Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (20 pt) NuBattery Inc. just developed a new battery for electric cars. Tesla has offered to buy the technology from NuBattery for $120m

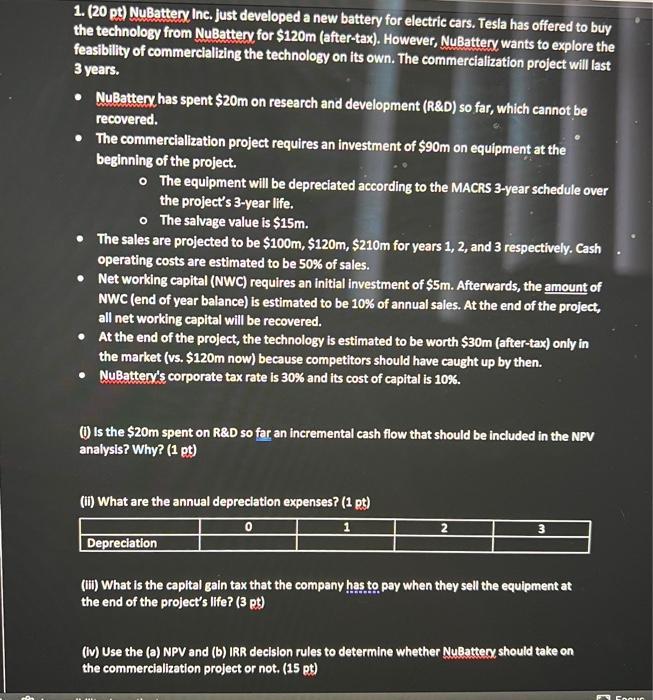

1. (20 pt) NuBattery Inc. just developed a new battery for electric cars. Tesla has offered to buy the technology from NuBattery for $120m (after-tax). However, NuBattery wants to explore the feasibility of commercializing the technology on its own. The commercialization project will last 3 years. NuBattery has spent $20m on research and development (R&D) so far, which cannot be recovered. The commercialization project requires an investment of $90m on equipment at the beginning of the project. o The equipment will be depreciated according to the MACRS 3-year schedule over the project's 3-year life. o The salvage value is $15m. The sales are projected to be $100m, $120m, $210m for years 1, 2, and 3 respectively. Cash operating costs are estimated to be 50% of sales. Net working capital (NWC) requires an initial investment of $5m. Afterwards, the amount of NWC (end of year balance) is estimated to be 10% of annual sales. At the end of the project, all net working capital will be recovered. At the end of the project, the technology is estimated to be worth $30m (after-tax) only in the market (vs. $120m now) because competitors should have caught up by then. NuBattery's corporate tax rate is 30% and its cost of capital is 10%. (1) Is the $20m spent on R&D so far an incremental cash flow that should be included in the NPV analysis? Why? (1 pt) (ii) What are the annual depreciation expenses? (1 pt) 0 1 Depreciation 2 3 (iii) What is the capital gain tax that the company has to pay when they sell the equipment at the end of the project's life? (3 pt) (iv) Use the (a) NPV and (b) IRR decision rules to determine whether NuBattery should take on the commercialization project or not. (15 pt) Fooun

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

i Is the 20m spent on RD so far an incremental cash flow that should be included in the NPV analysis Why The 20m spent on RD so far is not considered ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started