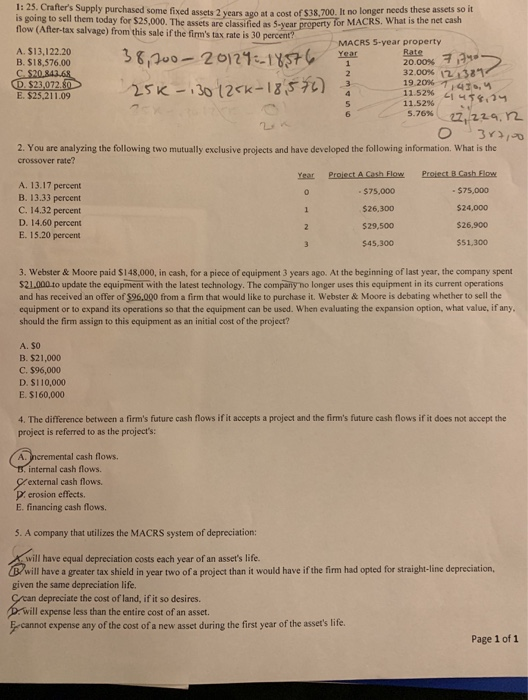

1: 25. Crafters Supply purchased some fixed assets 2 ears It no longer needs these assets so it at a cost of $38,700. is going to sell them today for $25,000. The assets are classified as 5-year property for MAC flow (After-tax salvage) from this sale if the firm's tax rate is 30 percent? ar property for MACRS. What is e MACRS S-year property A. $13,122.20 B. $18,576.00 2000% 11 32.00% 12:327 11.52% 11 u5g, , E. $25,211.09 11.52% 2.224, r2 5.76% 2. You are analyzing the following two mutually exclusive projects and have developed the following information. What is the crossover rate? Year Proiect A Gash Flow Proiect B.Cash Flow A. 13.17 percent B. 13.33 percent C. 14.32 percent D. 14.60 percent E. 15.20 percent $75,000 $26,300 $29,500 $45,300 - $75,000 524,000 $26,900 $51,300 3. Webster & Moore paid $148,000, in cash, for a piece of equipment 3 years ago. At the beginning of last year, the company spent $21.000 to update the equipment with the latest technology. The company no longer uses this equipment in its current operations and has received an offer of $96,000 from a firm that would like to purchase it. Webster &Moore is debating whether to sell the equipment or to expand its operations so that the equipment can be used. When evaluating the expansion option, what value, if any should the firm assign to this equipment as an initial cost of the project? A. $O B. $21,000 C. $96,000 D. $110,000 E. $160,000 4. The difference between a firm's future cash flows if it accepts a project and the firm's future cash flows if it does not accept the projec s referrd to as the projects: A. Incremental cash flows. internal cash flows. external cash flows erosion effects E. financing cash flows. 5. A company that utilizes the MACRS system of depreciation: will have equal depreciation costs each year of an asset's life. will have a greater tax shield in year two of a project than it would have if the firm had opted for straight-line depreciation, given the same depreciation life. rcan depreciate the cost of land, if it so desires. ill expense less than the entire cost of an asset. -cannot expense any of the cost of a new asset during the first year of the asset's life. Page 1 of 1