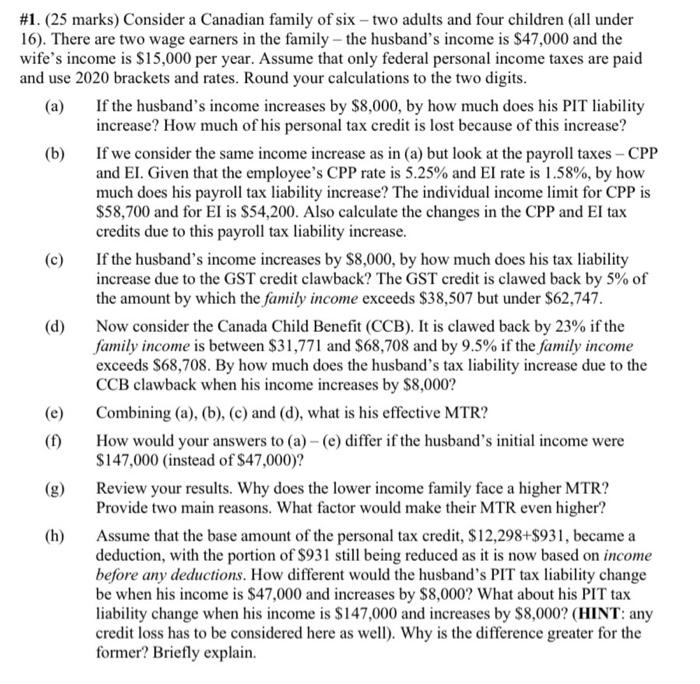

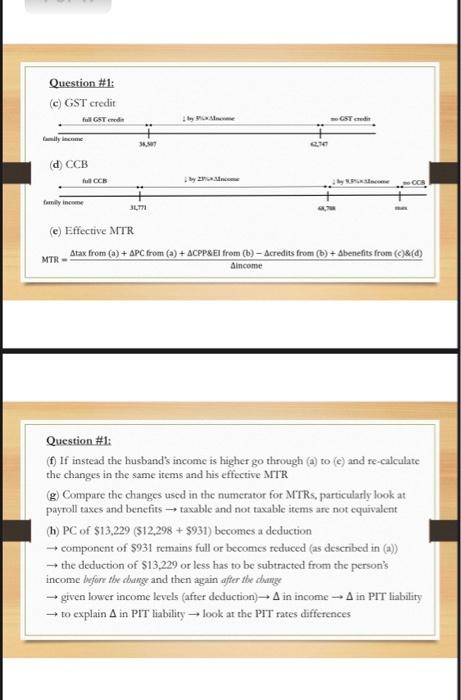

#1. (25 marks) Consider a Canadian family of six - two adults and four children (all under 16). There are two wage earners in the family - the husband's income is $47,000 and the wife's income is $15,000 per year. Assume that only federal personal income taxes are paid and use 2020 brackets and rates. Round your calculations to the two digits. (a) If the husband's income increases by $8,000, by how much does his PIT liability increase? How much of his personal tax credit is lost because of this increase? (b) If we consider the same income increase as in (a) but look at the payroll taxes - CPP and El. Given that the employee's CPP rate is 5.25% and El rate is 1.58%, by how much does his payroll tax liability increase? The individual income limit for CPP is $58,700 and for El is $54,200. Also calculate the changes in the CPP and El tax credits due to this payroll tax liability increase. (c) If the husband's income increases by $8,000, by how much does his tax liability increase due to the GST credit clawback? The GST credit is clawed back by 5% of the amount by which the family income exceeds $38,507 but under $62,747. (d) Now consider the Canada Child Benefit (CCB). It is clawed back by 23% if the family income is between $31,771 and $68,708 and by 9.5% if the family income exceeds $68,708. By how much does the husband's tax liability increase due to the CCB clawback when his income increases by $8,000? Combining (a), (b), (c) and (d), what is his effective MTR? How would your answers to (a)-(e) differ if the husband's initial income were $147,000 (instead of $47,000)? Review your results. Why does the lower income family face a higher MTR? Provide two main reasons. What factor would make their MTR even higher? (h) Assume that the base amount of the personal tax credit, $12,298+$931, became a deduction, with the portion of $931 still being reduced as it is now based on income before any deductions. How different would the husband's PIT tax liability change be when his income is $47,000 and increases by $8,000? What about his PIT tax liability change when his income is $147,000 and increases by $8,000? (HINT: any credit loss has to be considered here as well). Why is the difference greater for the former? Briefly explain. Question #1: Practically, all the calculations here are for changes for marginal calculations). No need to calculate full taxes. (a) If Aincome occurs in the same bracket: APIT=AIncome x bracket rate If not, Alncome = Alncome, + Aincome; APIT=Aincome, bracket rate, + Alncome, X bracket rate, The changes in the personal tax credit (PC): + base amount is split into $12,298 and $931 $931 is reduced if the individual's income is between $150,473 and $214,368 X-$150,473 at the rate of - the reduction in the base amount translates into the change in the tax credit $214,368-$150473 Question #1: b) Payroll taxes CPP Inciduain 10 py 44,200 Atax credite=0,15 Apayroll taxes Question #1: (e) GST credit GST rede - d) CCB 22 family ince " (e) Effective MTR MTR Atax from (a) + APC from (a) + ACPP& El from (b) - Acredits from (b) + benefits from (C)&(d) Sincome Question #1: (f) If instead the husband's income is higher go through (a) to e) and re-calculate the changes in the same items and his effective MTR (g) Compare the changes used in the numerator for MTRS, particularly look at payroll taxes and benefits taxable and not taxable items are not equivalent (h) PC of $13,229 ($12,298 +5931) becomes a deduction component of $931 remains full or becomes reduced (as described in (a)) the deduction of $13,229 or less has to be subtracted from the person's income before the change and then again after the change given lower income levels (after deduction - A in income - A in PIT liability to explain A in PIT liability -- look at the PIT rates differences #1. (25 marks) Consider a Canadian family of six - two adults and four children (all under 16). There are two wage earners in the family - the husband's income is $47,000 and the wife's income is $15,000 per year. Assume that only federal personal income taxes are paid and use 2020 brackets and rates. Round your calculations to the two digits. (a) If the husband's income increases by $8,000, by how much does his PIT liability increase? How much of his personal tax credit is lost because of this increase? (b) If we consider the same income increase as in (a) but look at the payroll taxes - CPP and El. Given that the employee's CPP rate is 5.25% and El rate is 1.58%, by how much does his payroll tax liability increase? The individual income limit for CPP is $58,700 and for El is $54,200. Also calculate the changes in the CPP and El tax credits due to this payroll tax liability increase. (c) If the husband's income increases by $8,000, by how much does his tax liability increase due to the GST credit clawback? The GST credit is clawed back by 5% of the amount by which the family income exceeds $38,507 but under $62,747. (d) Now consider the Canada Child Benefit (CCB). It is clawed back by 23% if the family income is between $31,771 and $68,708 and by 9.5% if the family income exceeds $68,708. By how much does the husband's tax liability increase due to the CCB clawback when his income increases by $8,000? Combining (a), (b), (c) and (d), what is his effective MTR? How would your answers to (a)-(e) differ if the husband's initial income were $147,000 (instead of $47,000)? Review your results. Why does the lower income family face a higher MTR? Provide two main reasons. What factor would make their MTR even higher? (h) Assume that the base amount of the personal tax credit, $12,298+$931, became a deduction, with the portion of $931 still being reduced as it is now based on income before any deductions. How different would the husband's PIT tax liability change be when his income is $47,000 and increases by $8,000? What about his PIT tax liability change when his income is $147,000 and increases by $8,000? (HINT: any credit loss has to be considered here as well). Why is the difference greater for the former? Briefly explain. Question #1: Practically, all the calculations here are for changes for marginal calculations). No need to calculate full taxes. (a) If Aincome occurs in the same bracket: APIT=AIncome x bracket rate If not, Alncome = Alncome, + Aincome; APIT=Aincome, bracket rate, + Alncome, X bracket rate, The changes in the personal tax credit (PC): + base amount is split into $12,298 and $931 $931 is reduced if the individual's income is between $150,473 and $214,368 X-$150,473 at the rate of - the reduction in the base amount translates into the change in the tax credit $214,368-$150473 Question #1: b) Payroll taxes CPP Inciduain 10 py 44,200 Atax credite=0,15 Apayroll taxes Question #1: (e) GST credit GST rede - d) CCB 22 family ince " (e) Effective MTR MTR Atax from (a) + APC from (a) + ACPP& El from (b) - Acredits from (b) + benefits from (C)&(d) Sincome Question #1: (f) If instead the husband's income is higher go through (a) to e) and re-calculate the changes in the same items and his effective MTR (g) Compare the changes used in the numerator for MTRS, particularly look at payroll taxes and benefits taxable and not taxable items are not equivalent (h) PC of $13,229 ($12,298 +5931) becomes a deduction component of $931 remains full or becomes reduced (as described in (a)) the deduction of $13,229 or less has to be subtracted from the person's income before the change and then again after the change given lower income levels (after deduction - A in income - A in PIT liability to explain A in PIT liability -- look at the PIT rates differences