Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are planning to buy a house by borrowing $10,000,000 from a bank. The mortgage implies monthly payments over 30 years, with the first

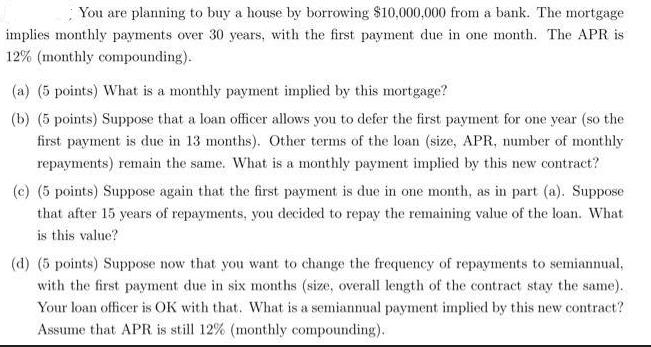

You are planning to buy a house by borrowing $10,000,000 from a bank. The mortgage implies monthly payments over 30 years, with the first payment due in one month. The APR is 12% (monthly compounding). (a) (5 points) What is a monthly payment implied by this mortgage? (b) (5 points) Suppose that a loan officer allows you to defer the first payment for one year (so the first payment is due in 13 months). Other terms of the loan (size, APR, number of monthly repayments) remain the same. What is a monthly payment implied by this new contract? (c) (5 points) Suppose again that the first payment is due in one month, as in part (a). Suppose that after 15 years of repayments, you decided to repay the remaining value of the loan. What is this value? (d) (5 points) Suppose now that you want to change the frequency of repayments to semiannual, with the first payment due in six months (size, overall length of the contract stay the same). Your loan officer is OK with that. What is a semiannual payment implied by this new contract? Assume that APR is still 12% (monthly compounding).

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the monthly payment for a mortgage of 10000000 with an APR of 12 and monthly compound...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started