Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. (20 points) Assume that you hold 100 common shares of a corporation XYZ. A new board just announced the policy that it is

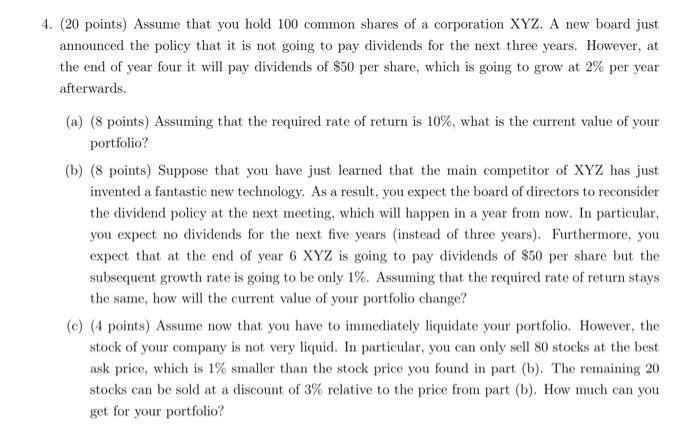

4. (20 points) Assume that you hold 100 common shares of a corporation XYZ. A new board just announced the policy that it is not going to pay dividends for the next three years. However, at the end of year four it will pay dividends of $50 per share, which is going to grow at 2% per year afterwards. (a) (8 points) Assuming that the required rate of return is 10%, what is the current value of your portfolio? (b) (8 points) Suppose that you have just learned that the main competitor of XYZ has just invented a fantastic new technology. As a result, you expect the board of directors to reconsider the dividend policy at the next meeting, which will happen in a year from now. In particular, you expect no dividends for the next five years (instead of three years). Furthermore, you expect that at the end of year 6 XYZ is going to pay dividends of $50 per share but the subsequent growth rate is going to be only 1%. Assuming that the required rate of return stays the same, how will the current value of your portfolio change? (c) (4 points) Assume now that you have to immediately liquidate your portfolio. However, the stock of your company is not very liquid. In particular, you can only sell 80 stocks at the best ask price, which is 1% smaller than the stock price you found in part (b). The remaining 20 stocks can be sold at a discount of 3% relative to the price from part (b). How much can you get for your portfolio?

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the current value of your portfolio we need to find the present value of the future dividends The dividends will start at the end of ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started