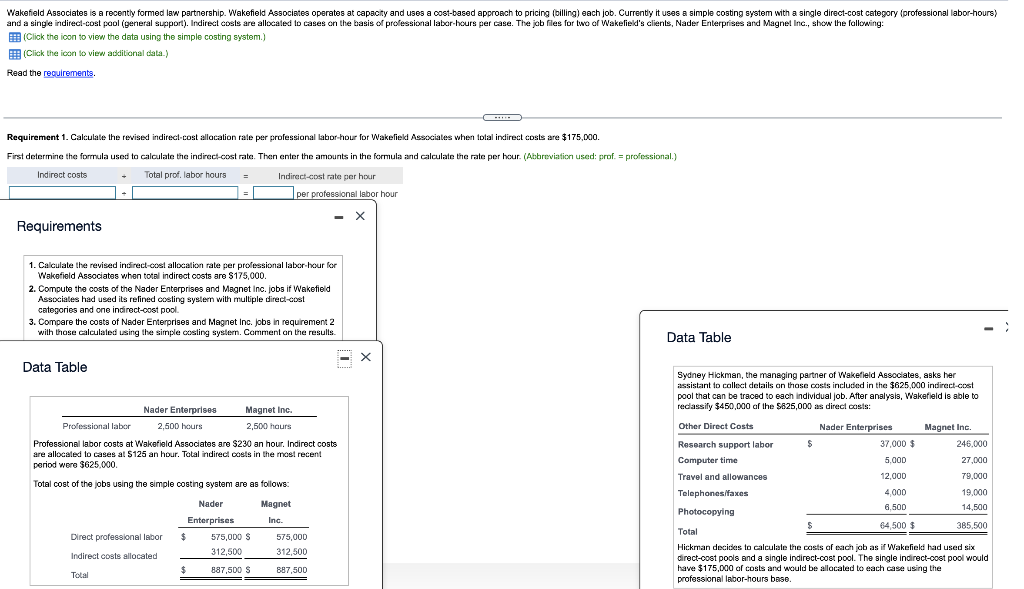

Requirements:

1. Calculate the revised indirect-cost allocation rate per professional labor hour for Associates when total indirect costs are .

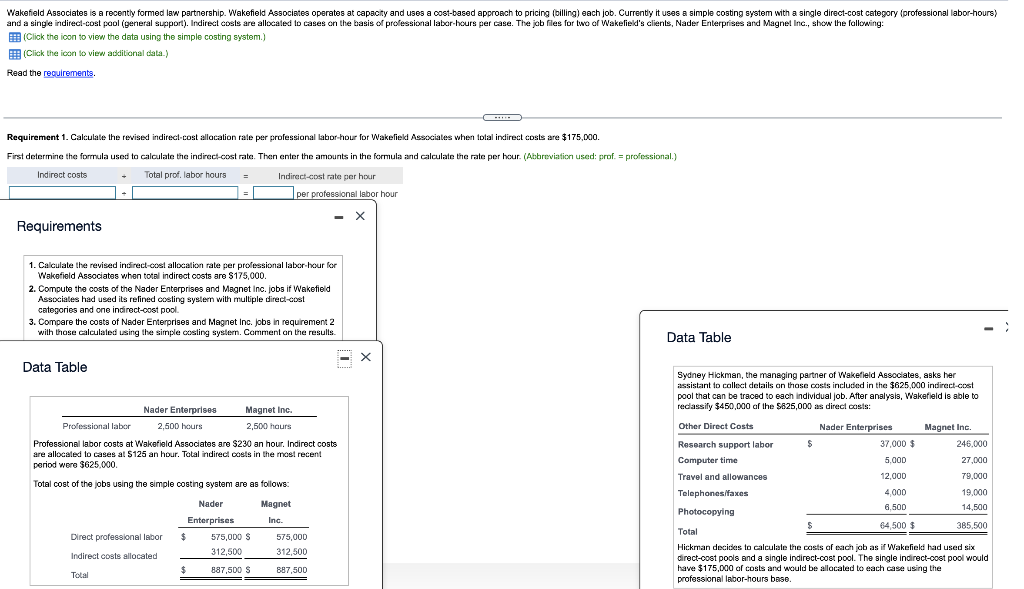

2. Compute the costs of the Enterprises and Inc. jobs if Associates had used its refined costing system with multiple direct-cost categories and one indirect-cost pool.

3. Compare the costs of Enterprises and Inc. jobs in requirement 2 with those calculated using the simple costing system. Comment on the results.

Wakefield Associates is a recently formed law partnership. Wakefield Associates operates at capacity and uses a cost-based approach to pricing (billing) each job. Currently it uses a simple costing system with a single direct-cost category (professional labor-hours) and a single indirecl-cost pool (general support). Indirect costs are allocated to cases on the basis of professional labor-hours per case. The jab files for two of Wakefield's clients, Nader Enterprises and Magnet Inc., show the following: B (Click the icon to view the data using the simple costing system.) (Click the icon to view additional data.) Read the requirements. Requirement 1. Calculate the revised indirect-cost allocation rate per professional labor-hour for Wakefield Associates when total indirect costs are $175,000. First determine the formula used to calculate the indirect-cost rate. Then enter the amounts in the formula and calculate the rate per hour. (Abbreviation used: prof. = professional.) Indirect costs Total prof. labor hours Indirect-cost rate per hour per professional labor hour = X Requirements 1. Calculate the revised indirect-cost allocation rate per professional labor-hour for Wakefield Associates when total indirect costs are $175,000. 2. Compute the costs of the Nader Enterprises and Magnet Inc. jobs if Wakefield Associates had used its relined cosling syslern with multiple direct-cost categories and one indirect-cost pool. 3. Compare the costs of Nader Enterprises and Magnet Inc. jobs in requirement 2 with those calculated using the simple cosling systern. Comment on the results Data Table X Data Table Nader Enterprises Magnet Inc. Professional labor 2,500 hours 2,500 hours Professional labor costs at Wakefield Associates are $230 an hour. Indirect costs are allocated to cases at $125 an hour. Total indirect costs in the most recent period were $625.000 Total cost of the jobs using the simple costing system are as follows: Nader Magnet Enterprises Inc. Direct professional labor $ 575,000 $ S 575,000 Indirect costs allocated 312,500 312,500 $ 887,500 S 887,500 Total Sydney Hickman, the managing partner of Wakefield Associates, asks her assistant to collect delails on those costs included in the $625,000 indirect-cost pool that can be traced to each individual job. After analysis, Wakefield is able to reclassify $450,000 of the $625,000 as direct costs: Other Direct Costs Nader Enterprises Magnet Inc. Research support labor $ 37,000 $ 246.000 Computer time 5.000 27,000 Travel and allowances 12,000 79,000 Telephones/faxes 4,000 19.000 6.500 14.500 Photocopying 64,500 $ Total 385.500 Hickman decides to calculate the costs of each jab as if Wakefield had used six direct-cost pools and a single indirect-cost pool. The single indirect-oost pool would have $175,000 af costs and would be allocated to each case using the professional labor-hours base