Answered step by step

Verified Expert Solution

Question

1 Approved Answer

[ 1 2 points ] A deferred start swap contract is a swap whose payments start at a later time. E . g . a

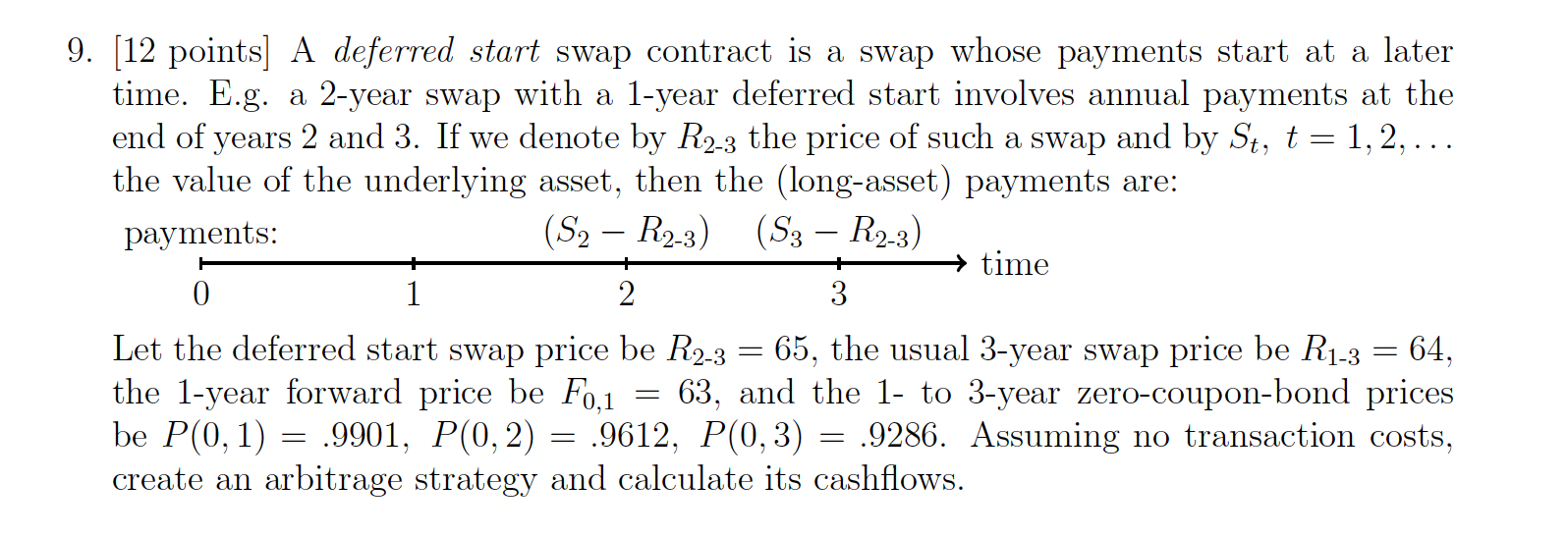

points A deferred start swap contract is a swap whose payments start at a later

time. Eg a year swap with a year deferred start involves annual payments at the

end of years and If we denote by the price of such a swap and by dots

the value of the underlying asset, then the longasset payments are:

Let the deferred start swap price be the usual year swap price be

the year forward price be and the to year zerocouponbond prices

be Assuming no transaction costs,

create an arbitrage strategy and calculate its cashflows.

please create a table to solve it with t t t t do not post your answer if you are not sure, ow will downvote

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started