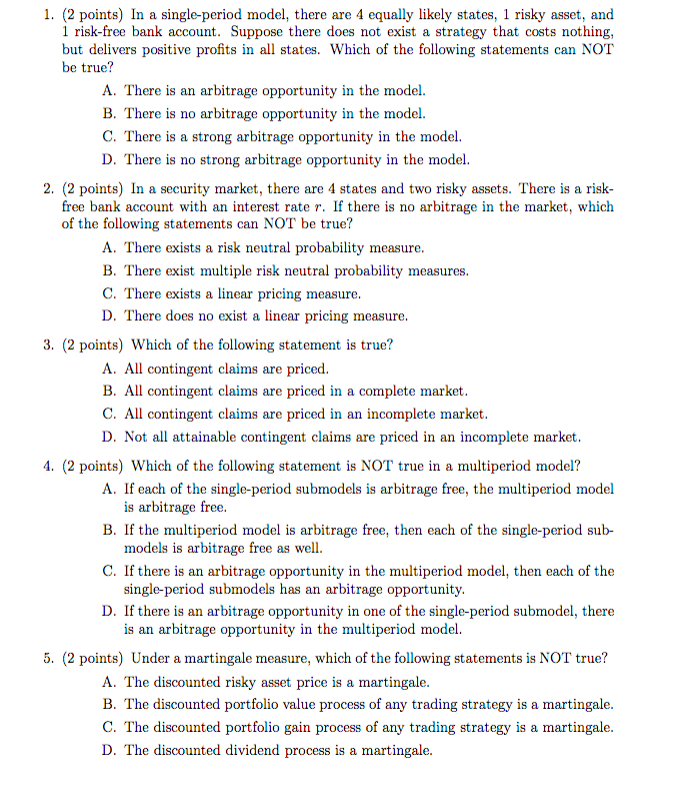

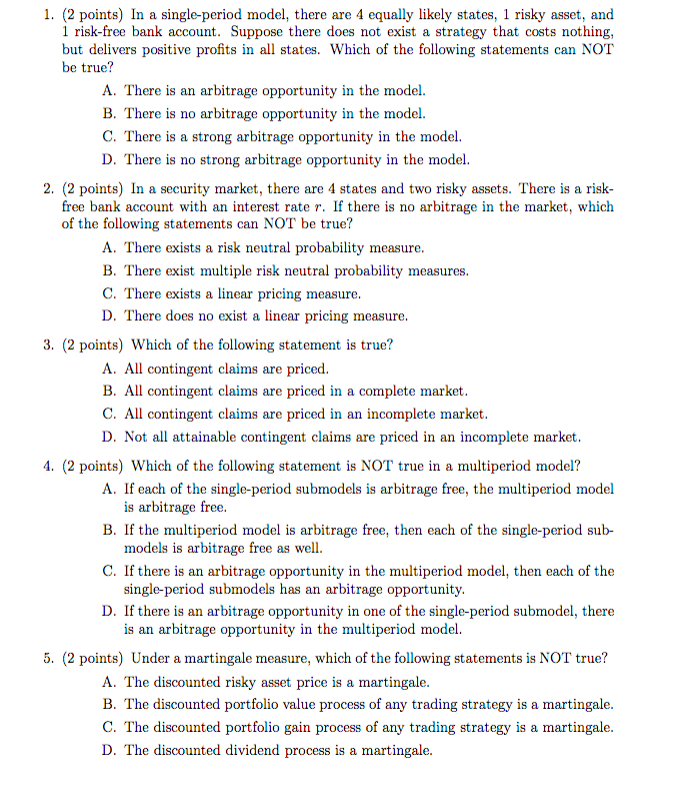

1. (2 points) In a single-period model, there are 4 equally likely states, 1 risky asset, and 1 risk-free bank account. Suppose there does not exist a strategy that costs nothing, but delivers positive profits in all states. Which of the following statements can NOT be true? A. There is an arbitrage opportunity in the model. B. There is no arbitrage opportunity in the model. C. There is a strong arbitrage opportunity in the model. D. There is no strong arbitrage opportunity in the model. 2. (2 points) In a security market, there are 4 states and two risky assets. There is a risk- free bank account with an interest rate r. If there is no arbitrage in the market, which of the following statements can NOT be true? A. There exists a risk neutral probability measure. B. There exist multiple risk neutral probability measures. C. There exists a linear pricing measure. D. There does no exist a linear pricing measure. 3. (2 points) Which of the following statement is true? A. All contingent claims are priced. B. All contingent claims are priced in a complete market. C. All contingent claims are priced in an incomplete market. D. Not all attainable contingent claims are priced in an incomplete market. 4. (2 points) Which of the following statement is NOT true in a multiperiod model? A. If each of the single-period submodels is arbitrage free, the multiperiod model is arbitrage free. B. If the multiperiod model is arbitrage free, then each of the single-period sub- models is arbitrage free as well. C. If there is an arbitrage opportunity in the multiperiod model, then each of the single-period submodels has an arbitrage opportunity. D. If there is an arbitrage opportunity in one of the single-period submodel, there is an arbitrage opportunity in the multiperiod model. 5. (2 points) Under a martingale measure, which of the following statements is NOT true? A. The discounted risky asset price is a martingale. B. The discounted portfolio value process of any trading strategy is a martingale. C. The discounted portfolio gain process of any trading strategy is a martingale. D. The discounted dividend process is a martingale