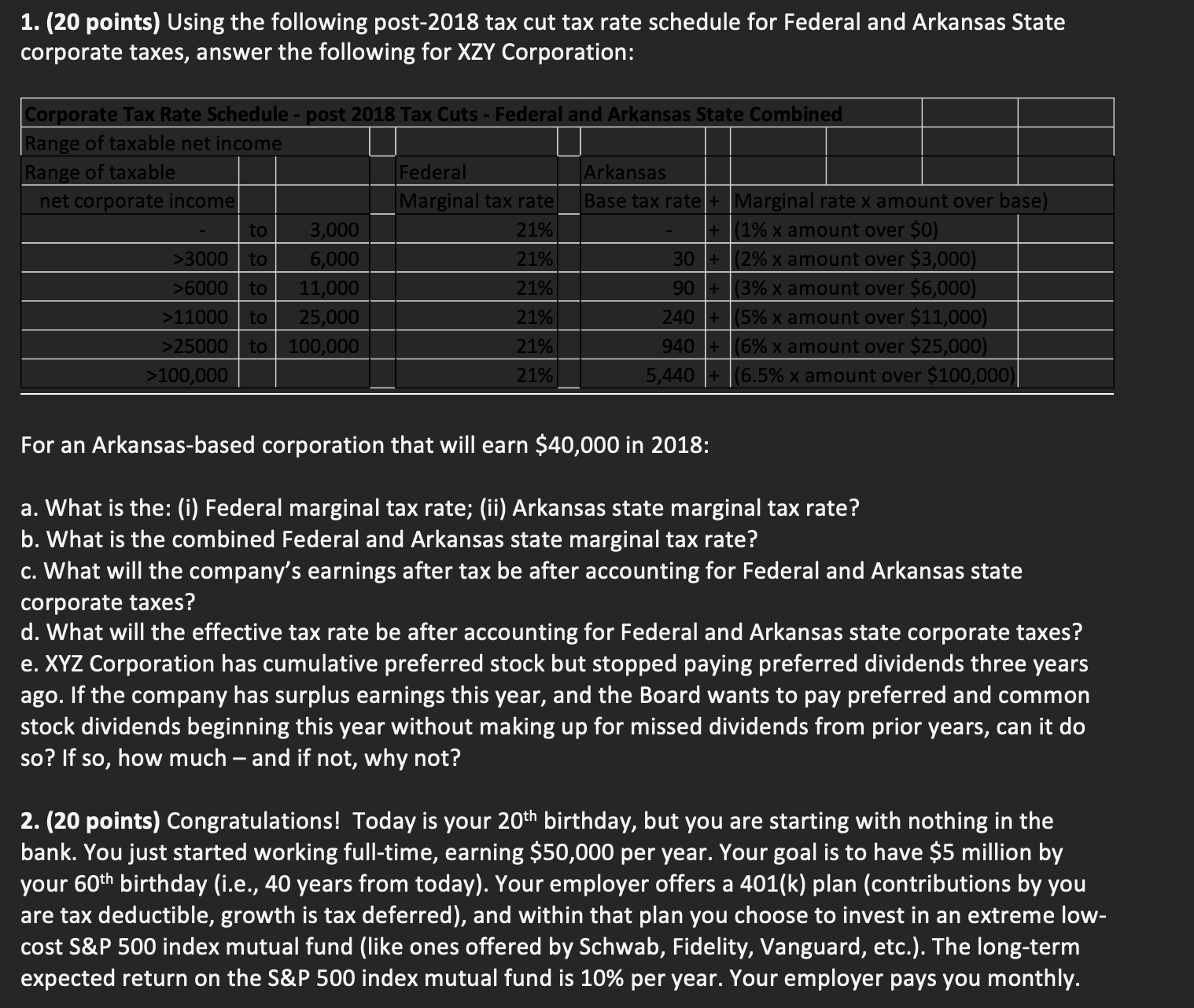

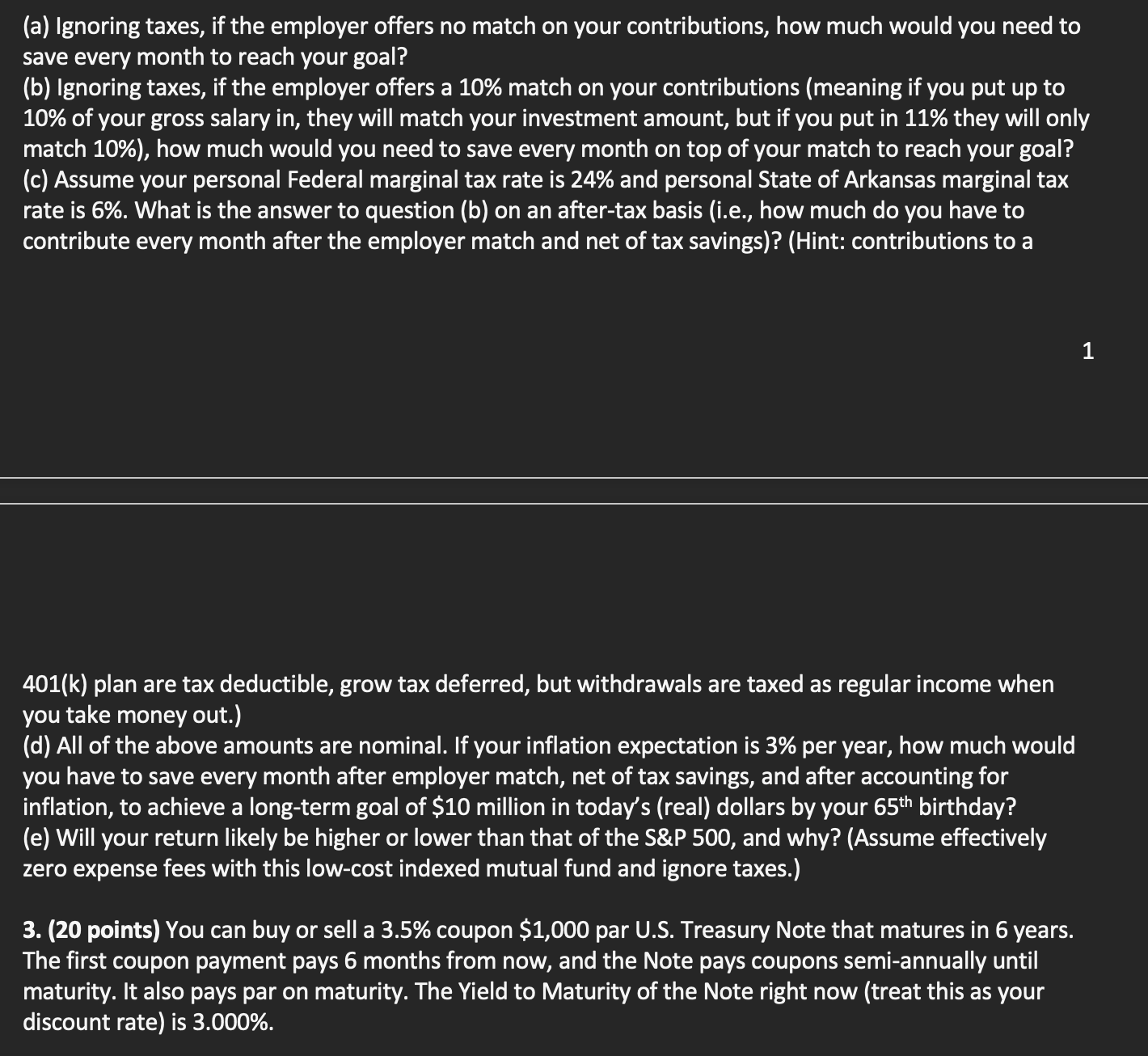

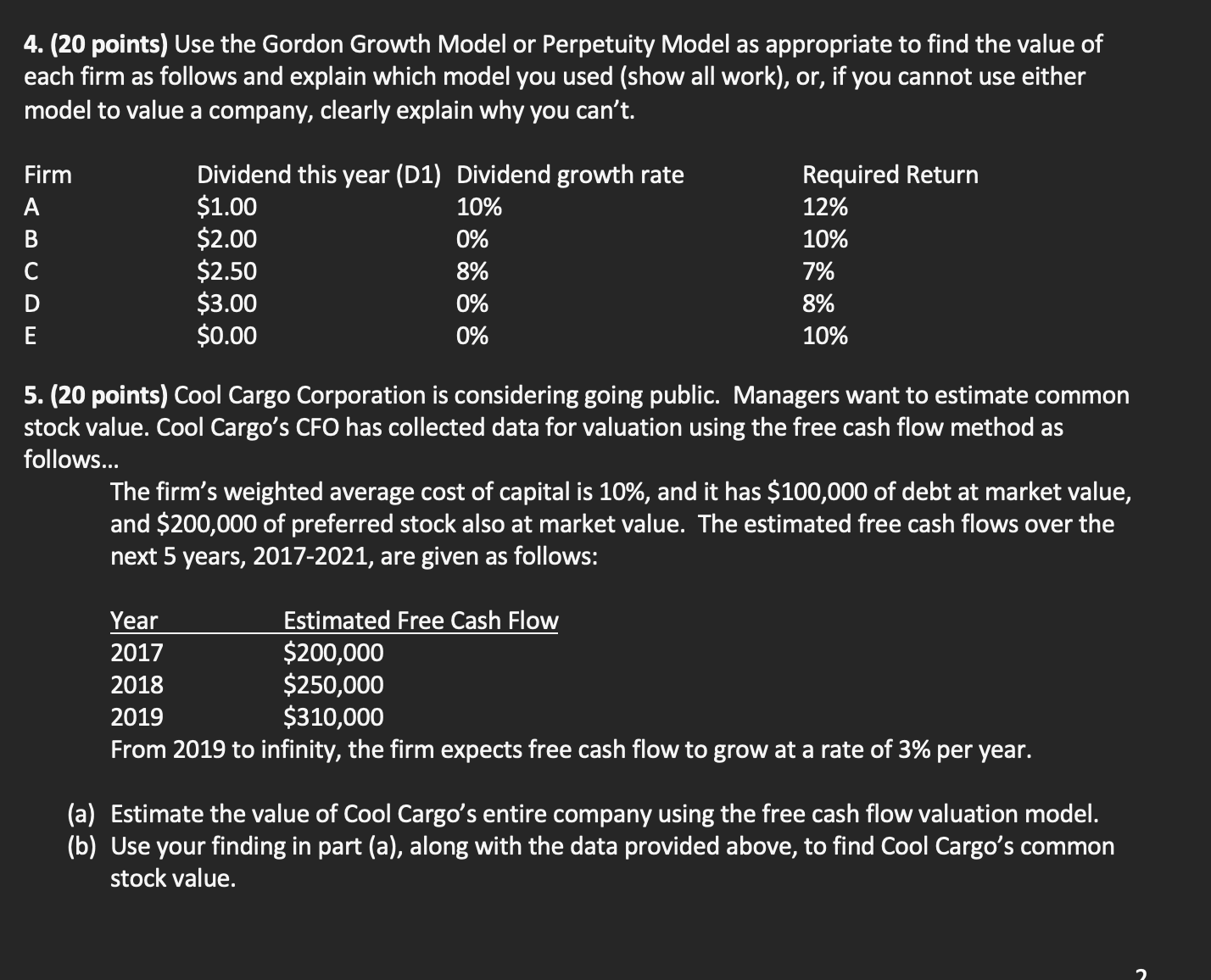

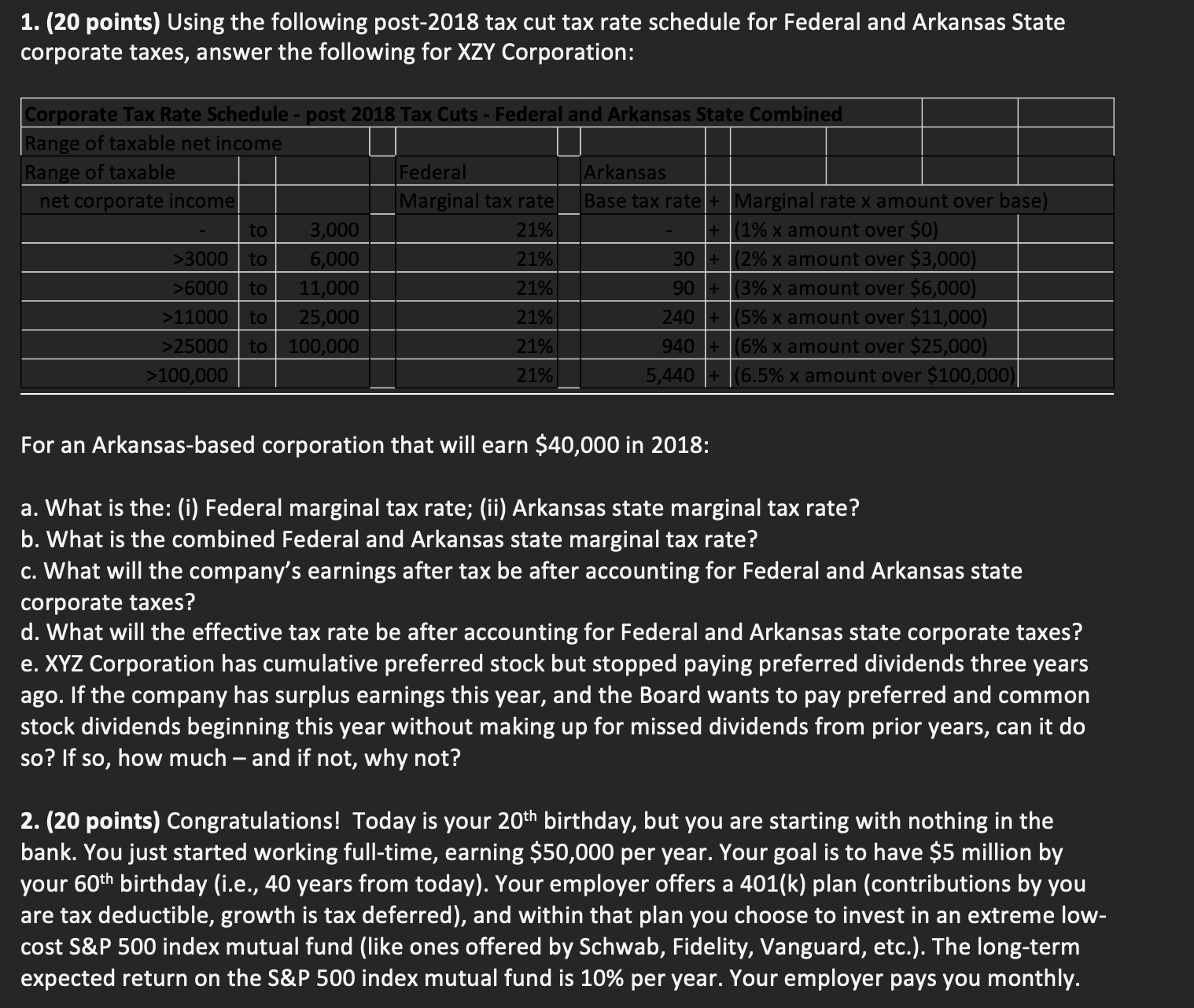

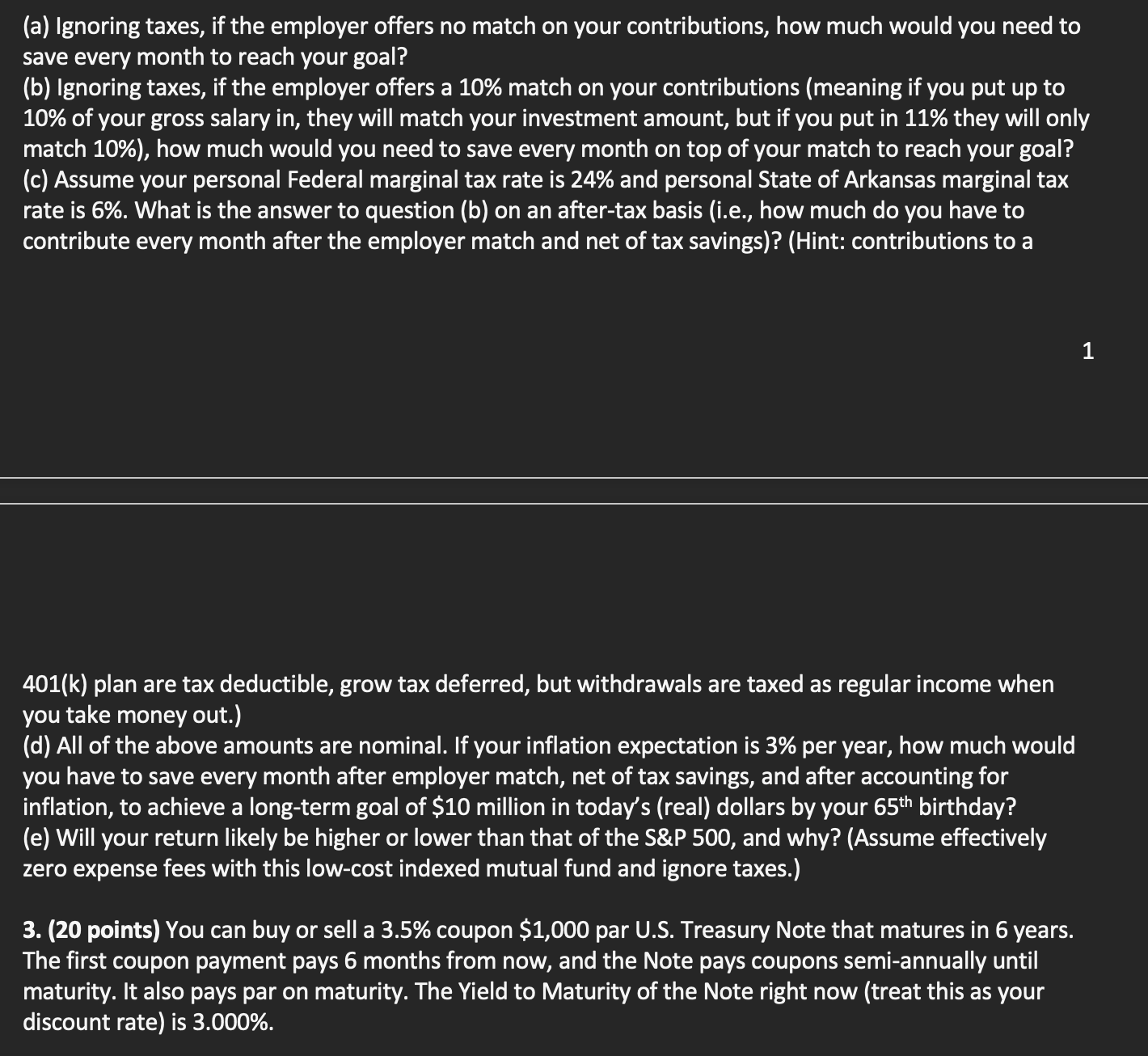

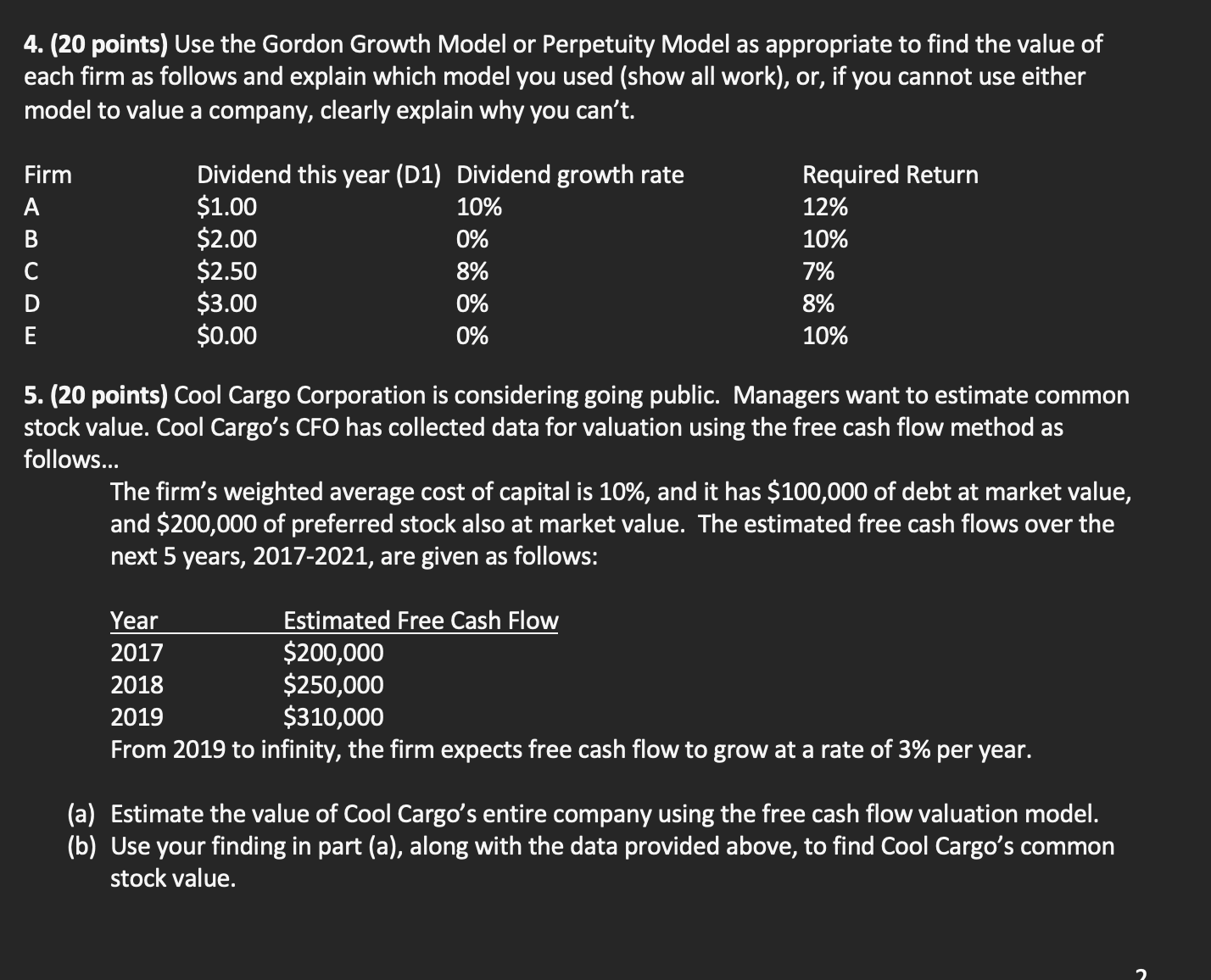

1. (20 points) Using the following post-2018 tax cut tax rate schedule for Federal and Arkansas State corporate taxes, answer the following for XZY Corporation: Corporate Tax Rate Schedule - post 2018 Tax Cuts - Federal and Arkansas State Combined Range of taxable net income Range of taxable Federal Arkansas net corporate income Marginal tax rate Base tax rate + Marginal rate x amount over base) to 3,000 21% + (1% x amount over $0) >3000 to 6,000 21% 30 + (2% x amount over $3,000) >6000 to 11,000 21% 90 + (3% x amount over $6,000) >11000 to 25,000 21% 240 + (5% x amount over $11,000) >25000 to 100,000 21% 940 + (6% x amount over $25,000) >100,000 21% 5,440 + (6.5% x amount over $100,000) For an Arkansas-based corporation that will earn $40,000 in 2018: a. What is the: (i) Federal marginal tax rate; (ii) Arkansas state marginal tax rate? b. What is the combined Federal and Arkansas state marginal tax rate? c. What will the company's earnings after tax be after accounting for Federal and Arkansas state corporate taxes? d. What will the effective tax rate be after accounting for Federal and Arkansas state corporate taxes? e. XYZ Corporation has cumulative preferred stock but stopped paying preferred dividends three years ago. If the company has surplus earnings this year, and the Board wants to pay preferred and common stock dividends beginning this year without making up for missed dividends from prior years, can it do so? If so, how much - and if not, why not? 2. (20 points) Congratulations! Today is your 20th birthday, but you are starting with nothing in the bank. You just started working full-time, earning $50,000 per year. Your goal is to have $5 million by your 60th birthday (i.e., 40 years from today). Your employer offers a 401(k) plan (contributions by you are tax deductible, growth is tax deferred), and within that plan you choose to invest in an extreme low- cost S&P 500 index mutual fund (like ones offered by Schwab, Fidelity, Vanguard, etc.). The long-term expected return on the S&P 500 index mutual fund is 10% per year. Your employer pays you monthly. (a) Ignoring taxes, if the employer offers no match on your contributions, how much would you need to save every month to reach your goal? (b) Ignoring taxes, if the employer offers a 10% match on your contributions (meaning if you put up to 10% of your gross salary in, they will match your investment amount, but if you put in 11% they will only match 10%), how much would you need to save every month on top of your match to reach your goal? (c) Assume your personal Federal marginal tax rate is 24% and personal State of Arkansas marginal tax rate is 6%. What is the answer to question (b) on an after-tax basis (i.e., how much do you have to contribute every month after the employer match and net of tax savings)? (Hint: contributions to a 1 401(k) plan are tax deductible, grow tax deferred, but withdrawals are taxed as regular income when you take money out.) (d) All of the above amounts are nominal. If your inflation expectation is 3% per year, how much would you have to save every month after employer match, net of tax savings, and after accounting for inflation, to achieve a long-term goal of $10 million in today's (real) dollars by your 65th birthday? (e) Will your return likely be higher or lower than that of the S&P 500, and why? (Assume effectively zero expense fees with this low-cost indexed mutual fund and ignore taxes.) 3. (20 points) You can buy or sell a 3.5% coupon $1,000 par U.S. Treasury Note that matures in 6 years. The first coupon payment pays 6 months from now, and the Note pays coupons semi-annually until maturity. It also pays par on maturity. The Yield to Maturity of the Note right now (treat this as your discount rate) is 3.000%. 4. (20 points) Use the Gordon Growth Model or Perpetuity Model as appropriate to find the value of each firm as follows and explain which model you used (show all work), or, if you cannot use either model to value a company, clearly explain why you can't. Firm A B Dividend this year (D1) Dividend growth rate $1.00 10% $2.00 0% $2.50 8% $3.00 0% $0.00 0% Required Return 12% 10% 7% 8% 10% C D E 5. (20 points) Cool Cargo Corporation is considering going public. Managers want to estimate common stock value. Cool Cargo's CFO has collected data for valuation using the free cash flow method as follows... The firm's weighted average cost of capital is 10%, and it has $100,000 of debt at market value, and $200,000 of preferred stock also at market value. The estimated free cash flows over the next 5 years, 2017-2021, are given as follows: Year Estimated Free Cash Flow 2017 $200,000 2018 $250,000 2019 $310,000 From 2019 to infinity, the firm expects free cash flow to grow at a rate of 3% per year. (a) Estimate the value of Cool Cargo's entire company using the free cash flow valuation model. (b) Use your finding in part (a), along with the data provided above, to find Cool Cargo's common stock value. 1. (20 points) Using the following post-2018 tax cut tax rate schedule for Federal and Arkansas State corporate taxes, answer the following for XZY Corporation: Corporate Tax Rate Schedule - post 2018 Tax Cuts - Federal and Arkansas State Combined Range of taxable net income Range of taxable Federal Arkansas net corporate income Marginal tax rate Base tax rate + Marginal rate x amount over base) to 3,000 21% + (1% x amount over $0) >3000 to 6,000 21% 30 + (2% x amount over $3,000) >6000 to 11,000 21% 90 + (3% x amount over $6,000) >11000 to 25,000 21% 240 + (5% x amount over $11,000) >25000 to 100,000 21% 940 + (6% x amount over $25,000) >100,000 21% 5,440 + (6.5% x amount over $100,000) For an Arkansas-based corporation that will earn $40,000 in 2018: a. What is the: (i) Federal marginal tax rate; (ii) Arkansas state marginal tax rate? b. What is the combined Federal and Arkansas state marginal tax rate? c. What will the company's earnings after tax be after accounting for Federal and Arkansas state corporate taxes? d. What will the effective tax rate be after accounting for Federal and Arkansas state corporate taxes? e. XYZ Corporation has cumulative preferred stock but stopped paying preferred dividends three years ago. If the company has surplus earnings this year, and the Board wants to pay preferred and common stock dividends beginning this year without making up for missed dividends from prior years, can it do so? If so, how much - and if not, why not? 2. (20 points) Congratulations! Today is your 20th birthday, but you are starting with nothing in the bank. You just started working full-time, earning $50,000 per year. Your goal is to have $5 million by your 60th birthday (i.e., 40 years from today). Your employer offers a 401(k) plan (contributions by you are tax deductible, growth is tax deferred), and within that plan you choose to invest in an extreme low- cost S&P 500 index mutual fund (like ones offered by Schwab, Fidelity, Vanguard, etc.). The long-term expected return on the S&P 500 index mutual fund is 10% per year. Your employer pays you monthly. (a) Ignoring taxes, if the employer offers no match on your contributions, how much would you need to save every month to reach your goal? (b) Ignoring taxes, if the employer offers a 10% match on your contributions (meaning if you put up to 10% of your gross salary in, they will match your investment amount, but if you put in 11% they will only match 10%), how much would you need to save every month on top of your match to reach your goal? (c) Assume your personal Federal marginal tax rate is 24% and personal State of Arkansas marginal tax rate is 6%. What is the answer to question (b) on an after-tax basis (i.e., how much do you have to contribute every month after the employer match and net of tax savings)? (Hint: contributions to a 1 401(k) plan are tax deductible, grow tax deferred, but withdrawals are taxed as regular income when you take money out.) (d) All of the above amounts are nominal. If your inflation expectation is 3% per year, how much would you have to save every month after employer match, net of tax savings, and after accounting for inflation, to achieve a long-term goal of $10 million in today's (real) dollars by your 65th birthday? (e) Will your return likely be higher or lower than that of the S&P 500, and why? (Assume effectively zero expense fees with this low-cost indexed mutual fund and ignore taxes.) 3. (20 points) You can buy or sell a 3.5% coupon $1,000 par U.S. Treasury Note that matures in 6 years. The first coupon payment pays 6 months from now, and the Note pays coupons semi-annually until maturity. It also pays par on maturity. The Yield to Maturity of the Note right now (treat this as your discount rate) is 3.000%. 4. (20 points) Use the Gordon Growth Model or Perpetuity Model as appropriate to find the value of each firm as follows and explain which model you used (show all work), or, if you cannot use either model to value a company, clearly explain why you can't. Firm A B Dividend this year (D1) Dividend growth rate $1.00 10% $2.00 0% $2.50 8% $3.00 0% $0.00 0% Required Return 12% 10% 7% 8% 10% C D E 5. (20 points) Cool Cargo Corporation is considering going public. Managers want to estimate common stock value. Cool Cargo's CFO has collected data for valuation using the free cash flow method as follows... The firm's weighted average cost of capital is 10%, and it has $100,000 of debt at market value, and $200,000 of preferred stock also at market value. The estimated free cash flows over the next 5 years, 2017-2021, are given as follows: Year Estimated Free Cash Flow 2017 $200,000 2018 $250,000 2019 $310,000 From 2019 to infinity, the firm expects free cash flow to grow at a rate of 3% per year. (a) Estimate the value of Cool Cargo's entire company using the free cash flow valuation model. (b) Use your finding in part (a), along with the data provided above, to find Cool Cargo's common stock value