1.

2.

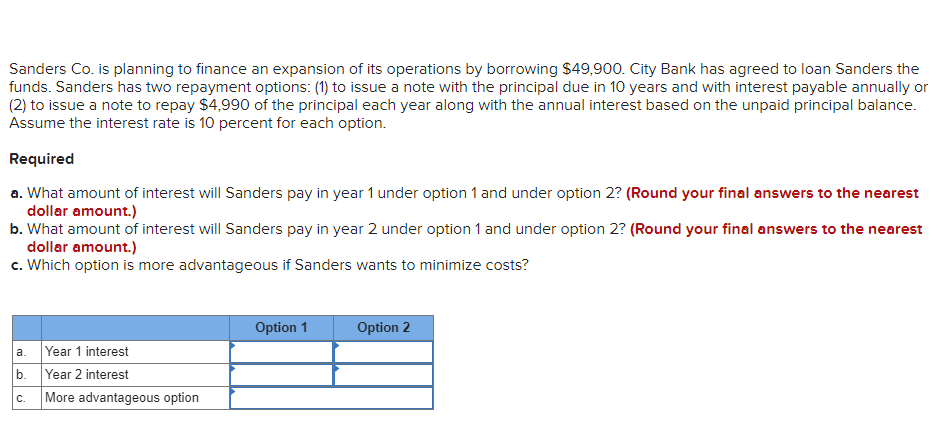

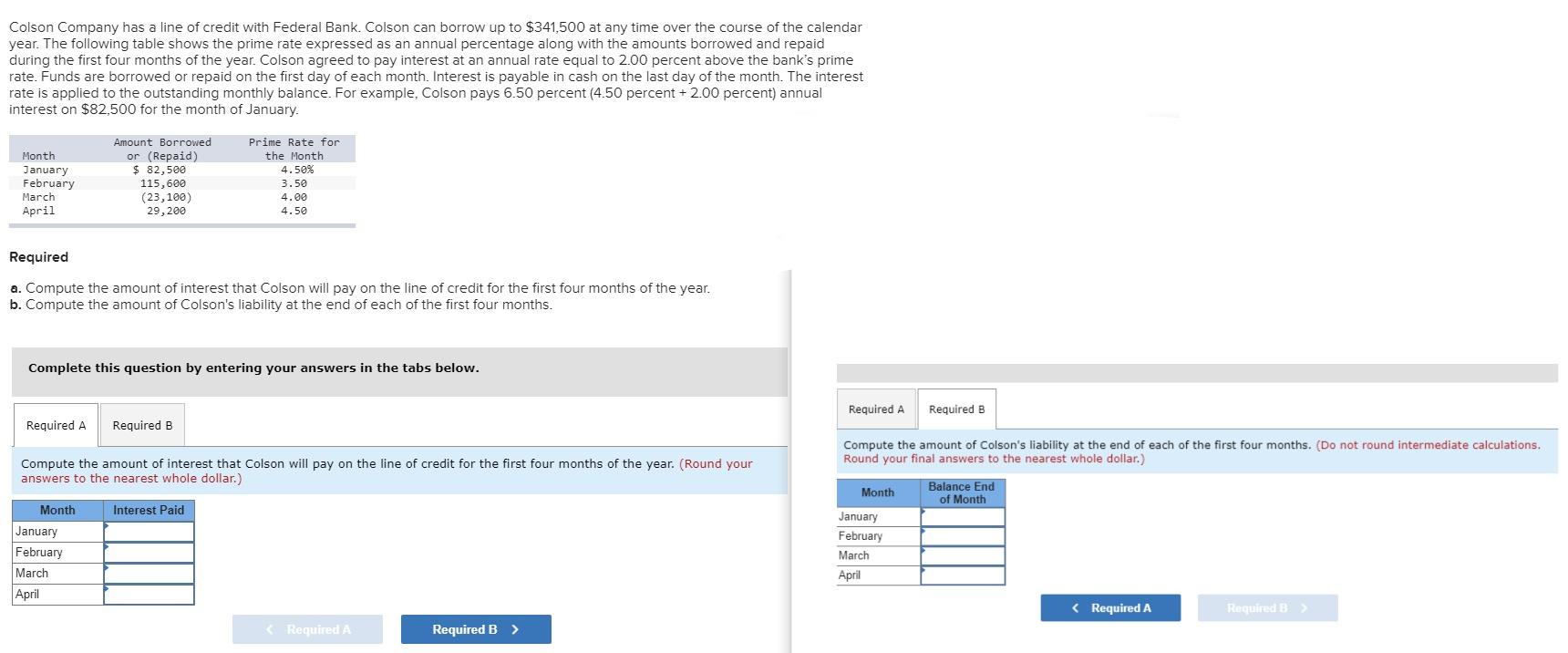

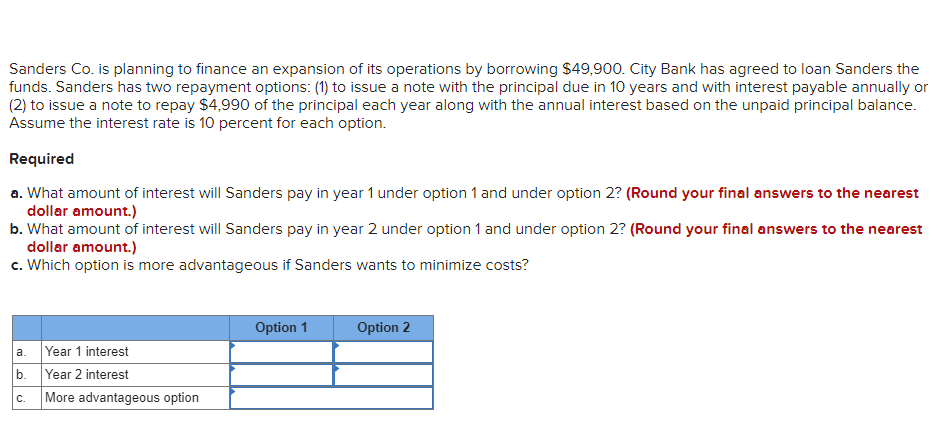

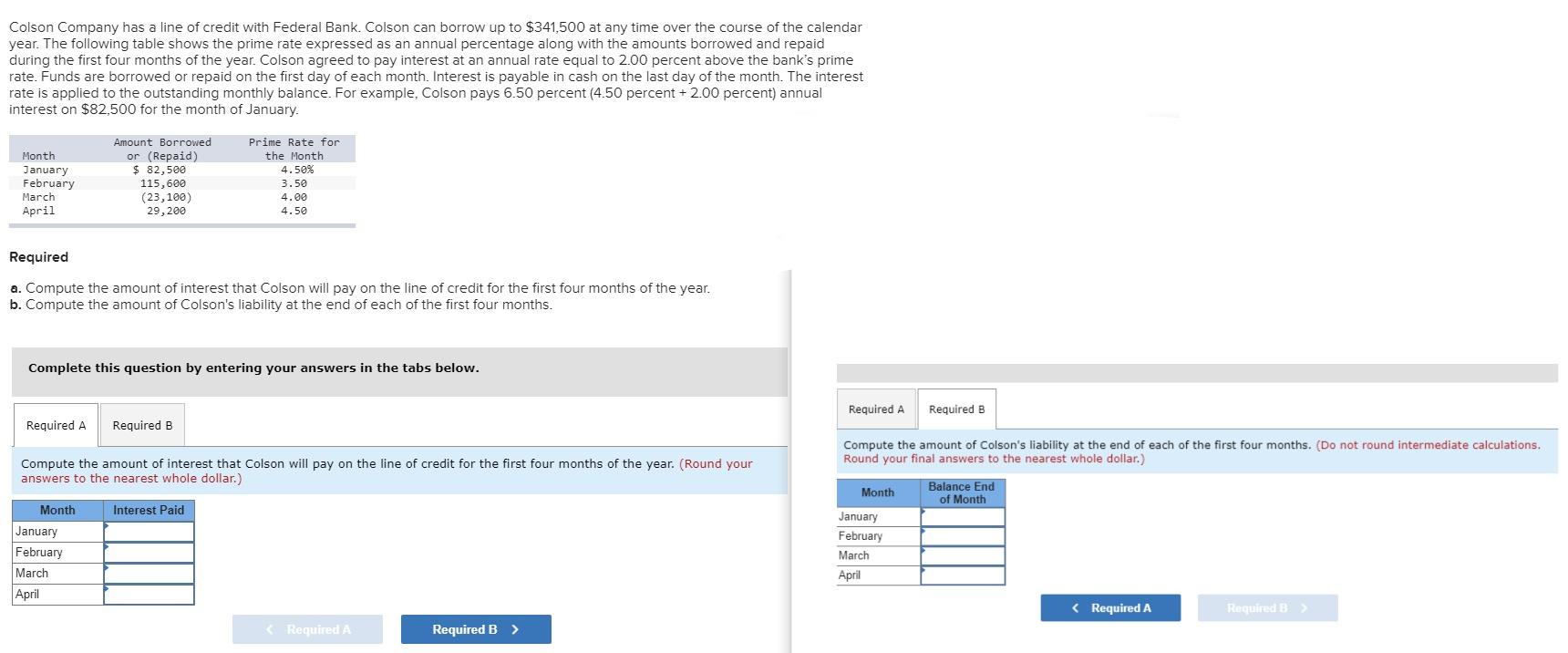

Sanders Co. is planning to finance an expansion of its operations by borrowing $49,900. City Bank has agreed to loan Sanders the funds. Sanders has two repayment options: (1) to issue a note with the principal due in 10 years and with interest payable annually or (2) to issue a note to repay $4.990 of the principal each year along with the annual interest based on the unpaid principal balance. Assume the interest rate is 10 percent for each option. Required a. What amount of interest will Sanders pay in year 1 under option 1 and under option 2? (Round your final answers to the nearest dollar amount.) b. What amount of interest will Sanders pay in year 2 under option 1 and under option 2? (Round your final answers to the nearest dollar amount.) c. Which option is more advantageous if Sanders wants to minimize costs? Option 1 Option 2 a b. Year 1 interest Year 2 interest More advantageous option C. Colson Company has a line of credit with Federal Bank. Colson can borrow up to $341,500 at any time over the course of the calendar year. The following table shows the prime rate expressed as an annual percentage along with the amounts borrowed and repaid during the first four months of the year. Colson agreed to pay interest at an annual rate equal to 2.00 percent above the bank's prime rate. Funds are borrowed or repaid on the first day of each month. Interest is payable in cash on the last day of the month. The interest rate is applied to the outstanding monthly balance. For example, Colson pays 6.50 percent (4.50 percent +2.00 percent) annual interest on $82,500 for the month of January. Month January February Amount Borrowed or (Repaid) $ 82,500 115,600 (23,100) 29,200 Prime Rate for the Month 4.50% 3.50 4.00 4.50 March April Required a. Compute the amount of interest that Colson will pay on the line of credit for the first four months of the year. b. Compute the amount of Colson's liability at the end of each of the first four months. Complete this question by entering your answers in the tabs below. Required A Required B Required A Required B Compute the amount of Colson's liability at the end of each of the first four months. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) Compute the amount of interest that Colson will pay on the line of credit for the first four months of the year. (Round your answers to the nearest whole dollar.) Month Balance End of Month Interest Paid Month January February March April January February March April