of the Retained Earnings account on a December 31, 2018 by using initial va and equity method. Answer is not complete. Complete this question by entering your answers in the tabs below. Req A to C2 Reg D a. What balance does Haynes's Investment in Turner account show on December 31, 2018, when the equity method is applied? b. What is the consolidated net income for the year ending December 31, 2018? c-1. What is the consolidated equipment balance as of December 31, 2018? c-2. Would this answer be affected by the investment method applied by the parent? Show less b. Investment in Tumer account Consolidated net income Consolidated equipment Would this answer be affected by the investment method applied by the parent? $ 374,030 $ 530,090 1 0 2 $ 929,670 1 No ReqD > C-2. voulu un diwei UE dielleu by ule livesuvel euiou appieu by ule pdien d. Prepare entry *C for the beginning of the Retained Earnings account on a December 31, 2018 by using initial partial equity and equity method. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg A to C2 Reg D Prepare entry *C for the beginning of the Retained Earnings account on a December 31, 2018 by using initial value, pa equity and equity method. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) No Date Accounts Debit Credit 1 56,000 December 31, 201 Investment in Turner Retained earnings 2 5,660 December 31, 201 Retained earnings Investment in Turner 5,660 3 December 31, 201 No journal entry required

1

1

2

2

please fix both

please fix both