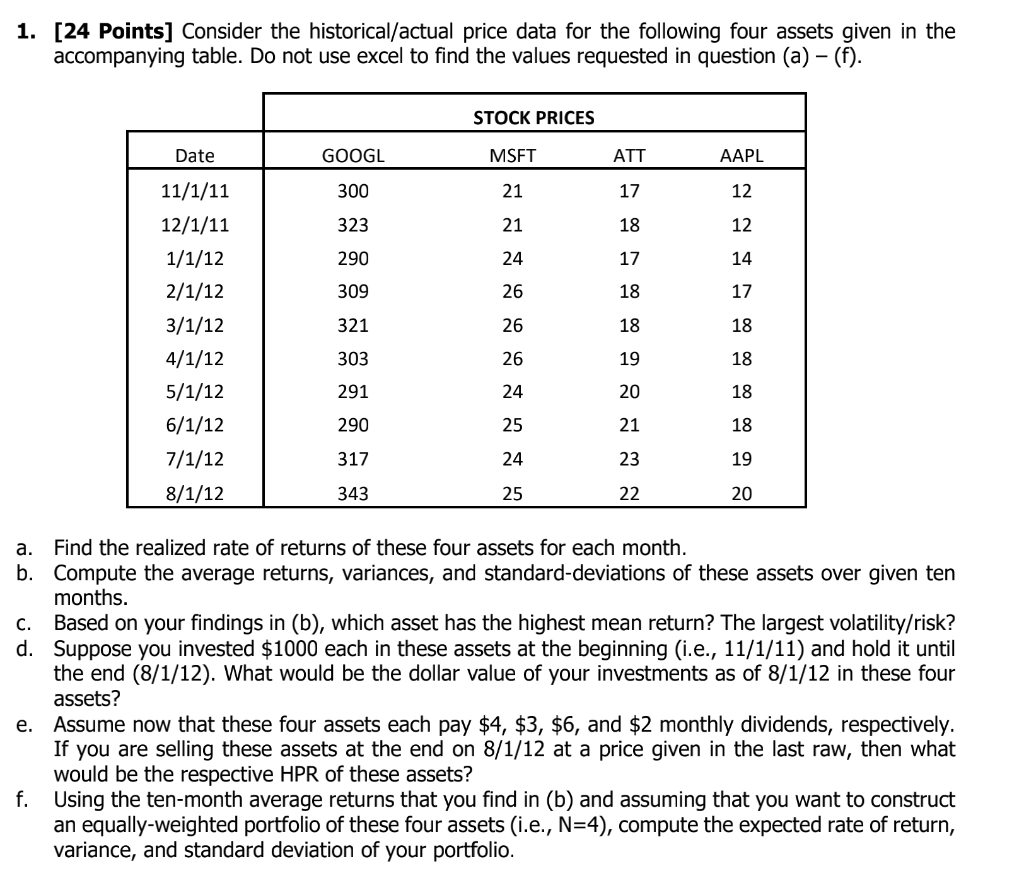

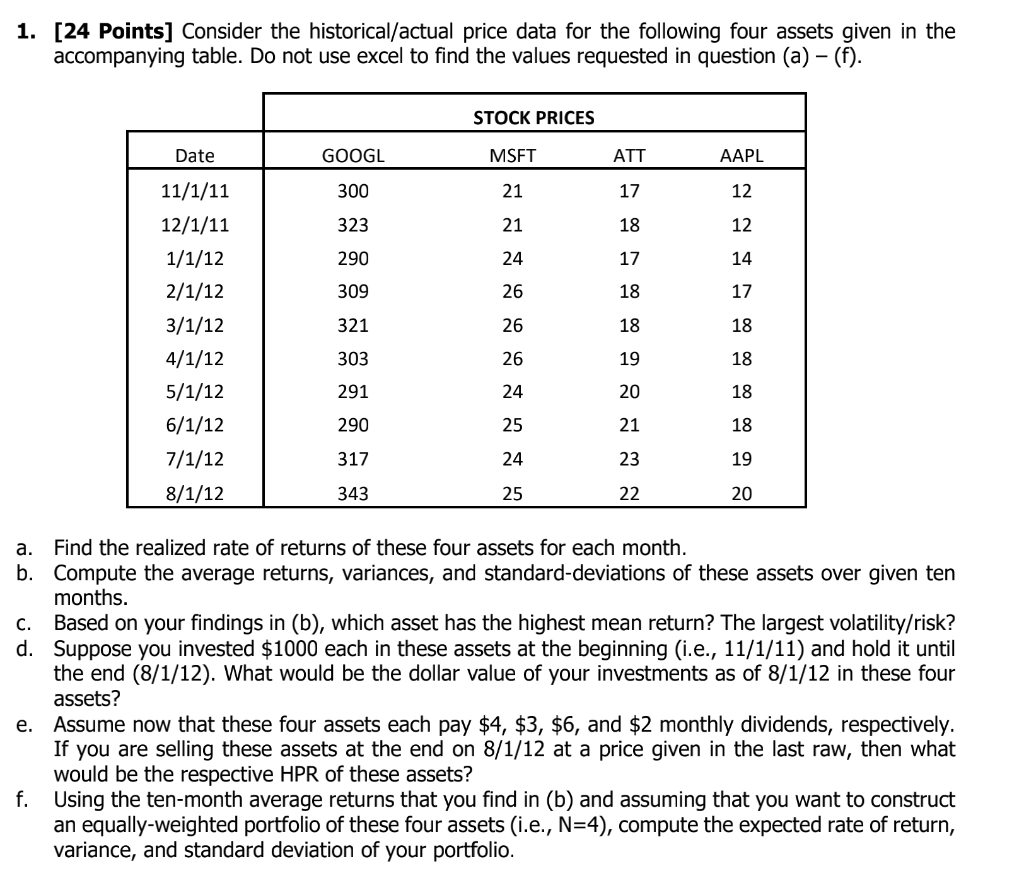

1. [24 Points] Consider the historical/actual price data for the following four assets given in the accompanying table. Do not use excel to find the values requested in question (a) (f). STOCK PRICES Date GOOGL MSFT ATT AAPL 300 21 17 12 323 21 18 12 290 24 17 14 309 26 18 17 321 26 18 18 11/1/11 12/1/11 1/1/12 2/1/12 3/1/12 4/1/12 5/1/12 6/1/12 7/1/12 8/1/12 303 26 19 18 291 24 20 18 290 25 21 18 317 24 23 19 343 25 22 20 a. Find the realized rate of returns of these four assets for each month. b. Compute the average returns, variances, and standard-deviations of these assets over given ten months. C. Based on your findings in (b), which asset has the highest mean return? The largest volatility/risk? d. Suppose you invested $1000 each in these assets at the beginning (i.e., 11/1/11) and hold it until the end (8/1/12). What would be the dollar value of your investments as of 8/1/12 in these four assets? e. Assume now that these four assets each pay $4, $3, $6, and $2 monthly dividends, respectively. If you are selling these assets at the end on 8/1/12 at a price given in the last raw, then what would be the respective HPR of these assets? f. Using the ten-month average returns that you find in (b) and assuming that you want to construct an equally-weighted portfolio of these four assets (i.e., N=4), compute the expected rate of return, variance, and standard deviation of your portfolio. 1. [24 Points] Consider the historical/actual price data for the following four assets given in the accompanying table. Do not use excel to find the values requested in question (a) (f). STOCK PRICES Date GOOGL MSFT ATT AAPL 300 21 17 12 323 21 18 12 290 24 17 14 309 26 18 17 321 26 18 18 11/1/11 12/1/11 1/1/12 2/1/12 3/1/12 4/1/12 5/1/12 6/1/12 7/1/12 8/1/12 303 26 19 18 291 24 20 18 290 25 21 18 317 24 23 19 343 25 22 20 a. Find the realized rate of returns of these four assets for each month. b. Compute the average returns, variances, and standard-deviations of these assets over given ten months. C. Based on your findings in (b), which asset has the highest mean return? The largest volatility/risk? d. Suppose you invested $1000 each in these assets at the beginning (i.e., 11/1/11) and hold it until the end (8/1/12). What would be the dollar value of your investments as of 8/1/12 in these four assets? e. Assume now that these four assets each pay $4, $3, $6, and $2 monthly dividends, respectively. If you are selling these assets at the end on 8/1/12 at a price given in the last raw, then what would be the respective HPR of these assets? f. Using the ten-month average returns that you find in (b) and assuming that you want to construct an equally-weighted portfolio of these four assets (i.e., N=4), compute the expected rate of return, variance, and standard deviation of your portfolio