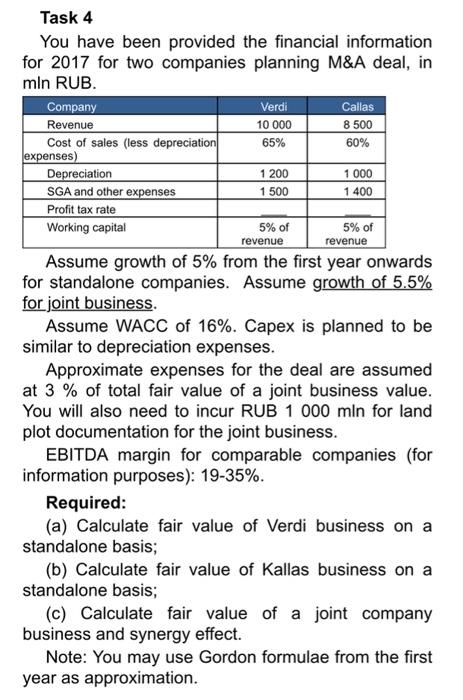

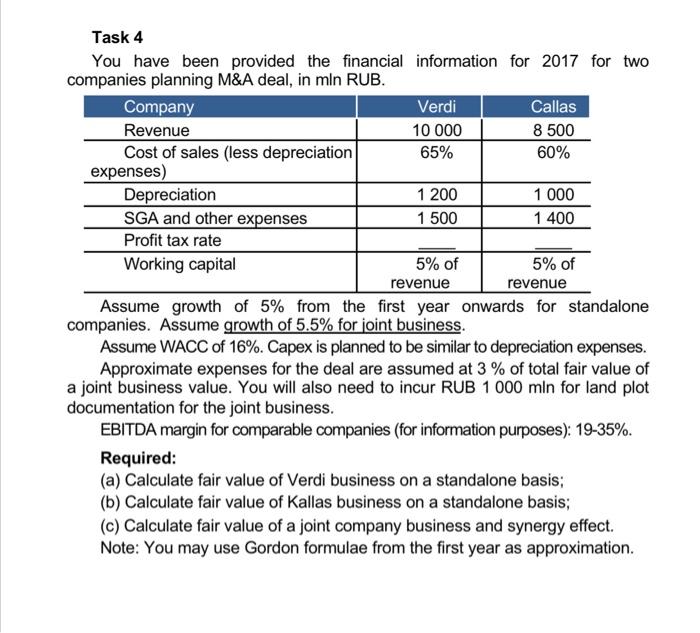

1 200 revenue revenue Task 4 You have been provided the financial information for 2017 for two companies planning M&A deal, in mln RUB Company Verdi Callas Revenue 10 000 8 500 Cost of sales (less depreciation 65% 60% expenses) Depreciation 1 000 SGA and other expenses 1 500 1 400 Profit tax rate Working capital 5% of 5% of Assume growth of 5% from the first year onwards for standalone companies. Assume growth of 5.5% for joint business. Assume WACC of 16%. Capex is planned to be similar to depreciation expenses. Approximate expenses for the deal are assumed at 3 % of total fair value of a joint business value. You will also need to incur RUB 1 000 min for land plot documentation for the joint business. EBITDA margin for comparable companies (for information purposes): 19-35%. Required: (a) Calculate fair value of Verdi business on a standalone basis; (b) Calculate fair value of Kallas business on a standalone basis; (c) Calculate fair value of a joint company business and synergy effect. Note: You may use Gordon formulae from the first year as approximation. Task 4 You have been provided the financial information for 2017 for two companies planning M&A deal, in mln RUB. Company Verdi Callas Revenue 10 000 8 500 Cost of sales (less depreciation 65% 60% expenses) Depreciation 1 200 1 000 SGA and other expenses 1 500 1 400 Profit tax rate Working capital 5% of 5% of revenue revenue Assume growth of 5% from the first year onwards for standalone companies. Assume growth of 5.5% for joint business. Assume WACC of 16%. Capex is planned to be similar to depreciation expenses. Approximate expenses for the deal are assumed at 3 % of total fair value of a joint business value. You will also need to incur RUB 1 000 min for land plot documentation for the joint business. EBITDA margin for comparable companies (for information purposes): 19-35%. Required: (a) Calculate fair value of Verdi business on a standalone basis; (b) Calculate fair value of Kallas business on a standalone basis; (c) Calculate fair value of a joint company business and synergy effect. Note: You may use Gordon formulae from the first year as approximation