Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. 2. Wilkinson Inc., which has a cost of capital of 10%, invested in a project with an internal rate of return (IRR) of 12%.

1.

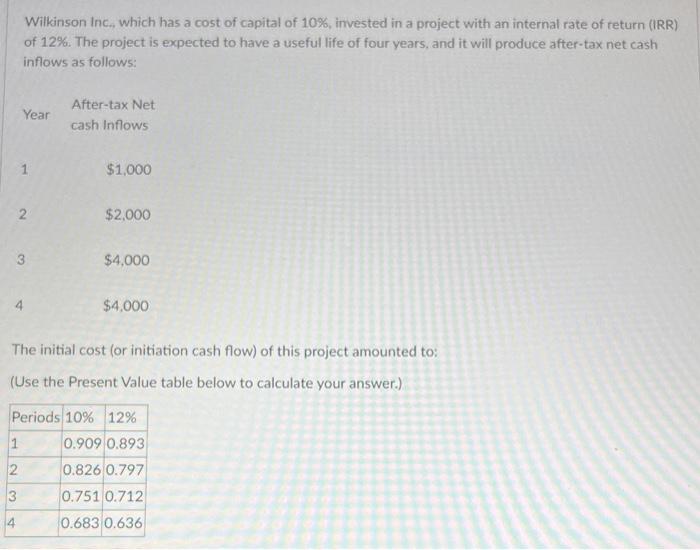

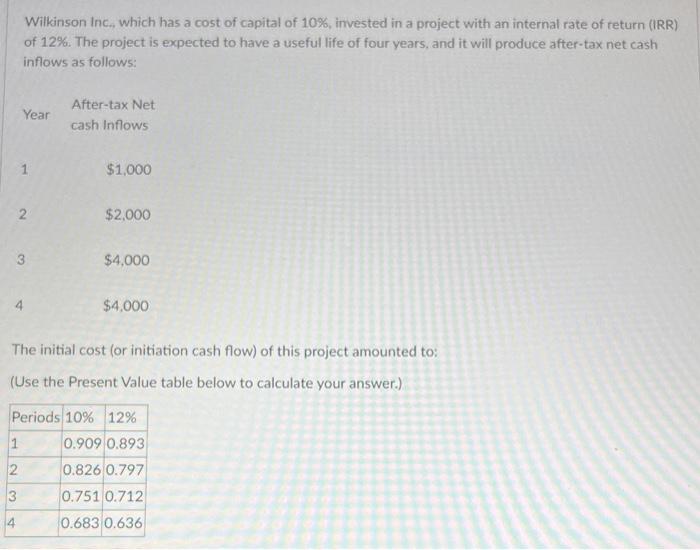

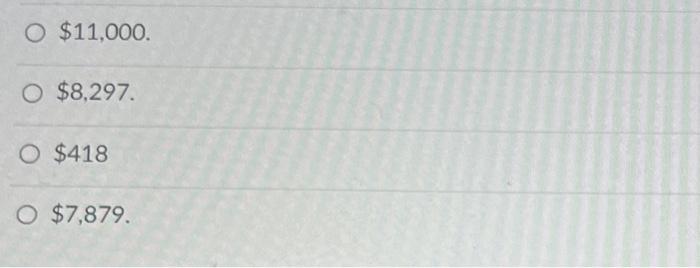

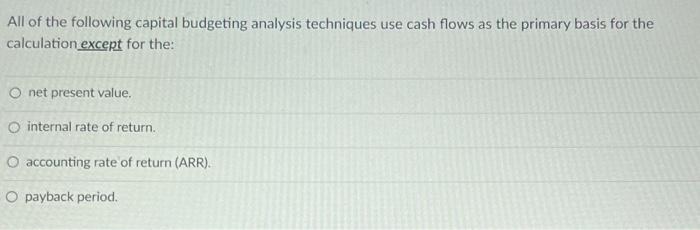

Wilkinson Inc., which has a cost of capital of 10%, invested in a project with an internal rate of return (IRR) of 12%. The project is expected to have a useful life of four years, and it will produce after-tax net cash inflows as follows: The initial cost (or initiation cash flow) of this project amounted to: (Use the Present Value table below to calculate your answer.) $11,000. $8,297. $418 $7,879. All of the following capital budgeting analysis techniques use cash flows as the primary basis for the calculation except for the: net present value. internat rate of return. accounting rate of return (ARR). payback period

2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started