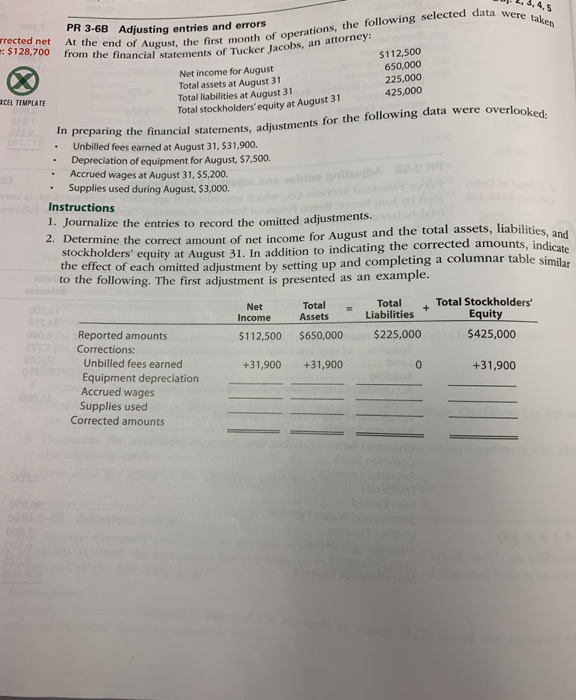

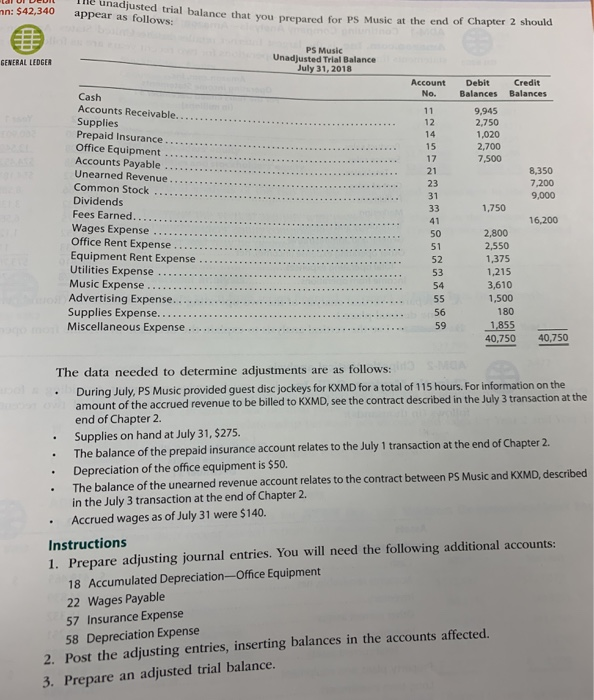

1. 2,3,4,5 ta were taken Of August, the first month of operations, the following selected data we nts of Tucker Jacobs, an attorney: PR 3-6B Adjusting entries and errors rrected net At the end of August, the fi : $128,700 from the financial statements of Tucker Jaco $112.500 Net income for August 650,000 Total assets at August 31 225,000 CEL TEMPLATE Total liabilities at August 31 425,000 Total stockholders'equity at August 31 ments for the following data were overlooked. In preparing the financial statements, adjustments Unbilled fees earned at August 31, $31,900. . Depreciation of equipment for August, $7,500. Accrued wages at August 31, $5,200. Supplies used during August, $3,000. Instructions 1. Journalize the entries to record the omitted adjustments. 2. Determine the correct amount of net income for August and ust and the total assets, liabilities, and stockholders' equity at August 31. In addition to indicating the corrected amounts, indicat the effect of each omitted adjustment by setting up and completing a columnar table simila to the following. The first adjustment is presented as an example. - + Net Income $112,500 Total Assets $650,000 Total Liabilities $225,000 Total Stockholders' Equity $425,000 +31,900 +31,900 0 +31,900 Reported amounts Corrections: Unbilled fees earned Equipment depreciation Accrued wages Supplies used Corrected amounts OS The unadjusted trial balance that you prepared for appear as follows: trial balance that you prepared for PS Music at the end of Chapter 2 should mn: $42,340 GENERAL LEDGER PS Music Unadjusted Trial Balance July 31, 2018 Account No. Debit Balances Credit Balances Cash Accounts Receivable.......... Supplies Prepaid Insurance... Office Equipment .... Accounts Payable Unearned Revenue... Common Stock Dividends Fees Earned........... Wages Expense Office Rent Expense. Equipment Rent Expense .. Utilities Expense ............. Music Expense Advertising Expense............ Supplies Expense............... Miscellaneous Expense ............ 9.945 12 2.750 14 1,020 2,700 7,500 8,350 7,200 9,000 1,750 16,200 2,800 2,550 1,375 1,215 3,610 1,500 180 59 1,855 40,750 40,750 The data needed to determine adjustments are as follows: . During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3 transaction at the end of Chapter 2. Supplies on hand at July 31, $275. The balance of the prepaid insurance account relates to the July 1 transaction at the end of Chapter 2. Depreciation of the office equipment is $50. . The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3 transaction at the end of Chapter 2. Accrued wages as of July 31 were $140. Instructions 1. Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated Depreciation--Office Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense 2 Post the adjusting entries, inserting balances in the accounts affected. 3. Prepare an adjusted trial balance