Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1 3 : 2 4 7 2 Assignment 1 4 of 7 2 4 2 0 2 4 Question 1 ( Marks: 1 0 0

:

Assignment

of

Question

Marks:

You have been appointed to assist the accountant of FreedomCo Pty Ltd in preparing the financial statements for the year ended December You have been provided with the following trial balance for the year ended December :

tableDebit,CreditR Ordinary shares,,Retained earnings at the beginning of the year,,Inventory at the beginning of the year,Land at costBuildings at costBuildings accumulated depreciation at the beginning of the year,,Pant at costPlant accumulated depreciation at the beginning of the year,,Motor vehicles at costtableMotor vehicles accumulated depreciation at the beginning of theyearTrade payables,,Trade receivables,Provision for credit losses at the beginning of the year,,PurchasesRevenueAdministrative expenses,Distribution expenses,Other expenses,BankOrdinary dividend paid, Preference shares at R Loan,,Other income,,

Additional information:

:

Assignment

Additional information:

The information below has not been processed yet.

No interest has been paid or accrued on the loan for the current year. The balance outstanding has not changed since the beginning of the year.

No preference dividend has been paid or accrued for.

A utility bill of R relating to December was received and paid in January

Provision for credit losses is maintained at a percentage of of the gross trade receivables balance.

Closing inventory has been valued at R

An expert independent valuer determined the fair value of the building at the beginning of the year as R The revaluation surplus will be realised through use of the asset over its remaining useful life. The company applies the elimination method to account for revaluations. Assume no tax implications on the revaluation.

Depreciation is calculated as follows:

Rate

Method

Depreciation on the building is calculated on the straightline basis. This depreciation is allocated to administrative expenses.

Depreciation on plant is calculated on the reducing balance method. The depreciation is allocated to cost of sales.

Depreciation on motor vehicles is calculated on the units of production method. Motor vehicles are expected to travel over their useful life. Kilometres travelled during the year amounted to The depreciation is allocated to distribution cost.

Motor vehicles with a cost of R and accumulated depreciation of R were sold at the end of the year for received on the date of sale.

New land was purchased on December for R of which R was received immediately and R will be received in years' time. It is assumed that this

transaction has a significant element of financing, and an appropriate marketrelated

transaction has a significant element of financing, and an appropriate marketrelated discount rate is per annum.

Taxation accrual for the period was estimated at R

The company issued bonus shares to the shareholders at bonus share for every held. This is a noncash transaction.

An ordinary dividend of was declared at year end.

A transfer of R was made from retained earnings to general reserves.

The company prepares its statement of profit and loss in accordance with the function method.

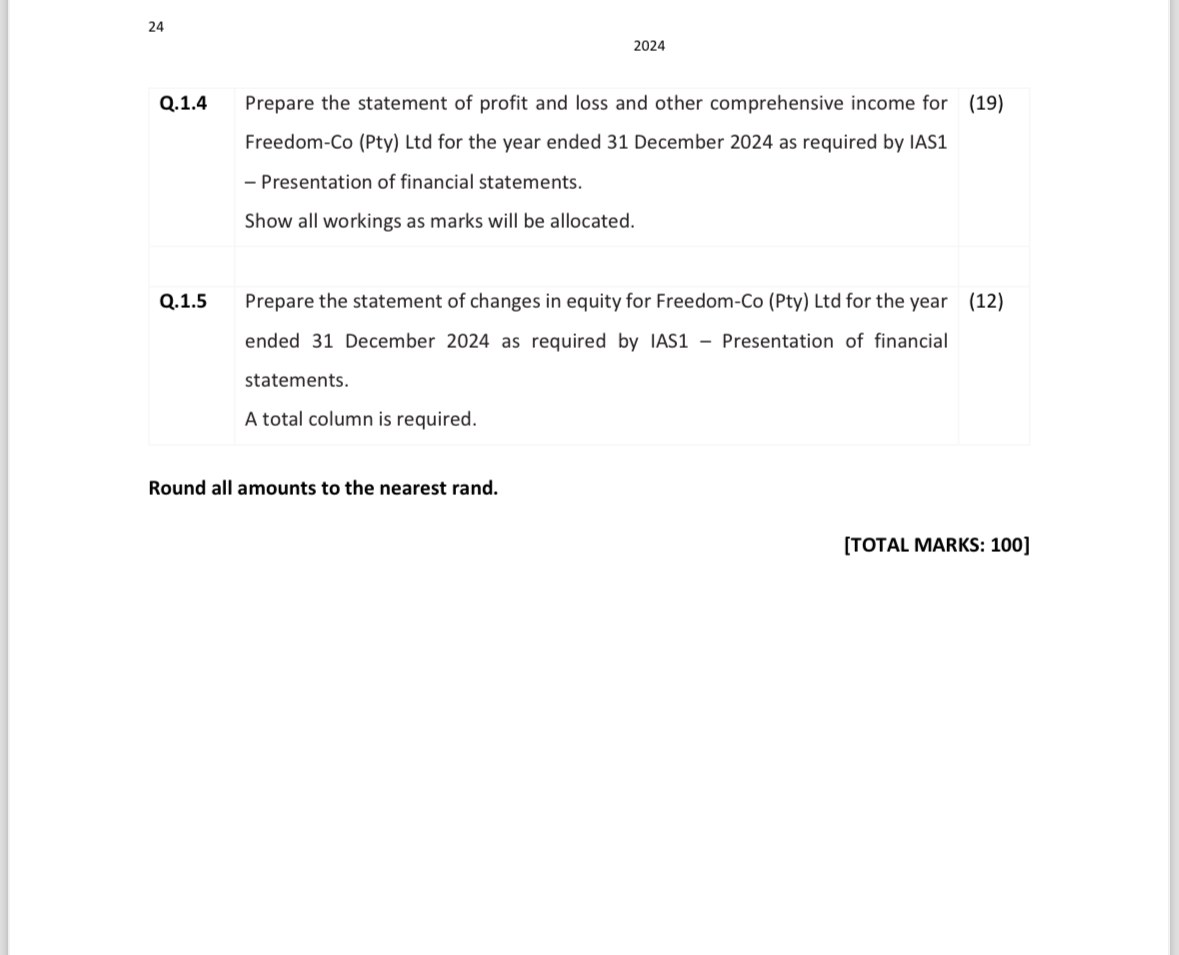

Q Prepare the statement of profit and loss and other comprehensive income for

FreedomCo Pty Ltd for the year ended December as required by IAS Presentation of financial statements.

Show all workings as marks will be allocated.

Q Prepare the statement of changes in equity for FreedomCo Pty Ltd for the year ended December as required by IAS Presentation of financial statements.

A total column is required.

Round all amounts to the nearest rand.

TOTAL MARKS:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started