Answered step by step

Verified Expert Solution

Question

1 Approved Answer

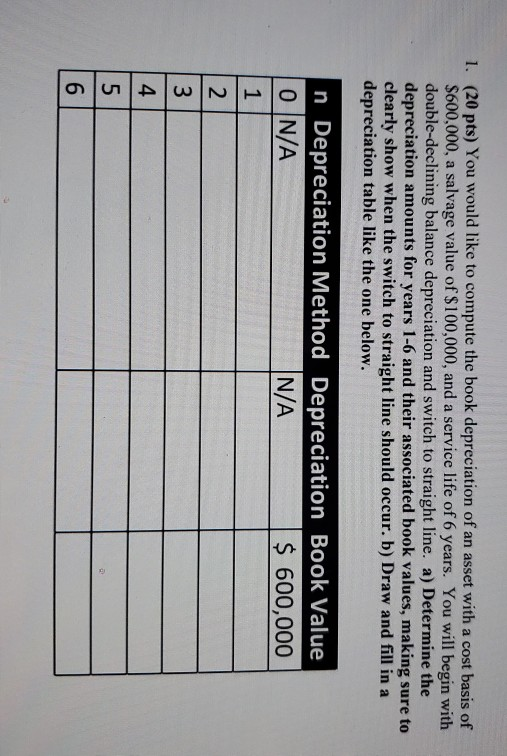

1. (20 pts) You would like to compute the book depreciation of an asset with a cost basis of $600,000, a salvage value of $100,000,

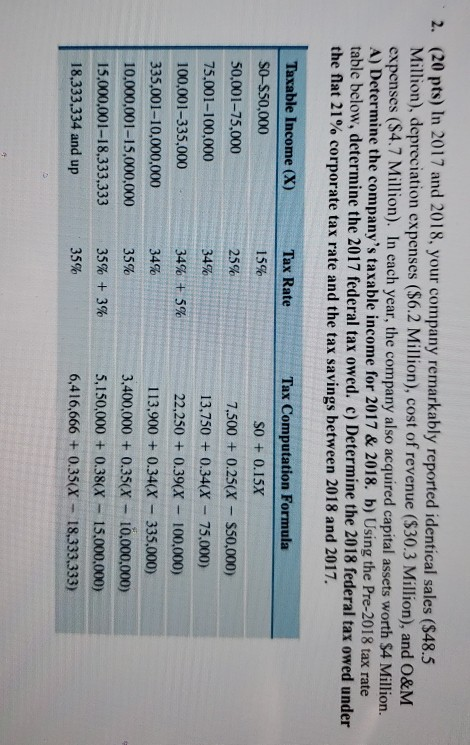

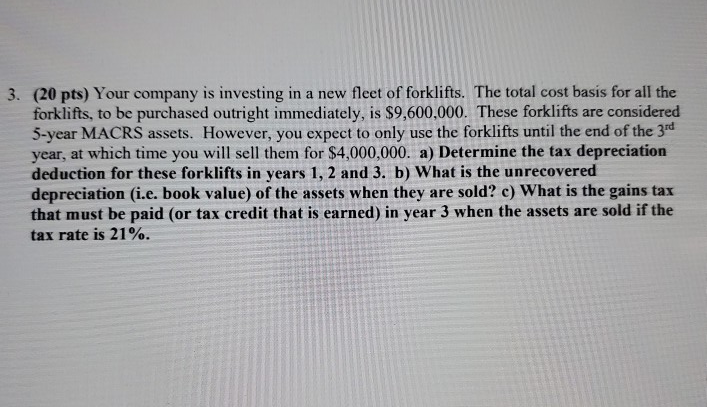

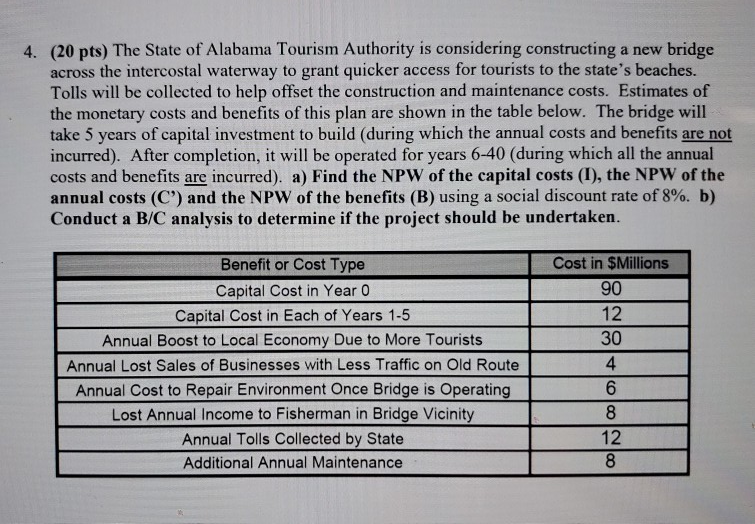

1. (20 pts) You would like to compute the book depreciation of an asset with a cost basis of $600,000, a salvage value of $100,000, and a service life of 6 years. You will begin with double-declining balance depreciation and switch to straight line. a) Determine the depreciation amounts for years 1-6 and their associated book values, making sure to clearly show when the switch to straight line should occur. b) Draw and fill in a depreciation table like the one below. in Depreciation Method Depreciation Book Value, 0 N/A IN/A $ 600,000 1 2 3 Un 2. (20 pts) In 2017 and 2018, your company remarkably reported identical sales ($48.5 Million), depreciation expenses ($6.2 Million), cost of revenue ($30.3 Million), and O&M expenses ($4.7 Million). In each year, the company also acquired capital assets worth $4 Million. A) Determine the company's taxable income for 2017 & 2018. b) Using the Pre-2018 tax rate table below, determine the 2017 federal tax owed. c) Determine the 2018 federal tax owed under the flat 21% corporate tax rate and the tax savings between 2018 and 2017. Tax Rate 15% 25% 34% Taxable Income (X) SO-S50,000 50,001-75,000 75.001-100,000 100,001-335,000 335.001-10,000,000 10,000,001-15,000,000 15,000,001-18,333,333 18,333,334 and up 34% + 5% Tax Computation Formula SO + 0.15% 7,500 + 0.25(X - $50,000) 13.750 + 0.34(X - 75,000) 22,250 + 0.39(X - 100,000) 113,900 + 0.34(X - 335,000) 3,400,000 + 0.35(X - 10,000,000) 5,150,000 + 0.38(X - 15,000,000) 6,416,666 + 0.35(X - 18,333.333) 34% 35% 35% + 3% 35% 3. (20 pts) Your company is investing in a new fleet of forklifts. The total cost basis for all the forklifts, to be purchased outright immediately, is $9,600,000. These forklifts are considered 5-year MACRS assets. However, you expect to only use the forklifts until the end of the 3rd year, at which time you will sell them for $4,000,000. a) Determine the tax depreciation deduction for these forklifts in years 1, 2 and 3. b) What is the unrecovered depreciation (i.e. book value) of the assets when they are sold? c) What is the gains tax that must be paid (or tax credit that is earned) in year 3 when the assets are sold if the tax rate is 21%. 4. (20 pts) The State of Alabama Tourism Authority is considering constructing a new bridge across the intercostal waterway to grant quicker access for tourists to the state's beaches. Tolls will be collected to help offset the construction and maintenance costs. Estimates of the monetary costs and benefits of this plan are shown in the table below. The bridge will take 5 years of capital investment to build (during which the annual costs and benefits are not incurred). After completion, it will be operated for years 6-40 (during which all the annual costs and benefits are incurred). a) Find the NPW of the capital costs (1), the NPW of the annual costs (C') and the NPW of the benefits (B) using a social discount rate of 8%. b) Conduct a B/C analysis to determine if the project should be undertaken. Cost in $Millions 9 0 12 30 Benefit or Cost Type Capital Cost in Year 0 Capital Cost in Each of Years 1-5 Annual Boost to Local Economy Due to More Tourists Annual Lost Sales of Businesses with Less Traffic on Old Route Annual Cost to Repair Environment Once Bridge is Operating Lost Annual Income to Fisherman in Bridge Vicinity Annual Tolls Collected by State Additional Annual Maintenance 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started